The foreign exchange market, also known as forex, is known for its unique feature of being open 24 hours a day. This accessibility allows investors from around the world to engage in trading activities during regular business hours, after work, and even in the middle of the night. However, not all trading times are equally favorable when it comes to forex trading. In this article, we will explore the different trading sessions, understand the market activity during these periods, and learn how this knowledge can be utilized to develop an effective trading plan.

Section 1: The Three Major Trading Sessions

1.1 Asian Forex Session (Tokyo)

The Asian trading session kicks off the week as liquidity returns to the forex market. It is primarily represented by the Tokyo capital markets, operating from midnight to 6 a.m. Greenwich Mean Time (GMT). However, other countries such as China, Australia, New Zealand, and Russia also contribute to the activity during this session. The Asian session is known to extend beyond the standard Tokyo hours, typically running between 11 p.m. and 8 a.m. GMT.

During the Asian session, traders can expect relatively lower volatility compared to the other sessions. This is because market participants from major financial centers in Europe and North America are not actively trading during this time. However, it's important to note that specific currency pairs influenced by the Asian markets, such as USD/JPY, AUD/JPY, and NZD/JPY, may experience increased activity and volatility. Traders interested in these pairs should closely monitor the Asian session for potential trading opportunities.

1.2 European Forex Session (London)

As the Asian trading hours draw to a close, the European session takes over, ensuring continued activity in the currency market. This session encompasses several major financial markets and is primarily defined by London. Due to the presence of other capital markets like Germany and France, the European session starts at 7 a.m. and concludes at 4 p.m. GMT.

The European session is often regarded as the most active and volatile session of the day. This is because it overlaps with the Asian session for a few hours, creating increased trading opportunities. Traders focusing on major currency pairs such as EUR/USD, GBP/USD, and EUR/GBP should pay close attention to the European session, as it offers significant liquidity and price movements. Economic data releases and news events from the European Union and the United Kingdom during this session can also greatly impact market sentiment and volatility.

1.3 North American Forex Session (New York)

When the Asian markets have already closed, and the European traders are halfway through their day, the North American session begins. This session is dominated by the U.S. market, with contributions from Canada, Mexico, and South American countries. New York City plays a significant role in this session, contributing to its high volatility and participation. The North American session unofficially starts at 12 p.m. GMT, considering the early activity in financial futures, commodity trading, and economic releases. It concludes at 8 p.m. GMT.

The North American session is characterized by robust trading volumes, particularly during the overlap with the European session. This period, known as the European/U.S. session overlap, typically occurs between 12 p.m. and 4 p.m. GMT. During this overlap, traders can experience increased volatility, as market participants from both regions actively engage in trading. Major currency pairs involving the U.S. dollar, such as USD/CAD and USD/MXN, tend to exhibit significant price fluctuations during this session. Additionally, important economic releases and announcements from the United States can amplify market movements.

Section 2: Understanding Market Volatility and Overlapping Sessions

2.1 Volatility During Session Overlaps

During certain periods, forex trading sessions overlap, leading to increased trading activity and heightened volatility. Notably, the Asian/European session overlap tends to generate more volatility, particularly for currency pairs actively traded during both Asian and European hours. This overlap occurs when the Asian session is winding down, and the European session is gearing up. Traders need to be cautious during this time as sharp price movements and rapid fluctuations can present both opportunities and risks. It's essential to closely monitor the market and adjust trading strategies accordingly.

Conversely, the European/U.S. session overlap, which occurs when the European session is coming to a close and the North American session is starting, typically exhibits slightly lower volatility compared to the Asian/European overlap. However, it still offers opportunities for traders, especially for currency pairs involving the euro and the U.S. dollar. Traders should consider the impact of economic events and news releases during this overlap, as they can significantly influence market sentiment and volatility.

