Setting the Scene: The Art of Trading in Euro-Based Pairs

Navigating the dynamic terrain of euro-based currency pairs involves mastering the art of tracking numerous events that could markedly impact the euro, popularly referred to as the "common currency". This requirement can pose a daunting challenge for forex traders, given the complexity and sheer volume of influential elements.

As it stands, the euro holds the status of the official currency for a notable 20 out of the 27 member nations forming part of the European Union (EU). These 20 nations, termed the euro area or the eurozone, were responsible for a combined GDP of approximately $14.6 trillion back in 2021. The overwhelming number of economic updates emanating from the eurozone each year prompts an important question for traders: which of these actually possess the power to move markets?

The Eurozone Economy: Identifying the Heavyweights

While the European Union prides itself on having 27 members, only a handful are robust enough to generate economic updates that truly shape the currency. The eurozone contributes a substantial chunk, accounting for over 85% of the European Union's Gross Domestic Product (GDP).

The powerhouse quartet of Germany, France, Italy, and Spain together represent roughly three-quarters of the eurozone's impressive $14.56 trillion GDP. Therefore, any trader seeking impactful reports must prioritize those that dissect the economies of these nations.

Interestingly, the economic dispatches from Germany and France are often deemed more significant by forex traders. In the aftermath of Brexit, these two countries now account for a whopping 50% of the eurozone's GDP.

Navigating through the Sea of Standardized Reports

It's imperative to recognize that while economic reports may vary among countries, a set of them are recognized as standard across all nations. These revolve around pivotal areas such as:

- Monetary policy

- Prices & inflation

- Confidence and sentiment

- GDP

- Balance of payments

The Pulse of Prices and Inflation: Dissecting Core CPI and Other Inflation Indicators

In the swirling currents of forex markets, the role of inflation cannot be overstated. It's the unseen hand that shapes the narrative, guiding currency values and impacting the livelihoods of millions across the globe. For those involved in euro-based forex trading, understanding how inflation is measured and how it influences the euro's valuation is fundamental.

Let's take a moment to examine inflation, described aptly as a double-edged sword. On one hand, a little inflation is considered healthy for an economy. It often signifies growing demand and a positive economic trajectory. Conversely, high inflation rates can erode purchasing power, destabilize economies, and trigger a depreciation in the value of a country's currency. This underscores why central banks pay keen attention to inflation indicators and are ready to take swift action, typically by adjusting interest rates, to maintain stability.

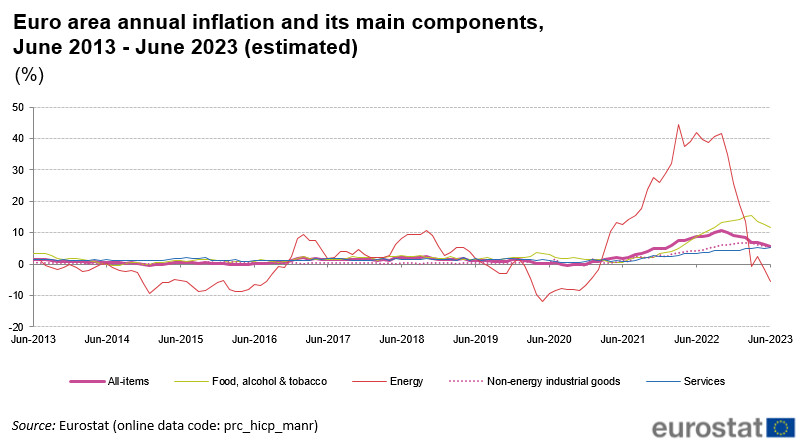

There are multiple metrics to monitor inflation, but in the context of the eurozone, the following are of significant importance:

- Eurozone Core Consumer Price Index (CPI)

- German CPI

- French CPI

The Consumer Price Index (CPI) stands as a sentinel in the realm of inflation indicators. It's the go-to gauge that tracks the average change over time in the prices paid by consumers for a basket of goods and services, reflecting the cost of living. These goods and services span an array of categories such as housing, food, transportation, and healthcare, among others.

However, within this sea of data, forex traders tend to give precedence to the Core CPI. This refined version of the CPI excludes typically volatile food and energy prices to offer a clearer and arguably more accurate insight into the underlying inflation trend.

While it might seem logical to believe that the release of the CPI report would generate significant ripples in the forex market, the reality tends to be a little different. The preliminary figures, such as the eurozone's CPI Flash Estimate, French CPI Flash Estimate, and the German Preliminary CPI, are released approximately two weeks before the official CPIs, dulling the potential impact of the actual CPI figures.

