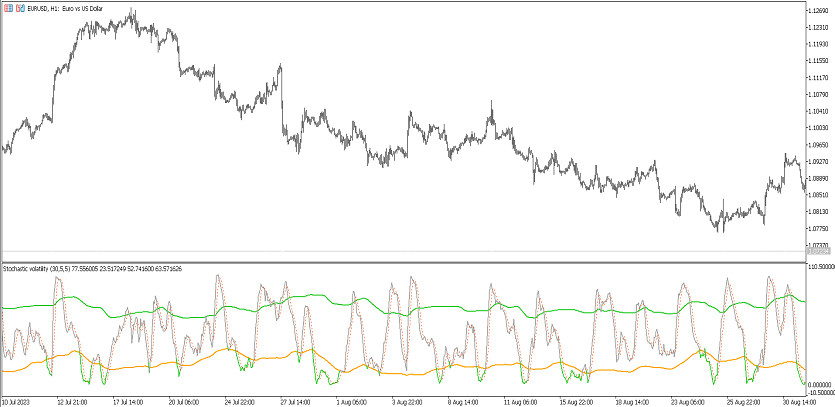

The Stochastic Volatility trading indicator is a trading algorithm that is based on the use of the standard Stochastic Forex indicator. As with the standard version, the indicator can be used for trend trading, and its calculations are based on determining the volatility of a trading asset, for example, a certain currency pair. The indicator is presented in the lower window of the price chart in the form of two lines: the main and the signal, which moves in a certain direction relative to the upper and lower borders of the channel. Taking into account the values of the indicator lines, the volatility of the asset is determined, and at the same time the moment of opening a certain trade.

Input parameters

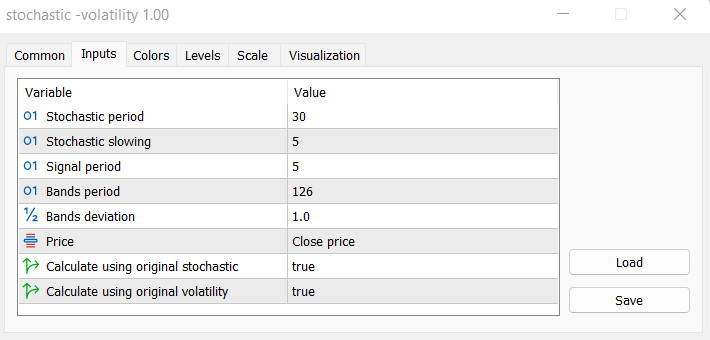

The Stochastic Volatility indicator settings consist of several sections. The Input parameters section is responsible for its technical operation, the Color section is responsible for general visualization, while the Levels section is used to add signal levels to the indicator window.

-Stochastic period - calculation period of the Stochastic indicator. The default value is 30.

-Stochastic slowing - slowdown period for indicator calculations. The default value is 5.

-Signal period - period of the indicator signal line. The default value is 5.

-Bands period - the value of the period of the channel lines. The default value is 126.

-Bands deviation - the period of deviation of the current channel values from the standard ones. The default value is 1.0.

-Price - type of price to which indicator calculations are applied. By default, it is set to Close price.

-Calculate using original stochastic - period using the standard Stochastic indicator. The default value is true.

-Calculate using original volatility - parameter for using the original market volatility. Defaults to true.

Indicator signals

To open a specific trade using the Stochastic Volatility indicator, it should be taken into account the volatility of the current market. For this, in turn, the intersection of the signal line with the main line, their direction and location relative to the channel boundaries are taken into account. In an upward trend and high volatility, a buy trade is opened, in case of high volatility and in a downward trend - a sell trade. When the trend changes and market volatility decreases, trades are closed.

Signal for Buy trades:

- The indicator lines are moving upward, while the main line is above the signal line. The lines cross the upper border of the channel.

When such conditions are received, a buy trade can be opened on the signal switch, due to the presence of an upward trend with high market volatility. When the trend changes, namely when opposite conditions are received, the current trade should be closed and a new one should be considered.

Signal for Sell trades:

- The indicator lines cross the lower border of the channel, while the signal line is above the main one.

A sell trade caused by the presence of a downward trend with high volatility can be opened immediately when such conditions are received. When opposite conditions are received from the indicator, the trade should be closed. At this moment, a change in the current trend is possible, which will allow us to consider opening new trades.

Conclusion

The Stochastic Volatility indicator is very effective since its calculations are based on a modification of the standard Forex indicator. At the same time, its signals are considered more accurate, since in addition to the current trend, the indicator also takes into account market volatility. Before using the indicator on a real deposit, it is recommended to practice on a demo account.