Technical analysis, at its essence, harnesses the power of statistical evaluation to steer trading decisions. The lifeblood of this approach is an extensive data pool, frequently expressed through charts, for scrutinizing stocks and entire markets. Occasionally, these charts' trend lines morph and intersect, producing recognizable figures often humorously referred to as "cup with handle," "head and shoulders," or "double top." Proficient traders become adept at identifying these typical patterns and using them as a roadmap for forecasting a stock or market's future trajectory.

Two such intriguing patterns are the golden cross and the death cross, each serving as a counterpoint to the other. A golden cross symbolizes the dawn of a long-term bull market, while the appearance of a death cross forecasts a looming long-term bear market. Both phenomena stem from the definitive validation of a long-term trend brought about by a short-term moving average surpassing a significant long-term moving average.

Essential Insights

- The golden cross foretells a lasting bull market, while the death cross indicates a prolonged bear market.

- These crossovers gain importance when they coincide with high trading volume.

- Upon the crossover, the long-term moving average becomes a significant support level (golden cross) or resistance level (death cross) from that point onward.

- While crosses can indicate a trend change, they usually serve as a robust confirmation of a shift that has already taken place.

- Both golden crosses and death crosses assist traders in determining optimal entry and exit points.

Interpreting the Golden Cross

A golden cross takes place when a short-term moving average surpasses a key long-term moving average, hinting at a decisive upward market trend. In simpler terms, the short-term average progresses faster than the long-term average until they intersect.

The golden cross development involves three stages:

- A declining trend that eventually concludes as selling pressure subsides

- The shorter moving average eclipsing the longer moving average

- The continuing upward trend, potentially leading to increased prices

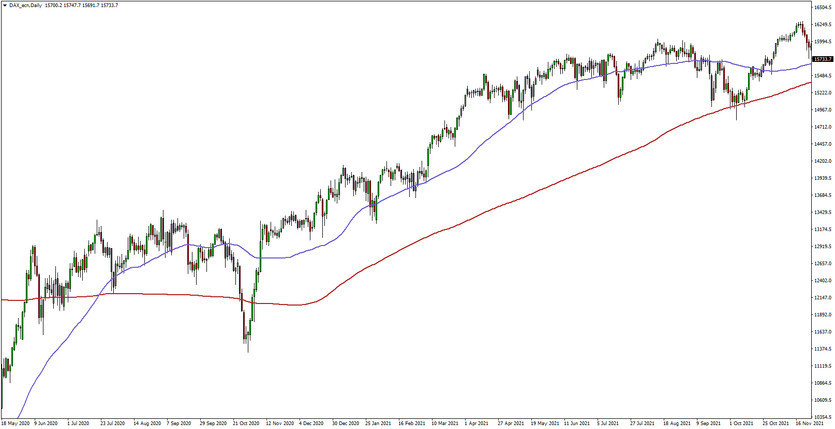

This chart showcases a Golden Cross in action on the DAX Index.

This chart showcases a Golden Cross in action on the DAX Index.

Understanding the Implications of a Golden Cross

The first stage involves a downtrend eventually bottoming out as selling exhausts. The second stage sees the shorter moving average surging past the longer moving average, confirming a trend reversal. The final stage comprises a sustained uptrend that hopefully results in higher prices. The moving averages function as support levels during pullbacks until they intersect downward, potentially forming a death cross.

Typically, traders employ the 50-period and the 200-period moving averages. The term "period" refers to a specific time increment. Larger periods generally result in more durable breakouts. For instance, the daily 50-day moving average passing above the 200-day moving average on an index like the S&P 500 is considered one of the most bullish market signals.

Day traders often use smaller periods like the 5-period and 15-period moving averages to trade intra-day golden cross breakouts. The chart's time interval can also be adjusted, from 1 minute to several weeks or months. As with larger periods, larger chart time frames also tend to produce stronger golden cross breakouts.

The Death Cross

On the other hand, a similar downward moving average crossover results in a death cross, which implies a significant downturn in the market. The death cross occurs when the short-term average trends downward and intersects the long-term average, essentially taking the reverse direction of the golden cross.

