US Dollar Fundamental Outlook: USD Bears Likely to Remain Dominant

Down, up, and then down again was the market reaction to the hot 4.2% CPI inflation report last week. As we warned in our previous weekly outlook here, the risk was to the downside for the dollar because everyone knew that the Fed is ready to disregard any overshoots in inflation for the time being. But, markets are not so certain that inflation is as transitory as the Fed likes to believe. The dollar was sold as real yields fell in reflection of the inflation surge.

Retail sales also missed expectations last week, perhaps further feeding bearish USD forces. The much hotter than expected CPI (3.6% y/y was the consensus forecasts) has investors worried that the Fed might be late in its response to contain inflationary pressures. Uncertainties have increased, we may see higher volatility in currencies in the period ahead. Markets are holding onto a firm USD bearish narrative that the Fed will keep an ultra-dovish stance, despite the inflation overshoot. This is driving the dollar down, and it is up to Fed to confirm or reverse that dynamic in the coming weeks and months. Until then, traders will likely continue to sell the dollar on rallies.

The US calendar for the week ahead is quieter. The highlight will be the FOMC minutes report, though no big reaction is expected around this release. Housing and manufacturing data will also be released throughout the week.

Euro Fundamental Outlook: Fx Traders Will Watch Eurozone PMI Data

The broader haphazard action in the Fx market feeds into the euro as well, and the common currency continues to trade without a clear directional bias. The euro spent another week driven by wider-ranging factors and developments elsewhere, with the main action taking place in the EURUSD pair.

Overall, the euro remains well-supported on several factors, such as the pick-up in EU vaccination rates, which fuels hope for a stronger economic recovery. At the same time, the recent disappointments in US data are feeding this narrative further and drive flows into euros.

Still, it’s too early to say that the EUR can start another major bull run at this stage. The June ECB meeting will be a big test for the currency as well as some political risks such as the German elections in the fall. This week’s focus on the EUR calendar is on Friday’s preliminary (flash) PMI surveys that will reveal the state of the services and manufacturing sectors. Lofty numbers are expected there, especially for manufacturing, suggesting that potential disappointments could lead to a negative EUR reaction.

EURUSD Technical Analysis:

The weekly EURUSD chart is gradually turning more bullish every week, and the past one was no different. The pair opened above the 1.21 level (former resistance) and managed to hold the ground and close the week above this level (actual close was 1.2145).

With the January-April downside retracement channel now clearly broken, the technicals are bullish here. The rejection of levels below 1.21 last week reaffirmed the breakout above this level on the week before.

EURUSD bulls are eying the January highs around 1.2350 as their next target, where some resistance forces are likely to exist.

To the downside, last week’s low around 1.2050 should serve as the first support that should hold any bearish attempts for the bullish trend to remain intact. Below it, 1.20 remains a key psychological and technical support zone.

British Pound Fundamental Outlook: Riding the Wave of a Speedy Immunization Campaign

Sterling was the best performing currency (among the major 8) last week as economic data confirmed the optimistic expectations about the economy. The recent hawkish shift at the BOE was also fueling the rally further over the past week. Traders are happy to buy sterling on dips as the UK economy is riding the wave of an effective and speedy vaccination campaign against Covid-19.

The calendar for the week ahead is a busy one, filled with important data, including employment, CPI inflation, and retail sales. The numbers should be positive overall, given the UK is on the way to a full reopening from restrictions. With likely solid prints in this week’s UK data, the mantra of buy GBP dips should remain very much alive.

GBPUSD Technical Analysis:

This week, we will look at a long-term GBPUSD timeframe to show an important development that traders are better to be mindful of (especially cable bulls).

That timeframe is the monthly. And the important thing to watch is the big resistance in the 1.45 wider area. As you can see on the chart below, the 1.45 area connects its significance to the 2018 highs and 2016 Brexit vote. But that’s not all. The 1.45 area in GBPUSD has a history of technical significance as far back as the 1990s and 1980s (1.40-1.45 is the actual wider area where the price has reversed). You can look at that long-term chart here.

The above should at least make the bulls careful in adding to their long-term long positions here. Nonetheless, the price is unlikely to reverse so suddenly and sharply just because this area has been reached. But it probably does mean that we are not going to break higher easily.

The 1.38 -1.40 area is the nearest support zone that should hold in order to keep the uptrend and the bullish channel intact.

Japanese Yen Fundamental Outlook: Note the Declining JPY Sensitivity to Risk-Off Episodes

These are strange times for the Japanese currency. Everyone is well- used to the idea that domestic Japanese developments aren’t a big factor in how the currency trades, but last week, we saw another strange phenomenon. Namely, a notable sell-off in stock markets failed to trigger a rally in the Japanese yen.

It appears that the suspicions by some that the yen is becoming less of a “safe-haven” in times of risk-off are coming about. Perhaps the new dynamic of 0% interest rates in all developed economies is the culprit, or maybe it’s due to Japanese investors’ positioning. Whatever the cause, Fx traders should take note because if the yen stops playing along with risk sentiment, then we could potentially be facing significant adjustments in the market.

The other typical driver of JPY, US 10-year yields, continue to exert downward pressure. If the uptrend in yields resumes, JPY could be pushed further lower.

USDJPY Technical Analysis:

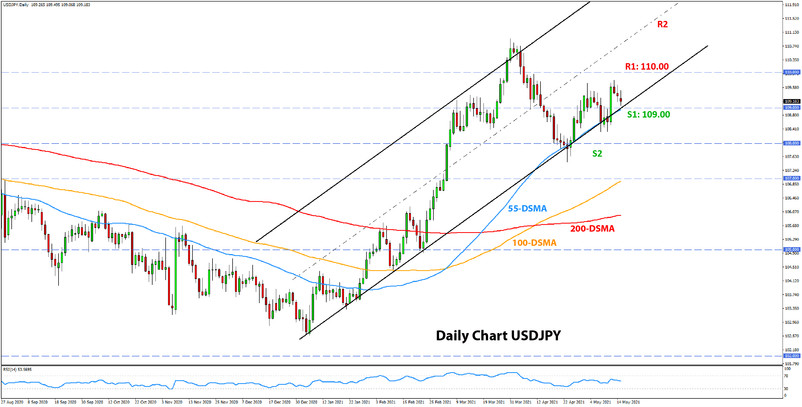

USDJPY continues to hold levels above 109.00, which means the bulls are in control. But, there have been repeated attempts to break below, and particularly also to break the support line of the rising channel that stands near 109.00 too (see chart). This bullish channel is of great importance in the current situation, so a downside breakout is likely to lead to some further selling.

Below 109.00, the next support is seen near the April lows, in the 108.00 – 107.50 area. Further down, 105.00 remains the key support area from a longer-term perspective.

To the upside, the nearest resistance is 110.00. A successful move above it could open up further upside potential, perhaps toward 112.00 and the upper line of the channel.