A Glimpse into Apple Inc

Established in 1976, Apple Inc (AAPL), etched its name in history as the premier U.S. enterprise to break past the $1 trillion market capitalization in 2018. The impressive expansion in sales, earnings, and stock price was historically anchored by robust sales of its flagship product, the iPhone.

With the deceleration in sales of iPhones and other tech hardware, Apple undertook a strategic initiative to transform into a global powerhouse in digital services. The corporate giant designs, produces, and markets a wide array of products like personal computers, tablets, smartphones, wearable technology, and software, along with other accessories and third-party digital content.

As the world's most valuable company in terms of stock market value, Apple's portfolio is extensive. It includes the iPhone, iPad, iMac, Apple Watch, Apple TV, and a host of software applications designed for consumers and professionals, like iOS, macOS, iPadOS, watchOS, iCloud, AppleCare, and Apple Pay. Apple distributes and supplies digital content and applications through platforms like Apple Store, Apple Arcade, Apple News+, Apple Fitness+, Apple Card, Apple Pay, and Apple Music. Here's what you need to understand about buying and selling Apple shares.

The Resurgence of Apple

Apple's financial year of 2019 experienced a rollercoaster ride, yet it managed to augment its revenue from the services division. However, earnings from its mainstream products like iPhones and MacBook laptops fell slightly short of the 2018 figures. For the initial fiscal quarter of 2020, Apple projected revenues in the range of $85.5 billion to $89.5 billion.

Despite the projections, Apple announced an all-time record with revenue and net income figures reaching $91.8 billion and $22.2 billion respectively. In the fiscal year of 2019, Apple reported sales of $260.2 billion and net income of $55.2 billion. The company also witnessed record-breaking earnings per share, which increased from $4.18 in the first quarter of 2019 to $4.99 in the initial fiscal quarter of 2020.

Investing in Stocks - The Why

As a prospective shareholder, it's critical to understand why you wish to invest in shares. Are you looking for capital growth, income from dividends, or both? Your investment objectives will steer your decision on what type of shares to invest in - whether it's high-growth tech shares or defensive companies with a consistent dividend yield.

The majority of investors seek companies with a proven track record of consistent earnings growth, a strong market position, and products or services with potential for future growth. Besides these, other factors like takeover speculations can also drive a company's share price upwards. Investors might also be enticed by recovery opportunities where a deflated share price offers potential for a significant rebound.

A Deep Dive into Apple's Profitable Business Segments

iPhone: The Groundbreaking Tech Marvel

At the heart of Apple’s product lineup, the iPhone holds its place as the iconic smartphone. This extraordinary device finds its place among the world's top five smartphone manufacturers. After the release of the iPhone 14, Apple experienced a significant demand surge, describing this latest model as the "new benchmark for performance, enabling our users to create and connect in unprecedented ways." Remarkably, sales for the iPhone 14 outperformed those for the iPhone 12, which already had "soaring" sales numbers as of December 2021.

The Mac: A Classic Powerhouse

Apple's computer business, centered around the Mac, encompasses both the MacBook laptops and the legendary iMac desktop computers. The division recorded sales of $35.1 billion (with $9.2 billion in the fourth quarter of 2021), marking an increase from the previous year’s $28.6 billion ($9 billion in Q4-2020).

Services: The Digital Hub

Apple's services division, anchored by the App Store and Apple Music, generates revenue from an array of offerings such as AppleCare, Apple Pay, iCloud storage, AppleCare warranties, and subscriptions to services like Apple Music, Apple Arcade, Apple TV+, and the Apple Card, which competes with other major payment solutions.

During the 2021 fiscal year, the Services segment generated $68.4 billion in revenue, with $18.3 billion for the fourth quarter. Compared to the previous year's $53.8 billion and Q4-2020's $14.5 billion, this result set a new record high for the unit.

Buying AAPL Stocks

Once you've identified a company you wish to invest in, several steps guide the process of purchasing shares.

1. Account Setup

Regardless of your level of experience, you'll need to create an account with a regulated broker to buy Apple shares. Stockbroking is a fiercely competitive field with a variety of services available for DIY investors – from online platforms operated by renowned financial service firms to investment trading apps designed for mobile devices. Before setting up an account, consider:

- Your ultimate financial objectives.

- The ability to withstand market fluctuations.

- The aim to minimize trading expenses.

- Understanding potential tax implications from share trading unless you utilize a tax-efficient wrapper such as an ISA.

Also, before purchasing any shares, ask yourself:

- Should I seek financial advice?

- Am I comfortable with the risk level involved?

- What is my investment budget?

- Can I afford a potential loss?

- Do I fully understand the company I'm considering investing in?

- Am I protected if my platform provider/advisor goes bankrupt?

