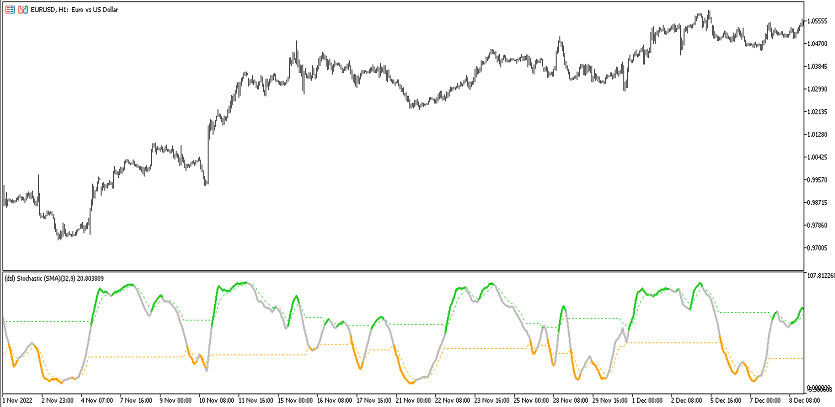

The DSL Stochastic Extended indicator is a trading algorithm that uses the DSL indicator applied to the calculations of the standard Stochastic forex indicator. Its calculations are used to trade with the trend and thus, its calculations are aimed at determining the direction and strength of the current trend, which in turn is determined by indicator values. It is represented in the lower window of the price chart in the form of three lines: the main and two signal lines, while the main line, under certain market conditions, is painted in a certain color, changing its direction. Thus, the indicator values determine the current trend and allow considering the opening of trade taking it into account.

The DSL Stochastic Extended indicator is suitable for use on any timeframes, with any currency pairs.

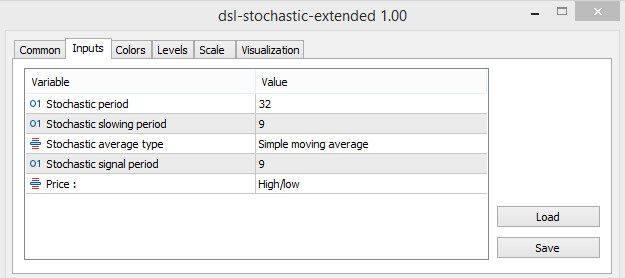

Input parameters

There are several sections in the settings of the DSL Stochastic Extended indicator that are responsible for its general functioning. Thus, its Input parameters section is responsible for its technical work, the Colors section is for changing its visualization parameters, and the Levels section is used to add signal levels to its window.

-Stochastic period - value of the period of the Stochastic indicator. The default value is 32.

-Stochastic slowing period - indicator slowing down period. The default value is 9.

-Stochastic average type - type of smoothing of Stochastic indicator calculations. By default, it is set to Simple moving average.

-Stochastic signal period - period of calculation of the signal line of the indicator. The default value is 9.

-Price - type of the price to which the indicator calculations are applied. By default, it has the High/Low value.

Indicator signals

To open a certain trade using the DSL Stochastic Extended indicator, the current trend is determined, namely its current direction and strength. To do this, it should be taken into account the direction and color of the main line and its intersection with the signal lines. Thus, if the indicator determines the presence of an uptrend, buy trades are opened, if the trend is down, sell trades. When the trend changes direction, trades are closed in both cases. At the moment when the indicator line does not intersect with the signal lines and has a neutral color, trades are not opened.

Signal for Buy trades:

- The indicator line goes up, crossing its upper level and is colored with the growth value.

Upon receipt of such conditions on a signal candle, a buy trade can be opened, due to the presence of an uptrend in the current market. The trade should be closed when the current trend changes, namely, when the opposite conditions are received from the indicator. At this moment, it should be considered opening new trades.

Signal for Sell trades:

- The indicator line goes down, intersecting with the lower signal line and acquires a color with a falling value.

A sell trade, due to the presence of a downtrend in the current market, can be opened immediately upon receipt of such conditions. The trade should be closed and the opening a new one should be considered when the current trend changes, namely, when the color and direction of indicator line change.

Conclusion

The DSL Stochastic Extended indicator is an efficient trading algorithm that is used for trend trading. The indicator is very easy to use and therefore suitable even for beginners who can strengthen their trading skills through preliminary practice on a demo account.