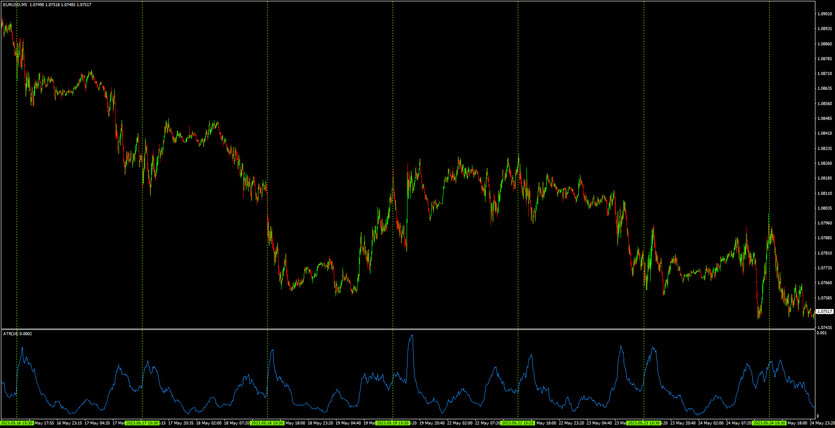

Notice the spikes in the ATR (volatility indicator) around the London - New York session overlap

Notice the spikes in the ATR (volatility indicator) around the London - New York session overlap

2.2 Tailoring Trading Strategies to Volatility

Traders must consider whether high or low volatility aligns better with their trading style. For long-term or fundamental traders, it may be preferable to establish positions during more active hours to capture substantial price movements driven by economic indicators, central bank decisions, or geopolitical events. These traders often conduct in-depth analysis and take a broader view of the market, considering the long-term trends and factors shaping currency movements.

On the other hand, short-term traders, such as day traders and scalpers, who aim to profit from intraday price fluctuations, thrive in volatile market conditions. They seek rapid price movements and liquidity to execute multiple trades within a short timeframe. These traders focus on technical analysis, use shorter timeframes, and employ strategies that capitalize on short-term price patterns and momentum.

It's crucial for traders to align their trading strategies with the level of volatility they are comfortable with. A thorough understanding of market dynamics during different trading sessions can help traders identify the most suitable times to execute their strategies effectively.

Section 3: Optimizing Trading Based on Preferred Currency Pairs

3.1 Customizing Trading Times for Preferred Pairs

When trading specific currency pairs, it's essential to identify the most active trading hours for those pairs. For example, the EUR/USD pair experiences the most movement during the European/U.S. session crossover, as both the euro and the U.S. dollar are major currencies actively traded during this period. Traders interested in this pair should focus their attention on the European/U.S. session overlap to maximize trading opportunities.

Similarly, traders interested in the GBP/JPY pair, which involves the British pound and the Japanese yen, should pay close attention to the Asian/European session overlap. During this time, market participants from both regions actively trade these currencies, leading to increased volatility and trading opportunities.

By customizing their trading times based on preferred currency pairs, traders can capitalize on the periods when those pairs are most active and volatile, increasing their chances of making profitable trades.

3.2 Considerations for Different Time Zones

Traders residing in different time zones need to adapt their trading routines accordingly. For instance, a U.S.-based trader interested in trading GBP/JPY, which has active hours during the Asian/European session overlap, would need to wake up early in the morning to align with the market's activity. It's crucial to avoid exhaustion and errors in judgment caused by lack of sleep.

Another option for these traders is to trade during the European/U.S. session overlap, where volatility remains high even when Japanese markets are offline. This allows them to take advantage of the significant trading volumes and price movements driven by the European and North American markets.

Traders should also consider the impact of daylight saving time changes in different regions. Daylight saving time shifts can affect trading session overlaps and the timing of economic releases, potentially influencing market dynamics. Traders should stay updated on these changes and adjust their trading schedules accordingly to ensure they are aware of the latest market conditions.

Additionally, it's essential for traders to maintain a balanced approach to trading by considering their own physical and mental well-being. Engaging in forex trading requires focus, concentration, and decision-making abilities. Traders should prioritize getting sufficient rest, managing stress levels, and maintaining a healthy lifestyle to optimize their trading performance.

The Bottom Line

Optimizing forex trading requires a comprehensive understanding of the different trading sessions and their characteristics. By recognizing the times when market activity and volatility are highest, traders can tailor their strategies to align with these periods and increase their chances of success. Whether focusing on specific currency pairs, session overlaps, or preferred trading styles, traders should continuously monitor the market, stay informed about economic events, and adapt their approaches as needed.

Remember, successful trading is not solely determined by the timing of trades but also by risk management, discipline, and continuous learning. By combining a strategic approach with proper risk assessment and psychological discipline, traders can navigate the forex market more effectively and improve their overall trading results.