2. Understanding the Trade

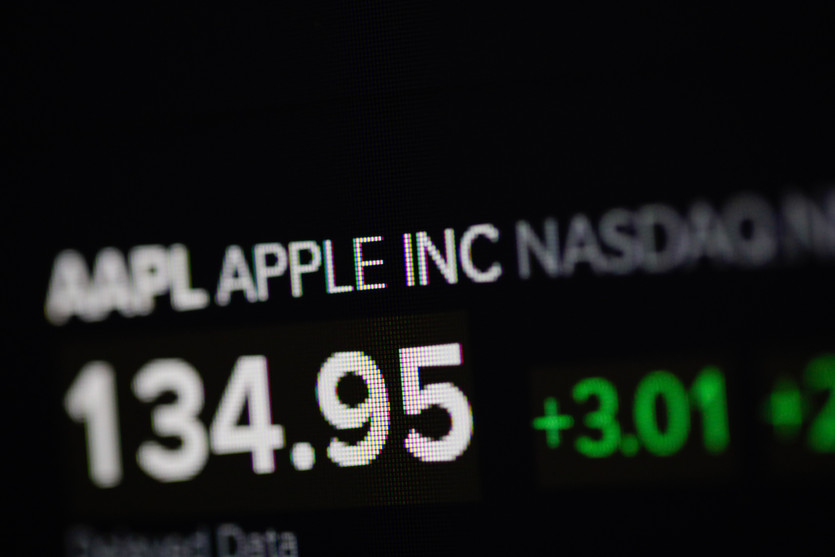

Apple Inc trades under the ticker symbol AAPL, listed on the tech-centric Nasdaq exchange in the US. Trading hours run from 9.30 am to 4 pm (Eastern Time). Most brokerage accounts should facilitate the purchase of US shares.

Bear in mind, purchasing shares in US dollars involves a foreign exchange fee (around 1% typically) unless the purchase is funded from a US dollar account.

3. Conducting Research

For more insight into Apple, visit the company’s online investor relations page. It is beneficial to compare Apple's valuation to other US technology companies.

4. Developing an Investment Strategy

Investors typically follow one of two methods: a lump sum purchase or investing smaller, regular amounts over time.

5. Placing an Order

When you're ready to buy Apple shares, log into your investment account or trading app, input Apple's ticker symbol (AAPL), and specify the number of shares you want to purchase or the amount you wish to invest.

6. Monitoring Your Investment

After buying shares, it's essential to keep an eye on your investment. Ensure you track the company’s progress, regularly check the share price, and stay informed about significant company events or market news. Although fluctuations are normal, a dramatic price drop may suggest an issue that requires your attention. You should also track any dividends paid by the company, as they contribute to your overall return.

7. Selling Your Shares

When you decide to sell your shares, log into your brokerage account or trading app, search for Apple's ticker symbol (AAPL), and choose the number of shares you want to sell. Be sure to consider the timing and tax implications of your sale.

Risks of Investing in Apple

Like any investment, purchasing Apple shares carries risks:

-

Market Risk: The risk that the stock market will decline, dragging down the company’s share price.

-

Business Risk: The risk that Apple underperforms due to internal problems.

-

Regulatory Risk: Apple has faced regulatory scrutiny in the past, particularly around the monopolistic practices of the App Store. Increased regulation could affect the company's profitability.

-

Competition: Apple faces stiff competition from other tech giants, such as Samsung, Google, and Huawei. A loss of market share to these competitors could impact Apple's earnings.

-

Currency risk: For non-US investors, currency fluctuation can impact the return on investment.

Despite these risks, Apple's strong brand and loyal customer base, along with its ability to innovate and introduce new products, have contributed to its overall success. As always, it's important for potential investors to do thorough research and consider their personal financial situation and risk tolerance before investing.

An Alternative Approach: Investing in Apple via Funds

Direct investment in individual companies, including Apple, can be thrilling and potentially lucrative. It can also qualify you for any company-specific shareholder benefits. However, it exposes you to market instability and unexpected fluctuations in share prices.

Financial advisors often suggest investing in a diversified range of assets and funds. These funds typically include a pre-built portfolio with shares from over fifty different companies, thus spreading the risk.

Given its significant position in the Nasdaq index, Apple's shares feature prominently in numerous global and specialist technology funds, investment trusts, as well as Exchange-Traded Funds (ETFs). This diversification is an alternative way to indirectly own a piece of Apple while spreading out potential risks.

Recent Financial Highlights

As of the last quarterly update on May 5, 2023, Apple presented the following financial data:

- A 3% decrease in Q2 revenue year-on-year, amounting to $94.8 billion

- Operating cash flow was reported at $28.6 billion

- Earnings per share remained steady year-on-year at $1.52

- An increased dividend of $0.24 per share, up 4%, paid on May 18

- The board authorized a $90 billion share repurchase program

In Conclusion

Investing in Apple can be a great opportunity, but like all investments, it does not come without risks. Understanding the company's business model, its products and services, and financial health can help you make a more informed decision. If you're considering buying Apple shares, take the time to consider your financial goals, risk tolerance, and investing strategy. And remember, no matter how confident you feel about your investment, never invest money you can't afford to lose.