US Dollar Fundamental Outlook: Can King Dollar Stage a Comeback?

The dollar slid for the third consecutive week, during what was a quiet USD calendar for the most part. The same drivers were behind USD’s pullback last week that have been pushing it down since the start of the month. Namely, US Treasury yields continued to consolidate downward while risk appetite remains supported. Furthermore, the markets are optimistic about Europe and other countries, who were far behind, catching up with Covid vaccinations.

The US economic calendar gets much busier this week. The main attention will go to the Fed meeting on Wednesday. The FOMC will convene for the first time since inflation shot above 2% earlier this month, and traders will be very interested to know the committee’s “thinking” about this. Last year, the Fed officially changed the inflation target from 2% to average inflation targeting (AIT) of 2%. Chair Powell clarified that AIT means the Fed will let inflation overshoot above 2% to compensate for all the months that inflation was running below the 2% target. But since then, he has repeatedly refused to specify how long they will let inflation run hot before they tighten policy.

It is this meeting on Wednesday that is the Fed’s first big test and opportunity to provide the specifics about their AIT regime. Although unlikely, there is a possibility that the Fed disappoints markets for which traders will likely punish the dollar. The alternative is the Fed hinting that they are ready to tighten policy once persistent inflation shows up on the radar. This looks like the more likely scenario and one which should elicit a bullish USD reaction.

The Q1 GDP report on Thursday is the other point of attention on the US calendar this week. Consensus forecasts are projecting 6.5% Q/Q growth, but with a speedy vaccine rollout and last month’s Biden stimulus checks, the risks look tilted to the upside for this print. If GDP beats expectations, then it will likely send the dollar soaring higher. Thus, the GDP report is another factor in addition to the Fed that could prove USD bullish this week.

Euro Fundamental Outlook: Traders Turning EUR Optimists Again, But Will It Last?

The common currency ended the past week in the green versus all of its other seven major peers. Though the gains were largely moderate, they come in the context of a dovish ECB that gave few reasons for the euro to rally.

Indeed, the day of the ECB meeting was a down day, but traders took the euro higher again on Friday after the positive services and manufacturing PMI surveys came out. The pick-up in vaccinations across the EU and expectations for a further acceleration of the pace seems to be getting investors optimistic about the EU outlook. Still, this doesn’t change the fact that the EU is lagging behind the United States and the United Kingdom by around 2-3 months when it comes to the vaccines. Hence, from this perspective, the gains in EURUSD and EURGBP should be relief rallies only, and the downtrends should eventually resume.

Another factor that may have contributed to EUR’s gains but was under the radar could be German politics. Namely, the pro-European Green party is making significant gains in the polls for the September federal election. Obviously, it’s a positive for the euro if a pro-EU faction is gaining sympathies instead of a (e.g.) populist party. We need to keep watching this space in the following months, and the German election may even take over as one of the primary EUR drivers in the summer and going into election day in late September.

The euro is falling today (Monday), however. The German Ifo report was weaker than forecasts, perhaps triggering the move. Another factor (more likely) is that traders are gearing up for the Fed meeting and are cutting down their positions. This week’s highlights of the EUR calendar are the flash GDP (German) and flash CPI reports on Friday. Eurozone CPI inflation is also forecasted to accelerate this month but will still stay below 2%, far short of the 2.6% in the US.

EURUSD Technical Analysis:

EURUSD rallied by more than 100 pips last week and touched the 1.21 level, near which it also closed the weekly candle. The pair even attempted to break 1.21 this morning but was rejected there. While the technical picture here has now been clearly distorted with the move to and above 1.21, it doesn’t mean that the resistance is definitely broken. As long as 1.21 holds, the bears are not completely dead.

If EURUSD moves above 1.21 this week, then the probabilities will increase for it to reach 1.22 next. There, notable resistance will be waiting from the February rejection high. Above it, 1.23–1.2350 should be the next resistance zone higher.

To the downside, 1.20 is the new nearest support. A break below it will rejuvenate the bears and will possibly have larger negative implications for EURUSD. The next support lower is at 1.19.

British Pound Fundamental Outlook: Sterling Remains Stuck in a Broader Consolidation

Although last week’s economic data was largely strong and even beat expectations, the pound failed to resume its uptrend. But the explanation for GBP’s behavior is not hard to find. We only have to go as far as positioning and the monstrous GBP rally from December to March to see that the consolidation still fits the definition of a “healthy correction” within the current context.

While GBP positioning is not excessively long, it is near that point after recently exiting it in tandem with the ongoing consolidation. The fundamentals remain predominantly bullish, which was confirmed by the data last week as well. The final thing that investors may now look for regarding the pound is further confirmation that the UK’s vaccination program was a success and that the country is indeed nearing the end of the pandemic. That means no more flare-ups or waves of Covid infections in the coming months. This should enable the UK economy to fully return to normalcy and get back into pre-crisis shape. Eventually, this should translate into an extension of the GBP uptrend. In the meantime, it will be no surprise if the currency continues to consolidate or even if it retraces further lower.

The UK Fx calendar this week is completely uneventful.