Hence, savvy traders often find more value in the art of tracking and interpreting the initial CPI Flash Estimates. This ability allows them to glean insights and anticipate movements in the euro's value well in advance of the official CPI release. By doing so, they stay a step ahead, strategizing and positioning themselves effectively in an ever-changing market landscape.

To sum up, mastering the pulse of prices and inflation involves understanding the role and workings of the CPI and other inflation indicators, their impact on the euro's value, and the strategic importance of staying ahead of official data releases. This nuanced approach can significantly enhance the success of your euro-based forex trading endeavors.

Taking the Pulse of Confidence and Sentiment: Navigating Economic Optimism and Pessimism

The forex market, in all its complexity, is an intricate dance of numbers and sentiments. Traders who thrive are not just those who crunch the numbers well, but also those who can successfully gauge the mood of the market. So, how can we measure something as abstract as confidence and sentiment in relation to forex trading? The answer lies in carefully curated reports such as the ZEW Survey.

To better comprehend and trade in the euro-based forex market, one must journey beyond raw economic data. It is just as crucial to understand the psychological undercurrents that ebb and flow beneath the surface.

ZEW Survey

Hailing from Germany, the ZEW survey provides a monthly temperature check on economic sentiment. The Centre for European Economic Research meticulously prepares this survey by inviting the opinions of up to 300 financial experts. The experts' task? To provide their expectations of economic progression over a medium-term horizon. The response structure is brilliantly simple: positive, no change, or negative. It is this simplicity that allows the ZEW indicator to lucidly reflect whether experts and analysts are optimistic or pessimistic about the economic future. The survey also includes feedback from experts across the eurozone, Japan, Great Britain, France, Italy, and the United States.

The ZEW survey carries immense weight in the forex world. If the actual ZEW indicator surpasses forecasts, it could bring about a positive effect on the euro. Conversely, a ZEW number below forecasts could put the common currency under pressure. As a general rule of thumb, a ZEW number above zero indicates optimism, while a number below zero is a sign of pessimism.

Forecasts and actual releases are one part of the equation. What adds to the intrigue is the analysis of the discrepancy between the expected and actual figures. Significant deviation can give rise to sudden market swings, presenting both risks and opportunities for traders. A prudent trader is one who knows how to play this delicate balancing act between forecasted sentiment and the actual pulse of confidence.

In summary, trading in euro-based forex markets calls for an ability to read the pulse of confidence and sentiment. Doing so involves an in-depth understanding of the key reports, the careful study of forecasts, and an ability to interpret these findings to navigate the market successfully. When you can achieve this, you're not just reacting to the market; you're moving in rhythm with it.

Monetary Policy: The Commanding Force in the Dynamics of Currency

When it comes to the intricate dance of currency values, few partners lead as strongly as monetary policy. It's the commanding force that underpins the ebbs and flows of the forex market, and it's pivotal in shaping the narrative for euro-based trading.

Currency values aren't arbitrary. They are strongly influenced by the financial strategies implemented by a nation's central bank. These strategies, collectively referred to as monetary policy, have wide-reaching effects on a nation's economy and, by extension, the strength of its currency. Central to these strategies are interest rates, which can be deftly maneuvered by central banks to stimulate or cool down the economy.

Let's focus our attention on the central bank of the eurozone - the European Central Bank (ECB). The ECB's decisions, specifically those concerning interest rates, play a fundamental role in determining the value of the euro.

ECB Press Releases

In the realm of monetary policy, ECB press releases are akin to seismic events. They're packed with crucial information and have the potential to move the markets significantly. For traders, these press conferences and their accompanying press releases are must-follow events.

However, the secret to leveraging these releases lies in understanding their structure. Each press release consists of two main parts:

- A prepared statement.

- An open press question period.

It's during the question period that the markets often see heightened volatility. The answers provided by the ECB President can be instrumental in swaying market sentiment and triggering currency fluctuations.

But it's not just about what is said, it's about how it's said. The nuances in the ECB President's language can provide valuable hints about future economic trajectories. If the President seems 'hawkish'—expressing concern about inflation—it could signal potential future rate hikes, usually causing the euro to appreciate. On the other hand, if the President appears 'dovish'—indicating a belief that inflation is under control—rate hikes may be less likely, leading to potential depreciation of the euro.

In essence, excelling in euro-based forex trading necessitates a deep understanding of the role and dynamics of monetary policy, particularly the intricacies of interest rate decisions. It's about appreciating the power of words and understanding that every sentiment expressed and every statement made during ECB press releases can sway the value of the euro. This awareness can equip traders to anticipate market movements better, enabling more strategic trading decisions.

