Most traders use classical technical analysis, analyzing the behavior of market participants by studying the price chart.

Fundamental analysis is also widely used, when a trader makes forecasts for the further movement of the market, relying on macroeconomic data, the political situation and statements of influential personalities, whose statements can influence the dynamics of quotations.

These are the two most popular types of analysis that are effective both independently and in conjunction with each other.

In addition to these two types of analysis, there is one more type - mathematical. This type of analysis is based on finding market inefficiencies and their use in various trading strategies and systems. The Spetsnaz strategy belongs to this type of mathematical analysis and is intended for trading the EURUSD currency pair.

Position opening rules

In terms of action, the strategy is extremely simple. You should start trading immediately after the opening of the European session.

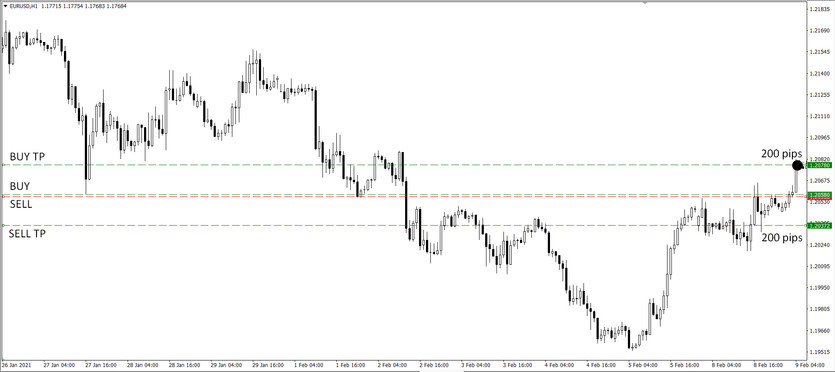

Two opposite trades are opened simultaneously. A take profit of 200 points is set for both a buy deal and a sell deal with 5 decimal places in the quotes. Stoploss is not set.

When one of the trades is closed by TP, another trade is opened again in the same direction with the same take-profit of 200 points. And you do not close the trade with the current minus, leave it as it is.

That is, if a buy trade is closed, then hold a sell and open a new buy with a take-profit of 200 points. And repeat these actions until the end of the trading day.

The next day, open two trades again at the current market. And yesterday's unprofitable trade is averaged so that for each trade involved in averaging there would be 200 points.

For such averaging, the following calculation formula is used:

(A + B + C) / H + 200, where

A, B, C - prices at which trades that are at a loss are opened,

H - the number of unidirectional unprofitable trades,

for Buy orders, add 20 points, for Sell orders, subtract them.

Details

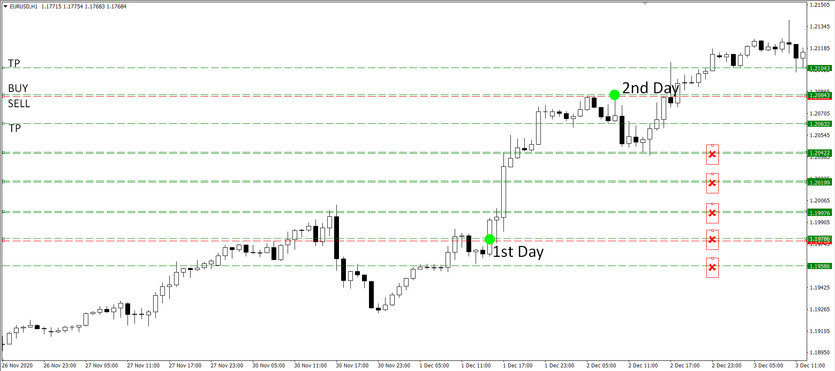

For example, suppose we opened Buy and Sell at 1.19786 and 1.19769 this morning, respectively. The price went up 200 points and closed at the price of 1.19986 Buy. Immediately open a new Buy at this price with a target of +200 points. For Sell, the current minus is 200 points. We do not touch it.

The price rises by another 200 points and Buy is closed at 1.20199. For Sell, the current minus is equal to 400 points. And this should be done while the price is moving in one direction.

The next day we enter the market, the price, for example, is at the quote 1, 20843. We open Buy again with a take of 200 points at 1.21043. And open Sell at 1.20832. But for this Sell and the unprofitable Sell, which has been hanging since yesterday, we must calculate their take-profits so that the profit for each is 200 points:

And it turns out that on the Sell of the first day there will be a loss of 50 points, and in the new Sell - a profit of 450 points. In total, 200 points per order.

But if the price does not reach these take-profits, but goes up, then when Buy is closed, we will open two new bidirectional trades, and we will average not 2, but 3 Sell deals.

Conclusion

The Spetsnaz strategy is interesting in that it gives a high profitability. Plus, the algorithm for working with it is quite schematic and will not cause difficulties. There is no need to waste time on technical analysis and monitoring of a suitable entry point.

But, this system also has its drawbacks. On a strong unidirectional movement without deep corrections, very large drawdowns can form, from which you can exit for a long time. Therefore, always follow the risk management appropriate to the size of your deposit. The risk for each of the opened trades should not exceed 1% of the size of your deposit.