Unveiling the Dunning-Kruger Effect

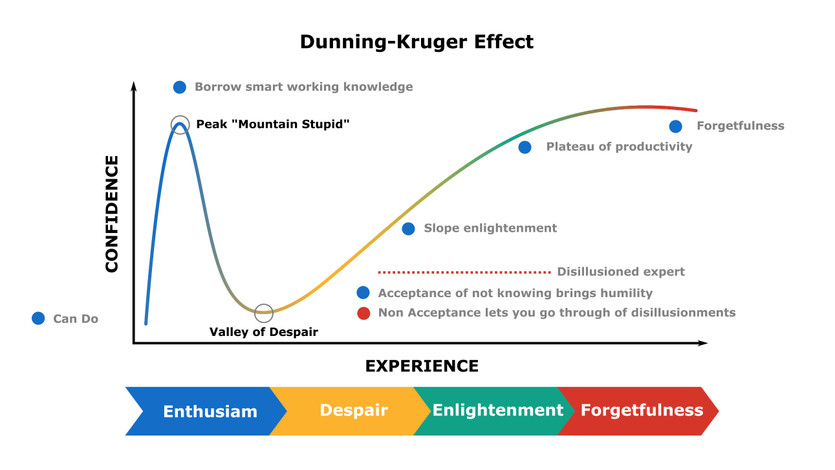

The Dunning-Kruger Effect, a concept brought to light by psychologists David Dunning and Justin Kruger in 1999, is a cognitive bias where individuals with limited understanding or capability in a specific subject tend to inaccurately rate their own abilities. In simpler terms, it refers to the phenomenon where individuals with little knowledge think they know more than they do, while conversely, those with more expertise can undervalue their own competence. This bias bears a striking resemblance to the condition known as imposter syndrome, wherein accomplished individuals are filled with self-doubt about their capabilities.

In the spheres of finance and investment, this bias can prove detrimental. Misguided confidence due to the Dunning-Kruger Effect can lead to hasty or risk-laden decisions, triggering considerable losses. Such scenarios typically occur when individuals are falsely confident about their ability to forecast market trends or understand the complexities of financial mechanisms, despite lacking the necessary expertise.

Deciphering the Underpinnings of the Dunning-Kruger Effect

This cognitive bias is thought to stem from cognitive limitations and a paucity of self-awareness. Those lacking a comprehensive understanding or skill set in a domain are frequently oblivious to their limitations, resulting in an inflated perception of their abilities. This is often embodied in the phrase "ignorance is bliss." The situation arises when individuals are unaware of their own ignorance and therefore overestimate their knowledge and abilities.

It's worth noting that this effect is not exclusive to uninformed individuals. Those with a high level of expertise might also depreciate their skills as they gain a deeper understanding of the complexities and nuances of their field. The phenomenon could be further amplified by the lack of metacognition or introspective abilities, leading to a continual pattern of underestimation and overconfidence.

Another possible explanation for the Dunning-Kruger Effect might be that people tend to rely on their personal benchmarks of what it means to be skilled at something, instead of objective, standardized measures. According to initial studies conducted by Dunning and Kruger, individuals with low competence levels were more likely to overestimate their abilities, while more competent individuals were more likely to underestimate their skills, thereby creating an inverted U-shaped curve. These findings were validated across various disciplines, including humor, logical reasoning, and English grammar.

The Widespread Implications of the Dunning-Kruger Effect

The Dunning-Kruger Effect has far-reaching implications across numerous domains, such as business, finance, healthcare, and politics, often resulting in subpar decisions, inefficiencies, and other negative outcomes.

Dunning-Kruger Effect at the Workplace

In a professional environment, the Dunning-Kruger Effect can manifest as employees accepting responsibilities beyond their capacity or making decisions without fully understanding the possible repercussions. Furthermore, individuals suffering from this effect may disregard feedback or constructive criticism, remaining steadfast in their self-perceived abilities and defending their choices. This could inhibit personal and professional growth, as well as hamper collaborative work dynamics.

A possible drawback is that hiring managers might unintentionally onboard less qualified candidates who display false confidence during interviews, or promotions might be undeservingly awarded to these individuals.

