Unraveling the Dynamics of Trading and Investing

Venturing into the world of finance can be thrilling and rewarding, particularly with the two predominant strategies at play: investing and trading. Simply put, an investor is akin to a marathon runner, participating for the long haul, while a trader operates like a sprinter, influenced by rapid market fluctuations.

Both strategies encompass the purchase of financial assets - be it stocks, ETFs, or bonds - with the shared aspiration of growing capital. However, they diverge when it comes to the time horizon. Trading tends to be fast-paced, engaging in the purchase and sale of shares for fleeting gains within a day or a week. Conversely, investing aims for enduring prosperity, with buying and selling decisions spanning months or even years.

Delving Deeper: The Essence of Investing

In essence, investing is like planting a tree, allowing it to mature over time to reap substantial returns. By curating a well-diversified portfolio inclusive of stocks, bonds, mutual funds, and the like, you create a robust financial fortress with potential for significant long-term growth.

In general, long-term investors gravitate towards companies that exhibit robust fundamentals and show promising future growth potential.

Differentiating Styles of Investing

When it comes to investing, not all approaches are created equal. Discerning investors may opt for various styles based on their personal preferences and risk tolerance.

Active Investing

Active investing entails hiring professionals like fund managers or portfolio managers to steer your financial ship. While their expertise may command hefty fees, the potential gains could justify the cost.

Passive Investing

For those who fancy being their own financial navigator, passive investing is the perfect fit. Here, you manage your funds personally, thereby circumventing expert or management fees, resulting in lower costs.

Value Investing

Value investing is akin to seeking diamonds in the rough - investing in robust, established firms while avoiding high-risk ventures. Relying on a company's historical performance, value investors prioritize stability.

Growth Investing

Growth investing is for those who don't shy away from a bit of risk in their quest for high returns. Even though these high-growth-rate investments can be a bit of a gamble, they hold the potential for high rewards.

Understanding the Trading Spectrum

Trading is the realm of short-term financial engagements, usually spanning a day or a week. Here, the objective is to exploit quick market movements to yield profits in a compressed timeframe. Intraday trading, for instance, might involve a higher risk level, but a trader could potentially secure a 15% return every month, in comparison to an investor's annual return.

While investing revolves around long-term asset retention, trading aims to capitalize on shorter-term price fluctuations. Traders leverage tools such as Stochastic Oscillators, Moving Averages, RSI, and MACD to identify promising trade setups.

Diverse Trading Techniques

Trading isn't a one-size-fits-all practice. Various methods cater to different trading preferences and strategies.

Intraday/Day Trading

As the name suggests, this strategy involves buying and selling stocks within a single day. The trades must be closed out within the day, as mandated by SEBI.

Futures & Options Trading

Also known as derivatives trading, this method focuses on contracts whose value hinges on the prices of an underlying asset. Traders anticipate the contract prices and aim to earn returns via price fluctuations, often employing leverage.

Delivery Trading

Also referred to as investing, delivery trading involves buying shares, holding them for a desired duration, and selling when convenient. Unlike other trading types, this strategy does not involve leverage or short selling and can extend for decades.

Swing Trading

Swing trading involves holding positions in selected shares, typically for a few weeks.

Scalp Trading

Here, traders use high leverage to seize small profits from even minor price changes.

