The TMT trading strategy is in demand among both experienced traders and beginners, due to the minimum losses when trading on small timeframes and the possibility of gaining profit at the end of the day due to a large number of deals. The trading system is based on the principle of trading in the direction of the trend of the weekly candle (W1), so the working timeframe is limited to M15.

Any currency pairs can be used, but it is best when using such strategies to focus on trend ones, in which there are movements, primarily on the majors.

The TMT strategy can be applied around the clock, but European and American sessions are recommended. There are fewer movements in the Asian session, and this time is less often used for scalping. Also, a trader should be prepared for additional losses due to the flat in the second half of the American session and in the Asian session.

Strategy settings

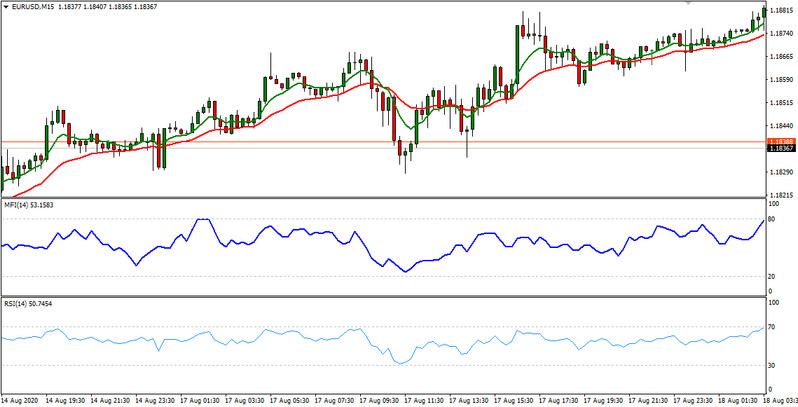

This system is based on a combination of two trend indicators (EMA) and two oscillators (MFI and RSI). The former defines the current daily trend, the latter - the pivot point in its direction after the correction. For confirming it, the strategy additionally uses a breakdown of the trend line of the local corrective movement, which is detected by graphical analysis.

Apply two moving averages (MA) with periods of 20 and 7 to the chart of a trading asset, which determines the direction of the local trend within the day. For both of these indicators, set the MA method to Exponential.

Then apply two more indicators to the chart: MFI and RSI, with default settings. (By default, their periods are 14.)

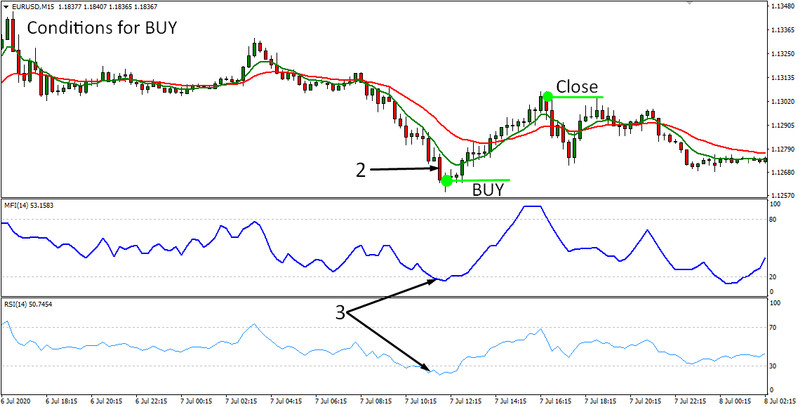

Conditions for opening long positions

1. The current weekly candle should be a bullish candle, which will mean that the asset being traded has an upward trend.

2. The price breaks both MA lines from top to bottom, after which one of the next M15 candles closes below the MA lines. Moreover, her body should not touch these lines.

3. At the same time, the MFI indicator line is below level 20, and the RSI line is below level 30.

When these conditions are met, a BUY deal is opened.

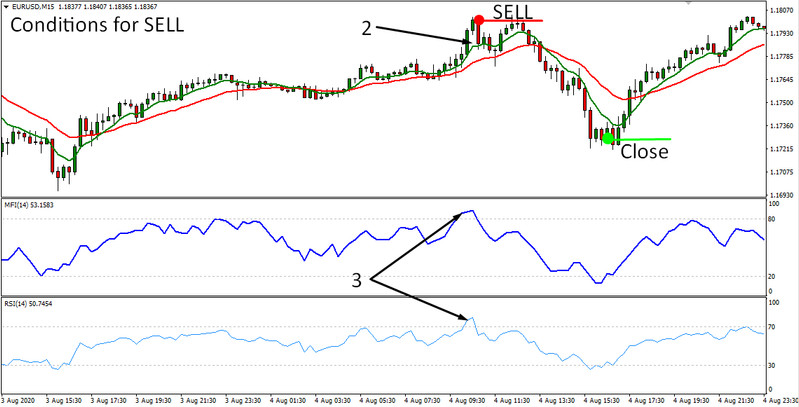

Conditions for opening short positions

The same conditions, but with opposite meanings, are relevant for SELL deals.

1. The current weekly candle should be a bearish candle.

2. The price breaks both MA lines upwards, after which one of the next M15 candles closes above the MA lines. The body of this candlestick should also not touch the MA lines.

3. At the same time, the MFI indicator line is above level 80, and the RSI line is above level 70.

Stoploss and TakeProfit

In this system, the exit from the position is carried out with the opposite signal of the MFI and RSI indicators, regardless of whether it is in profit or at a loss. The type of the weekly candle and the position of the MA lines are not taken into account.

Conclusion

TMT Scalping System is a fully functional system suitable for both experienced traders and beginners.

It is interesting for beginners, first of all, for its simplicity, but it is worth remembering about the ratio of risk to reward, and that you need to choose such volumes of transactions that will correspond to your deposit.

For experienced traders, the system can offer flexible customization without any rigid boundaries. It allows traders to add additional indicators and apply their own ideas to improve trading.