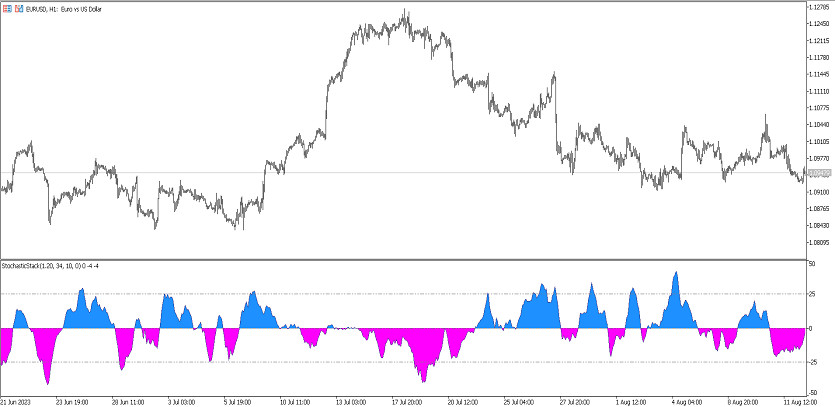

The Stochastic Stack indicator is one of the modification versions of the standard Stochastic forex indicator. Its calculations, like the standard version, are aimed at determining the current trend, namely its direction and strength, as well as trading during this period. At the same time, the indicator can be used in trading to determine whether the market is in the overbought and oversold zone. The indicator is presented in the lower window of the price chart as a histogram with signal levels, the direction and color of which depend on the current market conditions. Taking into account the values of the indicator, the current trend is determined, taking into account which the trade itself is opened directly.

The indicator is suitable for trading any currency pairs on any timeframe.

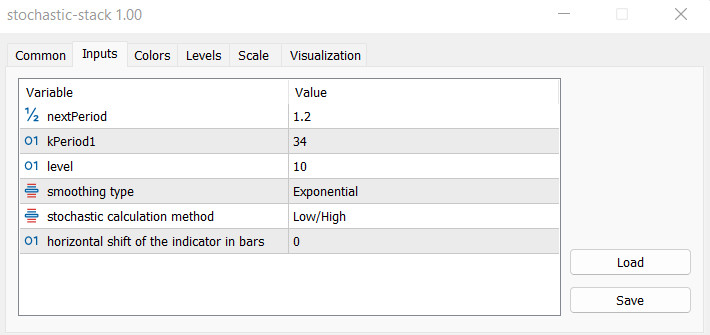

Input parameters

The Stochastic Stack indicator settings include several sections. Thus, the Input parameter section is responsible for the values of its technical work, the Colors section is responsible for its general visualization, and to add signal levels to the indicator window, the Levels section is used.

-nextPeriod - indicator calculation period. The default value is 1.2.

-kPeriod1 - indicator signal line period. The default value is 34.

-level - value of the signal level of the indicator. The default value is 10.

-smoothing type - the type of smoothing of the indicator values. The default value is Exponential.

-stochastic calculation method - price type used to calculate the indicator values. Default is Low/High.

-horizontal shift of the indicator in bars - the current horizontal shift of the indicator values. The default value is 0.

Indicator signals

The Stochastic Stack indicator is very easy to use due to its visualization. To open a certain trade, one should take into account the direction and strength of the current trend, which in turn are determined by the indicator values, namely the color and direction of its histogram, as well as its location relative to signal levels. If the indicator determines an upward trend, long positions are opened, if the trend is downward, short positions are opened. When the current trend changes, in both cases, trades are closed.

Signal for Buy trades:

- The histogram of the indicator has a color with a growth value and is located above the level of 25.0.

Upon receipt of such conditions, a buy trade can be opened on the signal candle due to the presence of an uptrend. If the current trend changes, namely, when the direction and color of the histogram change, the current trade should be closed and a new one should be considered.

Signal for Sell trades:

- The histogram of the indicator falls below -25.0 and is colored with the fall value.

A sell trade, due to the presence of a downtrend, can be opened immediately upon receipt of such conditions. Close the current trade and consider opening a new one should receive the opposite conditions from the indicator. At this moment, the current trend is expected to change.

Conclusion

The Stochastic Stack indicator is very effective, as its calculations are very accurate. Despite this, in order to improve the quality of trading, it is recommended to use the indicator with additional indicators, filters and advisers. In addition, practice on a demo account is recommended.