US Dollar Fundamental Outlook: Ranges Remain Intact for Now; Focus on Powell’s Testimony

The dollar remained within its recent ranges last week as the FOMC minutes report showed no big shifts in Fed’s thinking about tapering QE. Perhaps Chairman Powell’s testimony before Congress tomorrow and on Wednesday could provide more insights on this. The markets will watch his wording about the US economic recovery and the recent rise in Treasury yields. There is scope for a notable USD rebound if he expects a strong economic recovery and makes any mention of tapering QE later this year. But if Powell stays uber-dovish and avoids talking about the possible ways the Fed could end QE, then the US dollar will likely remain rangebound and could even fall in disappointment.

Fx Traders will also keep an eye on the USD calendar, where Thursday’s GDP data and Friday’s PCE inflation will be in focus. Consumer confidence, housing data, durable goods orders, and the Chicago PMI will also be released this week, which will show how the US economy fared in the most recent period. It’s probably too early for the US economy to show outperformance versus the rest of the world due to the faster vaccine rollout, so USD ranges to hold makes sense from this perspective too.

Euro Fundamental Outlook: EUR Stays Afloat as PMI Sentiment Surveys Surprise Positively

The euro posted a strong session last Friday as Markit’s PMI surveys showed that the manufacturing sector is stronger than expected across the Eurozone. The services sector remains much weaker due to the COVID-19 restrictions, and was even slightly weaker than the PMI forecasts. On balance, however, traders chose to focus on the strength in manufacturing, and the euro traded broadly neutral, strengthening vs some and weakening vs other major currencies.

Generally, the risk-on theme continues to be dominant, and that is evident in EUR pairs as well. The EUR is rising against the safe-haven JPY and CHF and falling against the risky NZD, AUD, and CAD. It is neutral versus the US dollar, which seems unlikely to change in the near-term.

The EUR calendar this week looks busy but without any major market-moving events. With that said, the EUR may keep to the sideways trend and continue to pick its direction from developments with COVID vaccinations and other parts of the world.

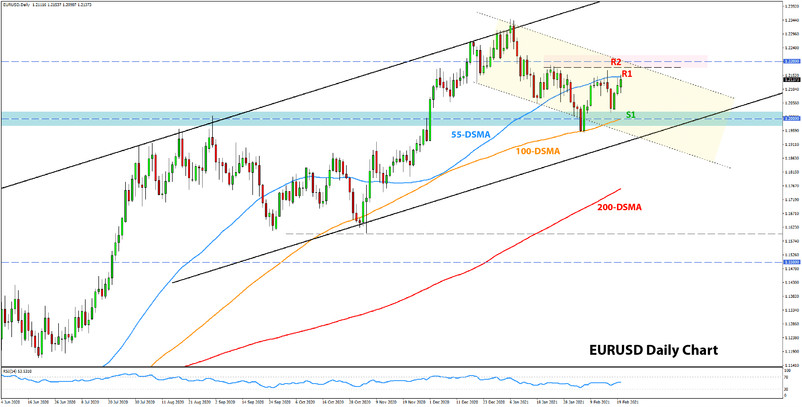

EURUSD Technical Outlook:

Not much has changed on EURUSD over the past week, and the pair is by and large following the script we laid out a few weeks ago. We said the base case for EURUSD is to remain in a range roughly between 1.20 and 1.22 for the time being. So far, that seems to be playing out as expected.

The resistance near the 55-day moving average (blue) is holding thus far as well. While we’ve identified the resistance around 1.22 to be more important, and the one to watch as a signal if EURUSD can break to the upside. Still, we should be careful in assessing that view since the price can test levels above 1.22, only to later return back below it. In such a scenario, this would likely be an excellent opportunity to go short.

Support remains at the 1.20 area.

British Pound Fundamental Outlook: Bullish It Is as the Sun Finally Shines on GBP

The pound sterling continues to benefit from the vaccine advantage the UK has over other developed nations and the recent removal of the risk of the BOE using negative rates. The fast vaccine rollout in the UK is expected to put the UK economy ahead of its peers, and Fx traders are already placing their bets on this narrative by buying the pound. Aside from the recent appreciation being a little steep, there are few reasons why this bullish GBP trend would pause or stop.

Although unlikely to provide big surprises, the highlights on the UK calendar this week are the employment reports out on Tuesday and the BOE’s Governor testimony in the UK Parliament on Wednesday.

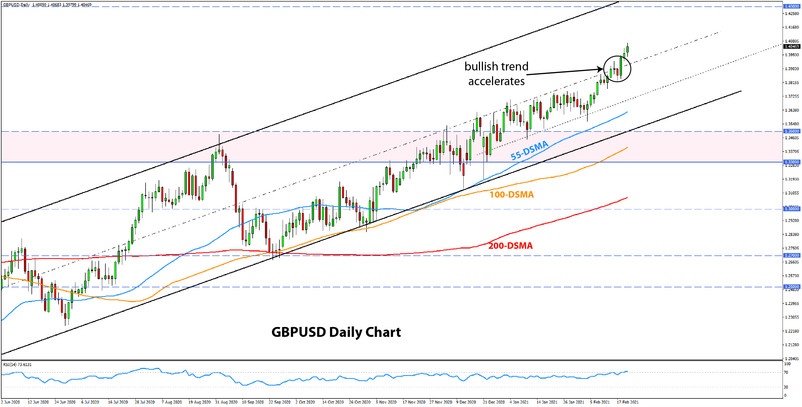

GBPUSD Technical Outlook:

The uptrend in GBPUSD is gaining traction as the price broke above the mid-point of the rising channel (see chart below). We’ve discussed this line many times in past weeks as a proxy for GBPUSD sentiment, and a bullish breakout confirms the strength in the underlying trend here.

With the price now above 1.40, GBPUSD is ready to attack the 1.44 resistance area around the 2018 highs. This is a major resistance area, so some price reaction there is very likely if and when GBPUSD reaches it.

To the downside, 1.40 and 1.39 are now moderate support zones that should keep the most recent “faster” bullish leg intact. The first stronger support lies in the 1.3700-1.3750 area.

Japanese Yen Fundamental Outlook: JPY Stays Soft in a Risk-On Environment

All major JPY pairs ended the past week higher, making JPY the weakest currency. However, the safe-haven yen fought back later in the week and still managed to recover a large part of the losses.

The themes that are driving the JPY weakness remain the same. General risk appetite keeps risky currencies bid while safe-havens are underperforming. Furthermore, the recent sell-off in US bond markets has pushed US Treasury yields higher, providing a reason for USDJPY to creep higher.

On the JPY calendar, BOJ and Tokyo core CPI inflation, industrial production, and retail sales data will be released this week.

USDJPY Technical Outlook:

While the bulls managed to break above the 200-day moving average last week (red line), the price came back below it again on Friday. USDJPY is now sliding further and is making a test on the rising support trendline around the 105.00 level. While this is an important confluence support area, the rather fast reversal is not the best sign for the bulls. Today’s close should provide more clues as to whether this support will hold or not.