Key Differences Between Investing and Trading

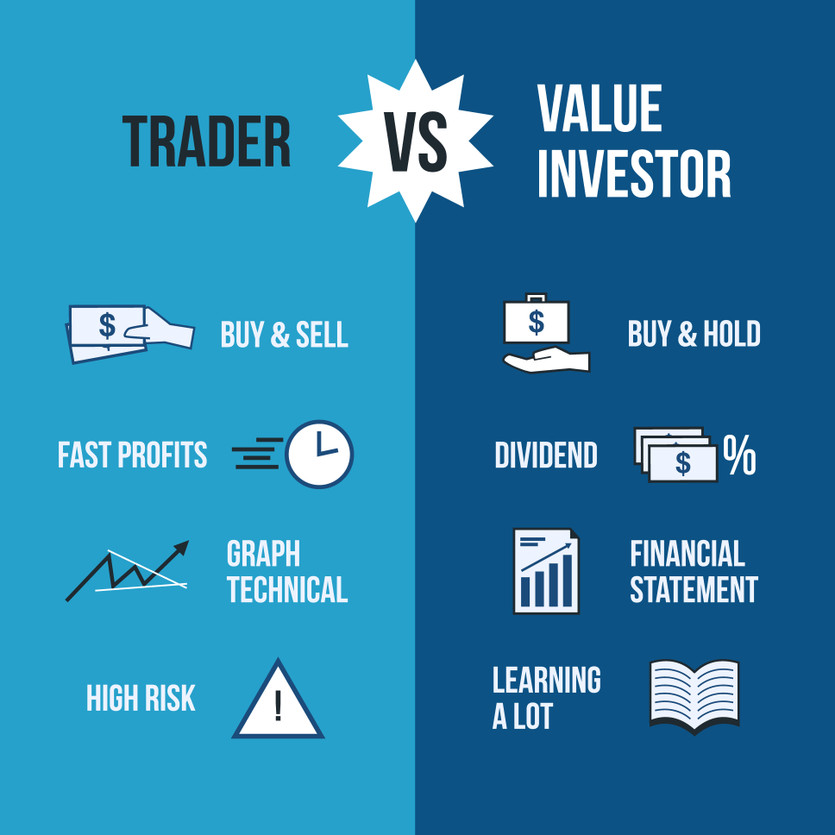

Risks

While investing tends to be less risky, as shares are held for extended periods to weather market volatility, trading poses higher risk due to the use of leverage. Minor price swings can significantly affect the invested capital.

Investment Duration

Investing is a long-term commitment akin to a marathon, whereas trading capitalizes on short-term price shifts, much like a sprint.

Capital Growth

Investing is a slow-burn strategy aiming for steady growth, along with additional benefits like dividends. In contrast, traders seek rapid profits by continually identifying promising trading opportunities.

Effort

Investing necessitates little regular effort, whereas trading requires thorough market analysis before each trade.

Analysis Style

Investors lean on fundamental analysis, examining company financials, balance sheets, key ratios, and growth potential. Traders, however, focus on technical analysis, studying charts, identifying price patterns, using indicators for trade signals, and staying in tune with market sentiments.

Who Should Trade or Invest?

The financial landscape welcomes all types of players, but the strategies employed vary depending on individual skill sets, risk tolerance, and time commitment. Understanding these elements can help you identify if you're better suited to be an investor or a trader.

Investing: The Long Game

Investing is an accessible entry point into the world of finance. It requires minimal prior knowledge, making it suitable for beginners and those who prefer a hands-off approach. You simply select a stock or other investment vehicle, use your Demat & Trading account to make the investment, and then periodically review your portfolio's performance.

Investing is ideal for those who value patience, long-term growth, and minimized risk. If you prefer a steady and consistent financial journey, are not bothered by short-term market volatility, and have the ability to lock away funds for extended periods, investing would be a suitable path.

Trading: The Quick Fire Route

On the other hand, trading calls for a more hands-on, skilled approach. It requires understanding and interpreting charts, identifying share patterns, and familiarity with technical indicators. Trading isn't just about buying and selling; it's about timing, speed, and constant vigilance.

Trading is suitable for those who are willing to dedicate time to learning the craft, and who enjoy the thrill of constant engagement with the market. If you have a high-risk appetite, can make quick decisions under pressure, and are comfortable with the potential for both high losses and high returns, trading may be the right fit for you.

Trading vs Investing: What's the Better Choice?

The decision between trading and investing isn't a matter of one being universally superior to the other. Rather, it comes down to individual circumstances, financial goals, risk tolerance, and market understanding.

Investing: The Tortoise’s Approach

Investing is a long-term strategy, much like a tortoise's journey. It may seem slow, but it offers steady growth over time. This approach can lead to substantial returns in the long run, thanks to the power of compounding. Moreover, investing allows you to earn dividends, which can be reinvested for even greater growth.

Investing is well-suited for those who can tolerate short-term market downturns and who have a long-term financial goal, such as retirement or a child's education. It requires less daily involvement, and fundamental analysis helps make informed decisions about which companies are poised for future growth.

Trading: The Hare’s Sprint

Trading, in contrast, is a fast-paced sprint. It's about making quick, frequent trades to profit from short-term market fluctuations. The potential for high returns is enticing, but it's essential to remember that this strategy also comes with higher risk, especially with day trading or high-leverage positions.

Trading is a good fit for those who have a thorough understanding of the market, a high-risk tolerance, and the time to monitor market movements closely. It requires a proactive approach and a willingness to continually learn and adapt to market trends.

In conclusion, both investing and trading have their own merits and drawbacks. It's essential to align your choice with your personal financial goals, risk tolerance, and time commitment. A well-rounded financial strategy could even include a blend of both investing and trading, depending on your individual circumstances.