The Yen Reaches Two-Week High

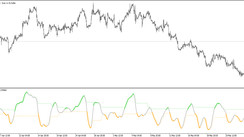

The yen, Japan's currency, reached a two-week high against the U.S. dollar on Monday. This upward movement came on the heels of a report indicating the Bank of Japan is contemplating a modification of its yield curve control policy. This would allow the yield of the 10-year Japanese government bond to exceed 1% after the conclusion of its Tuesday meeting.

Nikkei Report Catalyzes Yen Upturn

The dollar's defense faltered the entire day, sliding to 149.065 yen, a 0.4% decline. Consequently, the yen surged to an impressive 148.81 per dollar, its highest level since October 17. This was largely triggered by the Nikkei report, forcing a paradigm shift on the U.S. dollar position.

The Dynamics of the Bond Yield Control Policy

Increasing global rates exert high-pressure on BOJ, which initiated its two-day monetary policy meeting on Monday. The BOJ yield curve control policy holds a -0.1% short-term interest rate target and a 0% cap on the 10-year bond yield. As these standards come under scrutiny, the BOJ may adjust its policy accordingly.

Market Participants' Expectations

All eyes are on this week's interest rate decisions from the important monetary authorities - the U.S. Federal Reserve and England's central bank. Key economic indicators such as purchasing managers' surveys, eurozone inflation, GDP data, and U.S. nonfarm payrolls will accompany these significant announcements.

U.S. Treasury Debt Announcements and Currency Fluctuations

The U.S. Treasury's quarterly refunding announcement on Wednesday, coupled with its funding necessity due to mounting deficits, is set to trigger movements in both bond and currency markets. In addition, the resilience of the U.S. economy is projected to glow amidst these developments.