GDP and Economic Growth: The Indicators of Prosperity in the Economic Landscape

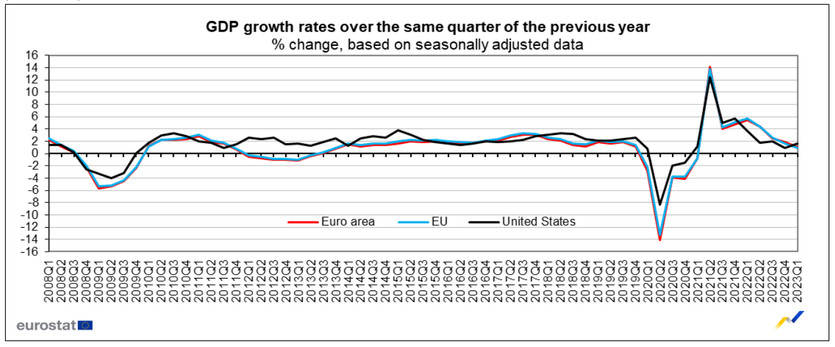

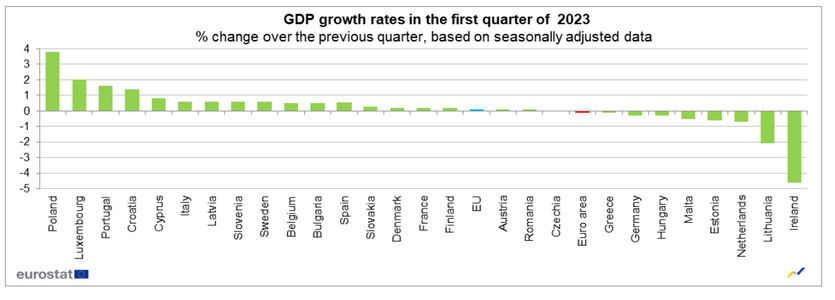

When it comes to evaluating the health and strength of an economy, one key indicator stands out - the Gross Domestic Product (GDP). This measure serves as the economic scoreboard, encapsulating the total value of all goods and services produced by an economy in a certain period. A thriving GDP indicates a robust and resilient economy, casting a positive light on the associated currency.

In the context of the eurozone, keeping a close eye on the GDP reports is crucial for successful forex trading. Here's why:

Eurozone GDP Reports

Published by Eurostat, the eurozone GDP report arrives on a quarterly basis, approximately two months after the close of the quarter. While it may seem a tad delayed, the report carries significant weight, as it provides a comprehensive overview of the economic output of the eurozone.

It's important to note that anticipation often precedes the release of the GDP report. Market analysts employ several techniques to forecast GDP figures, which means that the report’s impact is often priced into the market ahead of the official release. However, any significant discrepancy between these forecasts and the actual GDP figures can trigger notable market movements.

Typically, a strong GDP growth implies a healthy, robust economy. This is generally positive for the currency, which may appreciate as a result. Conversely, disappointing GDP figures could indicate economic slowdown or recession, potentially leading to a depreciation of the currency.

In summary, understanding the GDP and its relation to economic health is paramount in navigating euro-based forex trading. As a trader, you need to be attuned to the nuances of the GDP report, anticipate potential market reactions, and align your trading strategy with the rhythm of the economic growth narrative. Remember, the GDP report isn't just a snapshot of an economy's health, but a powerful steering force in the vibrant forex market.

Balance of Payments: The Trade and Capital Flow Equilibrium

The balance of payments is a financial statement that encapsulates a country's transactions with the rest of the world. It provides a holistic view of a country's economic interactions, detailing everything from the import and export of goods and services, to income payments, and other financial transfers. For the euro, three reports provide critical insights into this aspect:

- Eurozone Trade Balance

- German Current Account

- French Current Account

Each of these reports offers a unique and detailed perspective on the eurozone's economic interactions on a global scale. They are essential tools for comprehending the strength of the euro, and by extension, for making informed trading decisions.

-

Eurozone Trade Balance

Published monthly, this report showcases the value difference between imported and exported goods and services. It's a vital indicator of the eurozone's trade competitiveness. A trade surplus, where exports exceed imports, signifies a net inflow of domestic currency from foreign markets and is generally favorable for the currency. On the contrary, a trade deficit, where imports surpass exports, can lead to depreciation of the euro.

-

German and French Current Account

The current account reports for Germany and France, the two largest economies in the eurozone, are particularly significant. They offer valuable insights into these countries' trade balances, income payments, and other financial transfers. Just like the broader eurozone trade balance, a current account surplus in these countries is usually positive for the euro, while a deficit can put downward pressure on the currency.

The balance of payments reports offer an essential window into the financial health of the eurozone. A strong understanding of these reports can enhance your trading strategy, helping you anticipate potential market reactions and execute well-timed trades. Remember, successful forex trading requires more than just quick decisions—it demands a deep understanding of the complex economic interactions that drive the global forex market.