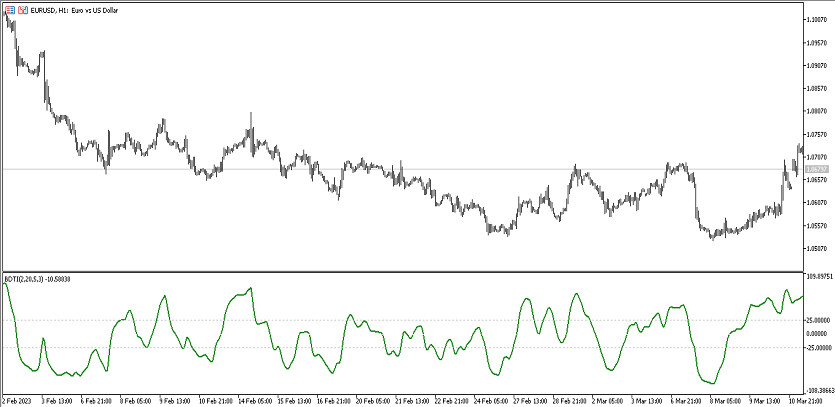

The Blau Directional Trend Index indicator is a trading algorithm whose calculations are based on determining the current trend and opening certain trades in this period directly. Using calculations, the indicator determines the direction and strength of the current trend, while the indicator is also suitable for determining the market at the time of overbought or oversold. It is represented in the lower window of the price chart as a line that, under current market conditions, moves in a certain direction relative to the signal levels -25.0 and 25. The current values of the indicator line determine information about the trend, which in turn allows opening a certain position in consequence.

The Blau Directional Trend Index indicator is suitable for trading on any timeframe, with any currency pairs.

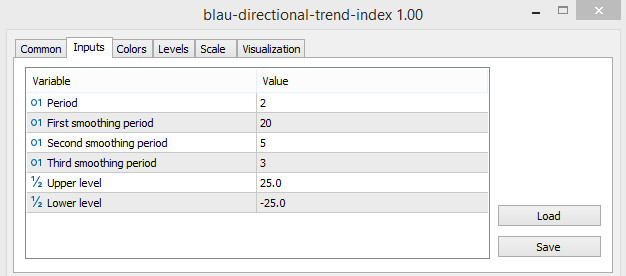

Input parameters

There are several sections in the settings of the Blau Directional Trend Index indicator, each of which affects its overall functioning. Thus, the Input parameters section affects its technical operation, the Colors section is responsible for its general visualization, and to add signal levels to the indicator window, the Levels section is used.

-Period - value of the indicator calculation period. The default value is 2.

-First Smoothing - the period of the first smoothing of the indicator values. The default value is 20.

-Second smoothing - value of the period of the second smoothing of the indicator calculations. The default value is 5.

-Third smoothing - the third smoothing of the indicator. The default value is 3.

-Upper level - upper level value of the indicator. The default value is 25.0.

-Lower level - value of the lower signal level of the indicator. The default value is -25.0.

Indicator signals

The algorithm for applying the Blau Directional Trend Index indicator is very simple. When using the indicator in trading, it is important to take into account the direction of the current trend. For this, in turn, the direction of the indicator line and its location relative to the signal levels -25.0 and 25 are taken into account. If the indicator determines the presence of an upward trend, long positions are opened, in a downward trend, short positions are opened. At the moment of a trend change, in both cases, positions are closed.

Signal for Buy trades:

-The indicator line goes up from level -25 to level 25, crossing level 0.

Upon receipt of such a condition, namely, after the line crosses the signal level 0 upwards, the trade should be closed. At this moment, the market is determined by the presence of an upward trend. If the direction of the line changes, the trade should be closed. At this moment, the market may change the trend, which will allow considering opening new trades.

Signal for Sell trades:

-The indicator line goes from top to bottom, from the signal level 25 to the level -25.

A sell trade can be opened immediately upon receipt of such conditions that characterize the presence of a downward trend in the current trend. When the current trend changes, namely at the moment the opposite conditions are received from the indicator, one should consider closing the current trade and opening a new one.

Conclusion

The Blau Directional Trend Index indicator is a very effective trading algorithm that allows trading during a certain trend. At the same time, in order to get maximum profit and accuracy from signals, it is recommended to use it with additional filters, indicators and advisers. And before using the indicator on a real deposit, it is recommended to practice on demo account.