This system is a trend trading strategy and can be used on various trading assets on an hourly timeframe. It can be attributed to intraday strategies since the duration of the retention of most trades usually does not exceed the interval of a trading day. The main source of signals in this strategy is the trend technical indicator Absolute Strength Histogram.

No additional filters are used here. The indicator values and pricing themselves serve as an additional signal filter.

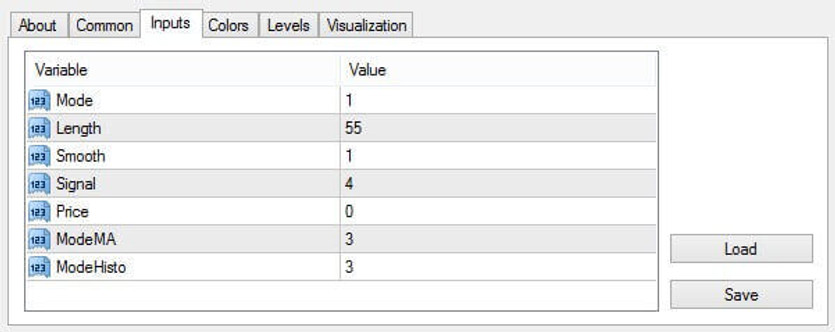

Indicator settings

Install the ASH indicator in your MT4 trading terminal and apply it to the price chart on which you will apply this strategy.

In the indicator input parameters, set the Mode parameter to 1. Set the Length parameter to 55. Leave the remaining parameters with default values.

So, increasing the Length value in the settings, the ASH indicator acquires more stable signals that can be used to open deals.

Conditions for opening long positions

When these conditions are met, a BUY deal is opened.

Please note that the most important condition here is the presence of a trend. In the given example, the first changing of the indicator bar color from red to green is ignored, because, at that time, there was still no pronounced trend.

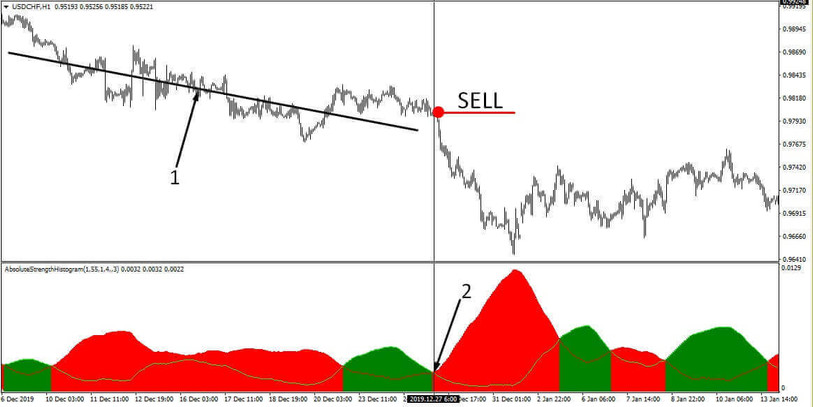

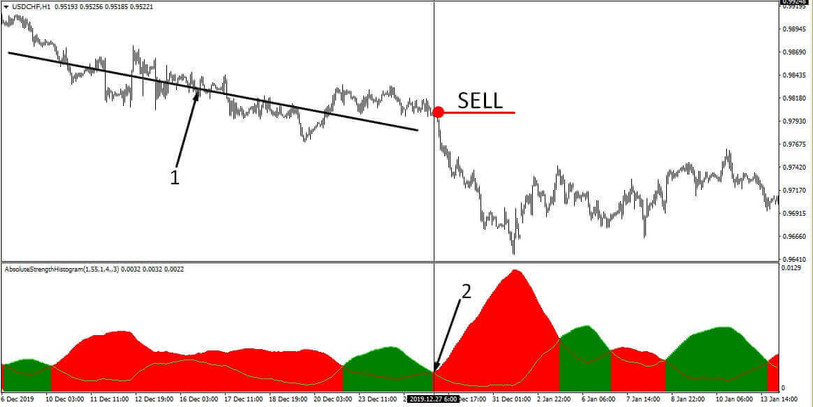

Conditions for opening short positions

Stop Loss and Take Profit

Use local extremums to fix possible losses on the deal. It is recommended to take profits with a trailing stop. Set the trailing stop step equal to the size of the stop-loss - this will increase the likelihood of catching large trend movements.

Conclusion

Strategy Trend Strength H1 is a prime example of a trending strategy. It also means that during periods of flat, such systems can cause losses. To avoid this, strictly adhere to the terms of the strategy and use it only on-trend movements.