GBPUSD Technical Analysis:

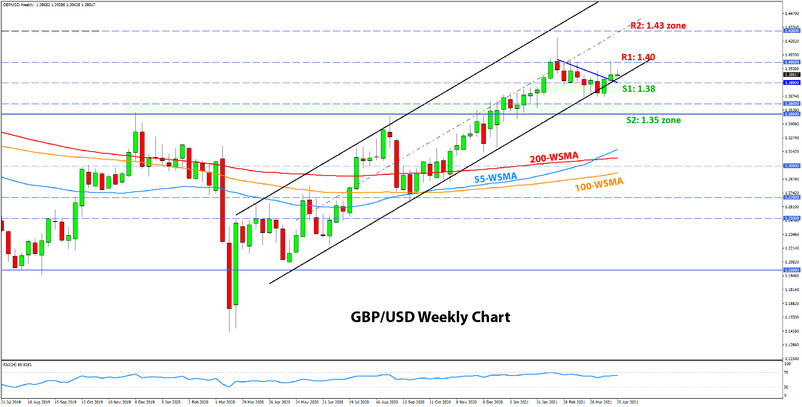

GBPUSD broke higher and reached the 1.40 level last week, but was eventually rejected there. The pair remains inside of the 1-year rising bull channel, which keeps the weekly technicals bullish here. However, the current levels are also very close to the support trendline of this channel, so a downside breakout and deeper correction can’t be excluded as a possible scenario.

Strong support is seen at 1.38 while last week’s 1.40 high is confirmed resistance and should be a solid technical zone. This situation may effectively make GBPUSD range-bound between 1.38 and 1.40. In any case, a break below or above either of those is likely to trigger a further continuation in that direction.

Japanese Yen Fundamental Outlook: JPY Standing Neutral, Awaiting Clearer Signals from Equities

The yen was relatively firm last week in the space of the major eight Fx currencies, gaining vs. some and falling vs. other peers. The extension of the decline in USDJPY is not that surprising since the dollar is falling broadly and US Treasury yields remain on a downward trajectory. The largely sideways action against other currencies last week shows that the JPY is holding up well but is not necessarily strong at the moment either.

Equity markets remain supported after recovering from a brief sell-off last week, keeping safe-haven currencies pressured. As long as equities keep posting new AHE (all-time highs), it will likely be difficult for safe-havens to stage any notable rally. Though the JPY has been able to do something of this sort in recent weeks, the overall evidence suggests that it’s been driven mainly by technical factors (see next section below).

JPY traders will watch the BOJ meeting tomorrow as the highlight of Japan’s economic calendar. Still, no big announcements are expected from them, so the meeting will likely go down as a non-event. BOJ Core CPI, retail sales, and the Tokyo Core CPI are also scheduled on the calendar this week.

USDJPY Technical Analysis:

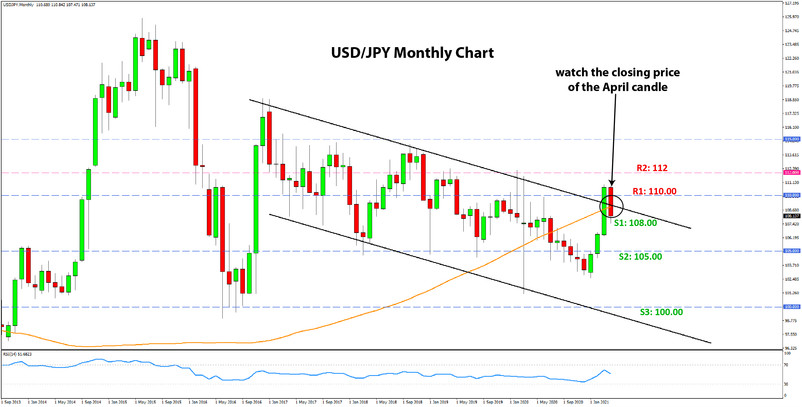

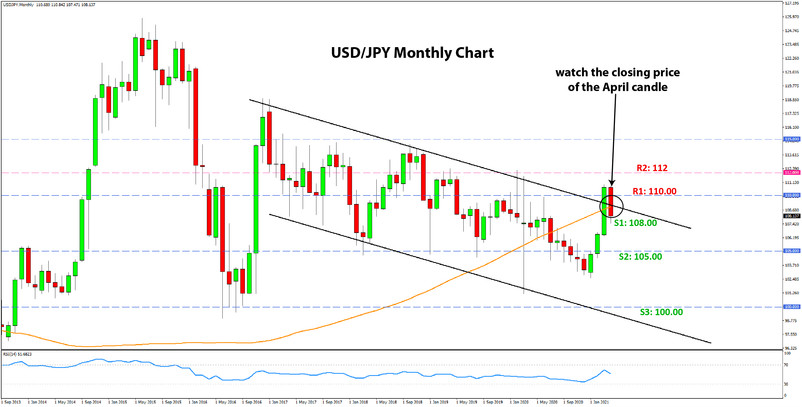

A few weeks ago, we showed the monthly USDJPY chart to demonstrate its importance within the current context and the resistance at the broader 110.00 area. It seems that thus far, the resistance held, just as we warned. USDJPY broke below the key 109.00 zone and is now back inside the 4-year channel (has been trading in it since December 2016).

If USDJPY closes near current levels, or in any case, below 109.00 is what matters, then it will virtually return inside the 4-year channel. This would be a bearish technical signal on the monthly chart, with implications that 105.00 is the likely next destination for USDJPY.

However, there is still one week to go before April is over, and USDJPY could still make a return above 109.00 in that time, effectively nullifying the move so far back inside the channel. Such a scenario would be significantly bullish for USDJPY from a technical point of view. It remains to be seen what happens in what could turn out to be an exciting final trading week of April.