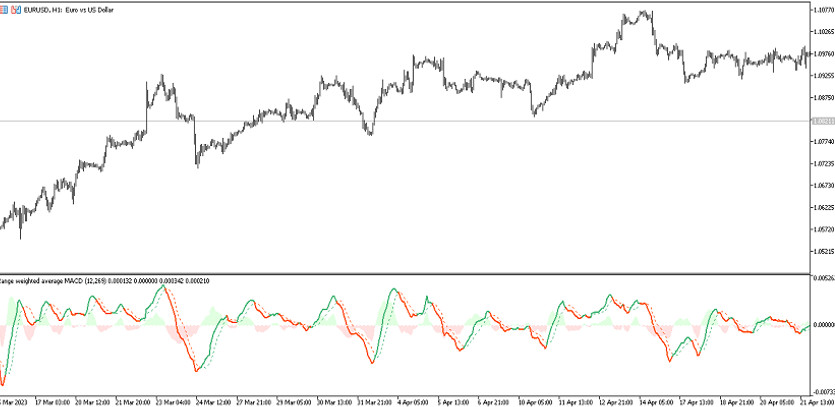

Range Weighted Average MACD is a trading algorithm based on a modification of the calculations of the MACD indicator, which is included in the standard forex set. This version of the indicator is considered more accurate due to the use of smoothing calculations using a moving average and more convenient visualization. The indicator's calculations are aimed at determining the current trend, namely its direction and strength, which in turn allows the opening of a certain trade. It is presented in the lower window of the price chart in the form of a colored histogram with two signal lines, which, when determining the current trend, intersect with each other, moving in a certain direction and coloring in a certain color. Information about the current trend, in turn, will allow considering the opening of a specific trade.

The Range Weighted Average MACD indicator is a universal tool suitable for use on any timeframe with any currency pair.

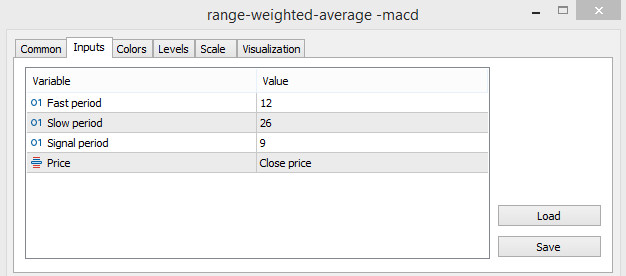

Input parameters

The settings of the Range Weighted Average MACD indicator consist of several sections. Its Input Parameters section is responsible for its general functioning and technical work, the Colors section is used to change its visualization, including the color scheme, and the Levels section is used to add signal levels to the indicator window.

-Fast period - value of the period of the fast moving average of the indicator. The default value is 12.

-Slow period - the period of the slow moving average. The default value is 26.

-Signal period - period of calculation of the signal line of the indicator. The default value is 9.

-Price - type of the price to which the indicator calculations are applied. By default, it has the Close price value.

Indicator signals

Range Weighted Average MACD is very easy to use, since in general the algorithm of its application is very similar to similar histogram indicators, including its standard version. To open a certain trade using the indicator, it should be determined the information about the current trend, namely the strength and direction. To do this, it should be taken into account several values of the indicator, namely the color, location and direction of the histogram and its signal lines. If the current market trend is upward, buy trades are opened, if the trend is downward, sell trades. When the current trend changes, in both cases, trades are closed.

Signal for Buy trades:

-The histogram of the indicator has a color with a growth value and is located above level 0. Its signal lines have a color with a growth value and move up, while the fast line is higher than the slow one.

Upon receipt of such a combination of conditions on a signal candle, a buy trade can be opened, due to the presence of an uptrend in the current market. Such a trade should be closed upon receiving a return signal from the indicator, namely, when the histogram color changes and its signal lines cross again. At this moment, it is possible a change in the current trend, which in turn allows considering the opening of new trades.

Signal for Sell trades:

-The signal lines of the indicator intersect so that the slow one is higher than the fast one, while both lines move down and have a color with a falling value. The indicator histogram is also directed downwards and has a color with a falling value.

Upon receipt of such conditions characterizing the presence of a downtrend, a sell trade can be opened. When the current trend changes, namely, upon receipt of reverse conditions from the indicator, the current trade should be closed and opening new ones due to a change in the current market trend should be considered.

Conclusion

The Range Weighted Average MACD indicator is a very effective trading algorithm, as its calculations are based on the use of a time-tested indicator. In order to improve trading skills and use this algorithm correctly, preliminary practice on a demo account is recommended.