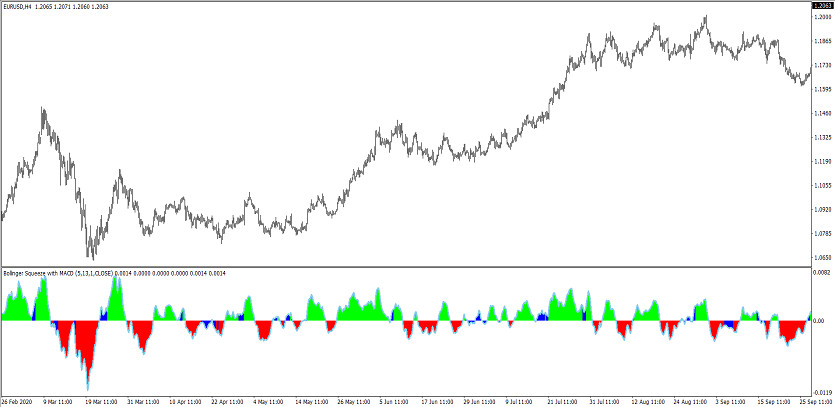

The Bollinger Squeeze with MACD indicator is a trading algorithm whose calculations are based on the interaction of a large number of indicators included in the standard Forex set. At the same time, before trading, an indicator is selected in the indicator settings, the calculations of which will be used when interacting with Bollinger Squeeze. Its calculations aimed at determining information about the current trend, namely its strength and direction. This, in turn, also allows determining the moment of opening a trade. The indicator is presented in the lower window of the price chart in the form of a histogram with a signal line, which, under certain market conditions, changes its color and direction.Depending on the current values of the indicator, the current market movement is determined, and at the same time a certain trade is opened.

The Bollinger Squeeze with MACD indicator is suitable for trading any currency pair, on any timeframe.

Input parameters

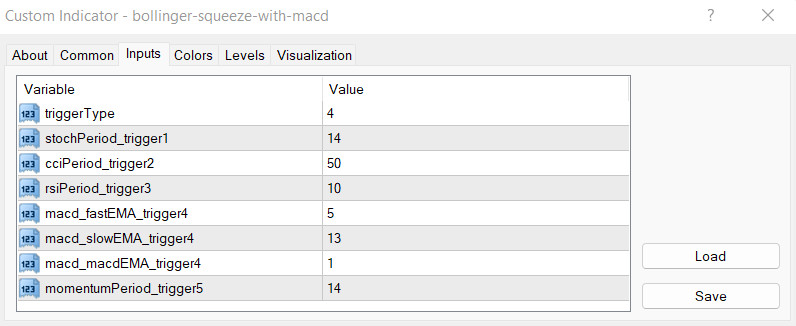

There are several sections in the settings of the Bollinger Squeeze with MACD indicator that are responsible for its general functioning. The Input parameters section is responsible for the values of its technical work, the Colors section is used to change the visualization parameters, and the Levels section is used to add signal levels to the indicator window.

-triggerType - type of indicator used for calculations. The default value is 4.

-stochPeriod trigger1 - Stochastic indicator period value. The default value is 14.

-cciPeriod trigger2 - calculation period of the CCI indicator. The default value is 50.

-rsiPeriod trigger3 - RSI indicator period. Default value is 10.

-macd fastEMA trigger4 - fast exponential moving average period of the MACD indicator. The default value is 5.

-macd slowEMA trigger4 - slow moving average period of the MACD indicator. The default value is 13.

-macd macdEMA trigger4 - period of the signal line of the MACD indicator. The default value is 1.

-momentumPeriod trigger5 - Momentum indicator calculation period. Default value is 14.

Indicator signals

The Bollinger Squeeze with MACD indicator is very easy to use due to its simple visualization. To open a specific trade using the indicator, it should be determined the strength and direction of the current trend. For this, the color, direction and location of the indicator histogram are taken into account. If the indicator determines an upward trend, long positions are opened if the trend is downward, short positions. At the moment the current trend changes, trades are closed. It should be borne in mind that at the time of a weak trend, trades are not opened at all.

Signal for Buy trades:

- The histogram of the indicator is colored with the growth value and rises above the signal level together with the signal line. At the same time, with each value, the histogram rises higher.

Upon receipt of such conditions characterizing the presence of an uptrend, a buy trade can be opened. Upon receipt of reverse conditions from the indicator, namely during a change or weakening of the current trend, the trade should be closed and a new one should be considered.

Signal for Sell trades:

- The histogram and the signal line of the indicator fall below level 0 and fall below with each value, it is colored in color with the value of the fall.

When a full combination of such conditions is received on a signal candle, a sell trade may be opened due to the presence of a downtrend. Upon receipt of the opposite conditions from the indicator, namely, when the current trend changes or weakens, the current trade should be closed and a new one should be considered.

Conclusion

The Bollinger Squeeze with MACD indicator is a very smart trading algorithm that allows choosing a trading indicator to perform calculations. Its signals are not only accurate but also very simple. Despite its ease of use, it is recommended to use a demo account before trading on a real deposit.