US Dollar Fundamental Outlook: USD Reversing Gains but Is the Upside Correction Over? – Fx Traders Watching FOMC Minutes This Wednesday

Last week, the dollar reversed all the gains it made two weeks ago, which serves to further attest to our view that the dollar is now in a broader consolidation. This would suggest that the dollar next leg may be up again, beginning soon. As we’ve discussed in recent weeks, the short USD trade was overdue for a correction, and that has indeed transpired. With traders recently scaling back on their short USD positions, it is a natural reaction for the currency to strengthen. Furthermore, traders are now beginning to think in the opposite direction, namely about USD outperformance due to the faster vaccine rollout in the US, especially compared to the EU.

Traders also continue to watch incoming newsflow on Biden’s 1.9 trillion dollars covid stimulus package. Here, the size of the final package that is approved by Congress is what will matter for markets and the dollar. However, with that still some weeks away, we’ll leave that discussion for some of our future weekly analysis posts.

The US is on holiday today (February 15), which means the action will likely be quiet in the Fx market. However, the calendar and trading should get busier later in the week. On the US data calendar, the focus is on Wednesday’s retail sales report and the FOMC minutes. The latter will be closely watched for any hints from the Fed if they are thinking about tapering QE sometime in the future. If there is any evidence of this, the dollar can rebound strongly as markets may start to price in a USD yield advantage again.

Euro Fundamental Outlook: Traders Starting to Question Bullish EUR Outlook

The biggest story for the euro right now is the vaccine disadvantage that the currency faces as the EU is trailing behind the US and the UK in vaccinating large parts of its population. This was not expected when vaccinations began in December, and some EUR bulls still refuse to acknowledge that the slower rollout of vaccines in the Eurozone can fuel a downside correction in EURUSD, but also in the broad EUR index.

The EUR bulls’ arguments are slowly losing weight, however. The EU is nowhere near to the pace of vaccinations in the UK and the US, and this is getting increasing attention from Fx traders. Many of them now believe that the EU’s “vaccine lag” will take the euro exchange rate lower over the next several weeks.

This week’s EUR Forex calendar features the ECB meeting accounts on Thursday and flash services and manufacturing PMI reports on Friday. Weakness in the PMIs particularly, could knock the EUR lower already this week as it will come as another sign that the EU economy is indeed slower to recover from the winter covid lockdowns.

EURUSD Technical Outlook:

EURUSD is by and large following the script we laid out a few weeks ago. We said the base case for EURUSD is to remain in a range roughly between 1.20 and 1.22 for the time being. So, far that seems to be playing out as expected.

Currently, the pair has encountered some resistance at the 55-day moving average (blue line) near the 1.2150 level. A test of 1.22, and nearby levels above 1.22, remains very possible. Potentially, a bearish setup or pattern after EURUSD thoroughly tests the 1.22 area could be an ”excellent” selling opportunity.

To the downside, support remains at the wider 1.20 area, encompassing the 100-day moving average (orange line).

British Pound Fundamental Outlook: GBP Pushing Higher as UK Achieves 15 Million Vaccination Milestone

UK officials announced yesterday that the first milestone of giving the first shot of a COVID vaccine to the most vulnerable groups of its population (around 15 million people) has been achieved. Pound sterling continues to benefit amid the smooth flow of the UK’s vaccination program. Furthermore, evidence from countries with fast vaccine rollout (e.g. Israel) shows that the vaccines are indeed very effective in preventing illness with COVID-19, further fueling optimism among investors.

The GBP data calendar this week features CPI inflation, retail sales, and services and manufacturing PMIs. However, the vaccine optimism is likely to overshadow any disappointments in actual data, although GBP could fall near-term in such a case. Nonetheless, any GBP dips should remain good buying opportunities in the current environment.

GBPUSD Technical Outlook:

GBPUSD broke above the 1.3750 moderate resistance and is now trading north of 1.39. Much as we suggested last week, an upside acceleration of the bull trend seems to be underway.

GBPUSD is now challenging the rising resistance trendline (mid-channel line on the chart), and if it successfully pushes above it there will be an increasing possibility that the price action accelerates toward the 1.44 highs from 2018. There, cable would meet the first significant resistance area, which is unlikely to break easily.

To the downside, last week’s 1.3750 resistance would act as moderate support that should keep the uptrend intact here.

Japanese Yen Fundamental Outlook: Risk Appetite and Rising US Yields Keep JPY Pressured

Rising US yields continue to pull USDJPY higher, while broad risk appetite is keeping the safe-haven JPY broadly under pressure. Still, it’s worth reminding that USDJPY remains firmly inside its wide ranges dating back to 2016. So, on a longer-term scale, JPY is still pretty much tracking the US dollar closely.

On the Fx calendar, Japan will release the national core CPI and manufacturing PMI this Friday. GDP and industrial production data that was released today beat estimates. However, the JPY weakened despite this, highlighting again its much closer correlation to risk sentiment than domestic data.

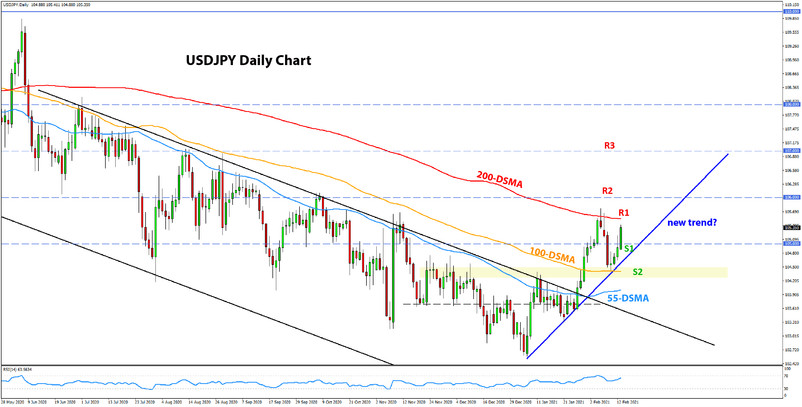

USDJPY Technical Outlook:

The USDJPY price action last week further confirmed the breakout of that narrow range around 103.50 and the 7-month descending channel. Namely, USDJPY came back to the 104.50 support area (former resistance), bounced there and is now making another run at last week’s highs near the 200-day moving average. A bullish breakout here seems more likely now, which will clear the way toward the 107.00 and 108.00 areas.

To the downside, the support zones remain unchanged, initial at 105.00, but the more important one at 104.50 around the 100-day moving average.