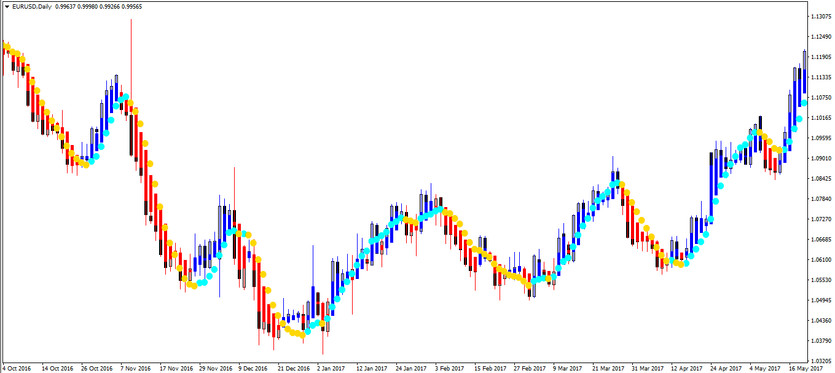

The Moderate trading strategy is a special algorithm designed for efficient trading, which is based on the calculations and signals of two custom indicators. Despite the fact that the indicators included in the strategy are not included in the standard forex set, they are very effective and accurate, therefore trades that are made using the Moderate strategy are very profitable. By confirming each other's signals, the indicators determine the current trend, and after that they indicate the candle on which to open a position in the direction with the current trend. The indicators that make up the strategy work as intended, and therefore, before using the strategy, it is recommended to study the scheme of the indicators.

The Moderate strategy can be used on all timeframes,however, the D1 interval will be considered the most suitable. The pair should be chosen between EURUSD and GBPUSD. However, it is not denied that the strategy can be used with other currency pairs, however, for this, it should be correctly adjusted the input parameters and chose timeframe.

Strategy indicators

The Moderate strategy is based on the functioning of two custom indicators, that is, they are not in the standard forex set, but this does not make them less effective. The indicators are perfectly combined with each other, and confirming each other's signals create an effective strategy.

- Heiken Ashi - indicator that determines the possibility of changing the direction of the trend. Its settings remain unchanged.

- Non Lag Dot - indicator that determines the current trend and the dominance of the current market power. Its settings also remain unchanged.

Trading with the Moderate strategy

In fact, using the Moderate strategy does not make much effort, since the concept of its operation is very simple. In order to open a position in the direction with the current trend, it is necessary to take into account the signals of the indicators included in it. And when both indicators of the indicator determine the current market trend, a trade can be opened in its direction. It is also possible that one of the indicators is late with the signal, that is, one indicates an upward movement, and the second one indicates a downward movement, at this moment it should be only waited until both indicators confirm each other's signals on a certain candle.

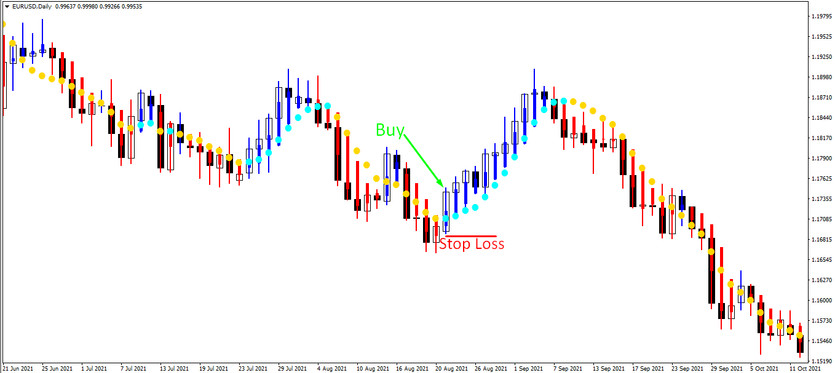

Conditions for Buy trades:

- The Heiken Ashi indicator colors the signal candle in color with the growth value.

- On the same candle, a Non Lag Dot indicator point of color with a growth value is formed.

After the appearance of such conditions from indicators, a buy trade can be opened, due to the presence of an uptrend in the market. Stop loss is set at the low of the signal candle, and take profit is twice as large as stop loss. Such a trade should be closed after at least one of the indicators generates a reverse signal. In this case, it should be prepared for a trend change, which will allow opening new trades.

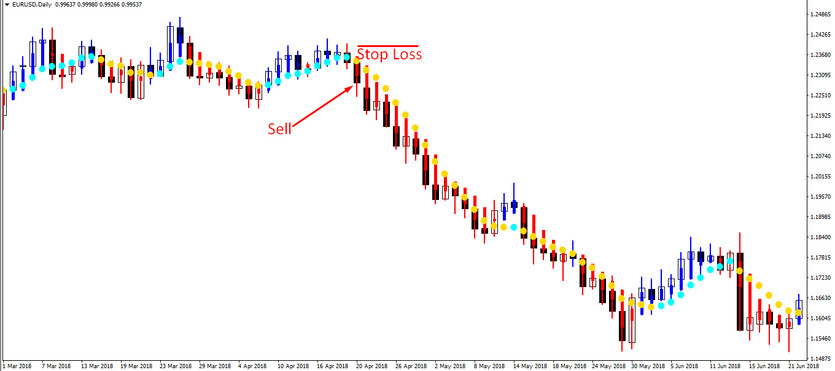

Signal for Sell trades:

- Heiken Ashi colors the current candle with the fall value.

- Non Lag Dot also acquires colors with a fall value at this point.

A sell trade, due to the presence of a downtrend, can be opened on a signal candle after receiving such conditions. A stop loss order is placed at the maximum point of the signal candle, and the take profit is equal to two stop loss sizes. The sell trade should be closed immediately after one of the indicators gives a reverse signal. At this moment, a change in the current trend is possible, after which it can be opened new positions.

Conclusion

The Moderate trading strategy is not only very effective, but also extremely easy to use, and therefore suitable even for beginners. The strategy uses two indicators that show good results in practice, and in combination with each other create an excellent strategy. If it is had certain difficulties in using the strategy, preliminary practice on a demo account is recommended.

You may also be interested The Lucky Couple Trading strategy for the EURUSD currency pair