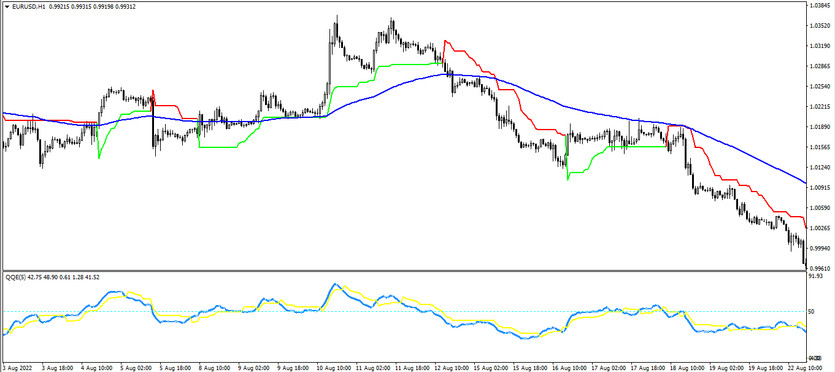

The QQE Super Trend is a very profitable yet easy to use strategy based on the functioning of three effective indicators. The indicators included in it do the job of determining the current market trend, and then, by confirming each other's signals, identify the optimal moment to open a position, taking into account the direction of the trend. Each indicator included in the strategy is used for its intended purpose, therefore, before using the QQE Super Trend strategy in practice, it is recommended to study the indicators included in it. The strategy can be called universal, since it, without losing its effectiveness, works on any timeframe, using any currency pairs.

Strategy indicators

The QQE Super Trend strategy includes only three indicators, but they, by interacting with each other, form an excellent trading strategy. One of the indicators included in the strategy is standard and frequently used, but the remaining two are not inferior to the standard one in this.

- EMA (100) - exponential moving average, the period of which is set to 100.

- QQE - indicator of quantitative and qualitative assessment of the market. The indicator settings remain unchanged.

- Super Trend - indicator of market volatility. Its settings should also be left unchanged.

Trading with the QQE Super Trend strategy

When making trades using the QQE Super Trend trading strategy, one should take into account the values of each indicator included in it relative to the arcs of the other. That is, if the values of all three indicators were shoved on a certain candle, then a position can be opened on this candle in the direction of the current trend. However one of the indicators may be a little late, and in this case,it should be waited for a signal from its side, and only then open a trade

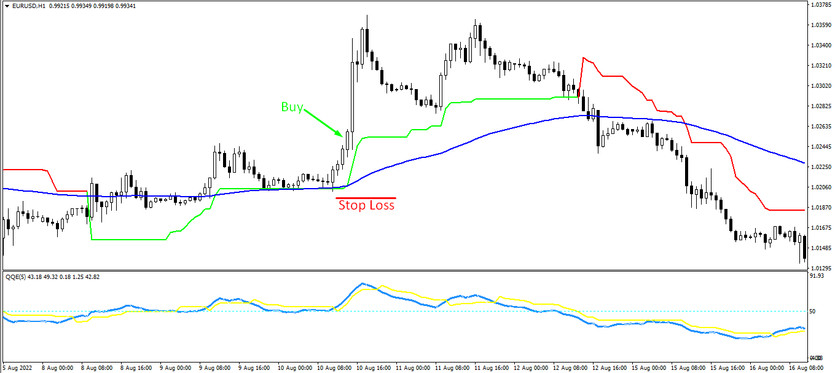

Conditions for Buy trades:

- The price is above the moving average, which in turn is above the line of the Super Trend indicator.

- The line of the Super Trend indicator is moving up and has a color with a growth value.

- The lines of the QQE indicator cross the level of 50 upwards, while its main line is above the signal line.

Upon receipt of such conditions, a long position can be opened on the current candle, which should be closed with a stop loss below the Super Trend line, after the price falls below the moving average, or some indicator will give a reverse signal, since in this case the possibility is considered opening new trades.

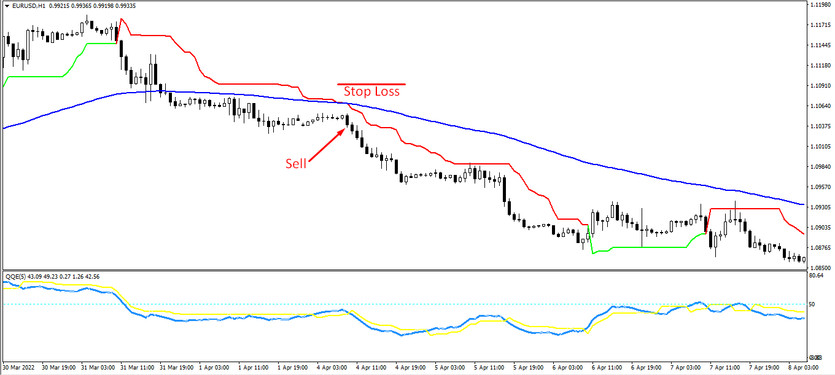

Conditions for Sell trades:

- The price is under the EMA indicator (100), while the moving average itself is below the Super Trend indicator.

- At the same time, the Super Trend indicator itself has a color with a falling value and moves down.

- The lines of the QQE indicator intersect so that the signal line is above the main one, and both lines are below the level of 50.

After such conditions match on a certain candle, a sell trade can be opened. Stop loss is set just above the Super Trend line. The trade should be closed when it is received the opposite conditions from at least one of the indicators, at this moment it should prepared to open a new position.

Conclusion

The QQE Super Trend trading strategy is very effective, despite the simplicity of its use. With the right approach, the strategy brings the best possible result from any trade. However, in order to carefully analyze all the nuances of the indicators included in it, it is recommended to practice on a demo account.