Dunning-Kruger Effect in the Realm of Business and Finance

In the world of finance and business, the Dunning-Kruger Effect can greatly influence decision-making processes and investment strategies. Amateur investors, due to overconfidence in their abilities, may make poor choices when it comes to picking stocks, analyzing corporations, or predicting market trends, resulting in suboptimal investment decisions and possible financial losses.

Strategies to Counteract the Dunning-Kruger Effect

To mitigate the Dunning-Kruger Effect, it's crucial to foster a culture of humility, acknowledge personal limitations, and embrace feedback and constructive criticism. Inviting a diverse range of perspectives, engaging with colleagues and mentors, and learning from subject matter experts can aid in developing a more accurate understanding of one's abilities, thereby reducing the risk of costly mistakes.

Respect for the expertise and knowledge of those who have undergone specialized training in a particular field is also essential. For healthcare organizations, the establishment of clear decision-making guidelines and protocols and the promotion of collaborative work environments can help diminish the impact of the Dunning-Kruger Effect.

Common Queries Regarding the Dunning-Kruger Effect

The so-called "double curse" of the Dunning-Kruger Effect describes a situation where unskilled individuals significantly overrate their own abilities while highly skilled individuals downplay their own proficiency.

Even though there has been some scholarly critique regarding the statistical methods used in the original study, the Dunning-Kruger Effect is widely accepted as a legitimate cognitive bias that impacts people's perceptions of their skills and expertise.

Imposter syndrome, contrary to the Dunning-Kruger Effect, is a condition where highly competent individuals underestimate their worth, leading to feelings of self-doubt and anxiety. This syndrome can affect anyone, but it is particularly prevalent among high-achieving individuals, perfectionists, and people in highly competitive environments.

Dunning-Kruger Effect in Trading

Navigating the world of trading can be a challenging endeavor, and the Dunning-Kruger Effect can add another layer of complexity to this task. Here are some strategies that traders can employ to mitigate the potential impacts of this cognitive bias:

-

Acknowledge and Understand the Dunning-Kruger Effect: The first step is to be aware of the Dunning-Kruger Effect and its potential impacts on your trading decisions. Understanding that initial overconfidence can lead to poor decisions will make you more vigilant.

-

Continued Education and Skill Building: Always strive to learn more about your field of interest. The more educated you are, the better your ability to accurately assess your skills and knowledge. Subscribe to industry journals, attend webinars, or join a local investment club to ensure you are continually learning and improving.

-

Engage in Self-Reflection: Regularly assess your skills and knowledge in an objective manner. Are you really as good a trader as you think you are? Self-reflection can help you identify areas of weakness and improve upon them.

-

Seek Feedback and Mentorship: Consider finding a mentor or a trading partner who can provide you with an unbiased perspective on your trading strategies. Their input can provide a reality check and help you calibrate your self-perception.

-

Practice Risk Management: Implement robust risk management strategies to protect your investments. This can help mitigate losses that could be caused by overconfidence in your trading abilities.

-

Avoid Impulsive Decisions: Overconfidence can often lead to hasty and impulsive decisions. Take your time with every trade, do your research, and think things through before making any decisions.

-

Be Patient: Skills and expertise take time to develop. Don't rush the process.

-

Use Demonstrated Trading Strategies: Stick to tried-and-tested trading strategies, especially if you are a novice trader. Experimenting with unproven strategies without a deep understanding of the market can lead to significant losses.

-

Respect the Market: Remember, the market is always unpredictable and even the most experienced traders can make mistakes. Do not let success lead to overconfidence, but instead remain humble and adaptable.

-

Stay Emotionally Balanced: It's essential to maintain emotional balance in trading. Both fear and overconfidence can lead to poor decisions. Developing a disciplined trading routine and keeping emotions in check can greatly improve your decision-making ability.

Remember, recognizing the Dunning-Kruger Effect and its implications is only the first step. Making a conscious effort to implement these strategies in your trading routine can help you counteract this cognitive bias, improve your trading decisions, and increase your chances of success in the financial markets.