Although the death cross may seem threatening by name, it's not necessarily a harbinger of doom. Historical market data often shows a rebound with above-average returns following a death cross.

This illustration represents a Death Cross on the GBPUSD currency pair. The short-term moving average takes a downturn, crossing the long-term average. This compelling signal suggests a forthcoming bear market, revealing potential opportunities for strategic trading

This illustration represents a Death Cross on the GBPUSD currency pair. The short-term moving average takes a downturn, crossing the long-term average. This compelling signal suggests a forthcoming bear market, revealing potential opportunities for strategic trading

Understanding the Death Cross and Its Implications

The death cross indicates that price momentum has declined over a slightly longer than two-month period, assuming the 50-day moving average is involved. Notably, the death cross has predicted every severe bear market of the past century, including 1929, 1938, 1974, and 2008. However, this overlooks numerous instances where the death cross only resulted in a market correction.

Data cited in Barron's from Fundstrat research indicates that the S&P 500 index experienced an increase about two-thirds of the time, averaging a 6.3% gain over a year following the death cross. Shorter time frames also showed appealing market gains after a death cross.

The death cross tends to be a more effective bearish market timing signal following market losses of 20% or more, as downward momentum in weak markets can signify worsening fundamentals. However, it's more of a coincident indicator of market weakness rather than a leading one.

Additional Considerations: Variations and Significance

When it comes to defining this critical moving average crossover, opinions vary among analysts. Some analysts characterize it as a crossover of the 50-day moving average over the 100-day moving average. Others, meanwhile, perceive it as the crossover of the 50-day average over the much longer 200-day average. This variation underscores the need for traders to understand the specific parameters used in their chosen trading strategy or analysis tool.

Moreover, the time frame of the crossover also holds significance in trend analysis. Some market watchers take note of the crossover on smaller time frame charts as further evidence of a robust, ongoing trend. Whether these variations lie in the precise definition or the time frame utilized, the term 'crossover' consistently refers to a short-term moving average intersecting a major long-term moving average.

Furthermore, it's vital to recognize that while these patterns provide valuable insights, they're not foolproof indicators of future performance. Like any trading strategy, they should be used in conjunction with other indicators and market analysis techniques. Understanding the market context, macroeconomic factors, and specific company performance can all influence the relevance and accuracy of a golden cross or death cross signal.

Lastly, remember that these tools are often best utilized as part of a broader, comprehensive investment strategy. They can provide valuable signals for when to enter or exit trades, but relying solely on these signals without considering other factors could potentially lead to misinformed trading decisions. It's always best to combine these technical indicators with sound financial judgement and intuition cultivated through trading experience.

The Final Word: The Impact and Usage of Golden Crosses and Death Crosses in Trading

Golden crosses and death crosses are more than just intriguing phenomena in the world of trading; they are vital components of technical analysis that have the potential to significantly impact trading decisions. Each signal embodies a distinct market forecast: a golden cross points to the advent of a bull market, while a death cross suggests the onset of a bear market.

These forecasts are not random or based on mere guesswork; they are underpinned by the robust confirmation of a long-term trend that emerges when a short-term moving average intersects a major long-term moving average. These intersections provide traders with valuable directional cues, aiding them in making critical decisions about when to enter and exit trades.

But it's important to remember that, as potent as these tools are, they are not infallible predictors of future performance. Market conditions are shaped by a multitude of factors, and these patterns, while insightful, are only one piece of the puzzle. Traders should also consider market sentiment, economic indicators, and company-specific news when making investment decisions.

Therefore, while these cross patterns can offer key insights, they should be used as part of a balanced and well-informed investment strategy. They can serve as guideposts, helping traders navigate the complexity of the markets. However, successful trading also requires a healthy dose of financial acumen, risk tolerance, and a keen understanding of the broader market landscape.

As with all tools and techniques in the trading world, the golden cross and death cross are most effective when employed thoughtfully and judiciously. By understanding their implications and using them appropriately, traders can better navigate the challenges and opportunities of the financial markets.