US Dollar Fundamental Outlook: Expect Range Trading Ahead of a Decisive Nonfarm Payrolls Report

Dollar bears tried to push for new lows last week but failed, and the DXY index closed the weekly bar at the same level where it opened (Doji candle). While the overall mood in the market remains USD bearish, cautious traders probably opted to close out short dollar positions, book profits, and/or stay away from entering new bearish bets ahead of this week’s critical Nonfarm payrolls report. This dynamic likely played a role in last week’s pause of the downtrend. The range trading should continue at least until the release of the jobs and NFP reports this Friday.

The new week in Fx is having a slow start as the US is on holiday today but will get much busier from tomorrow. The ISM manufacturing PMI on Tuesday and ISM services PMI on Thursday will be closely watched by traders and are expected to show strong readings, though the market may not react much on their release as traders’ main attention will remain fixated on Friday’s NFP. But the ISM reports will be important in painting the overall dollar picture after the dust settles from this week’s busy calendar.

As a first sign of “thinking about thinking” to turn more hawkish, Fed speakers started to “softly” talk about tapering in recent weeks. The obvious reason is the massive surge in inflation which was also confirmed by their preferred PCE price index last week (core PCE shot to 2.5% vs 2.3% forecasts). But the market reaction to these comments from Fed officials has so far been muted, mainly due to the prolonged weakness in the labour market, evident in April’s abysmal NFP, which is why this Friday’s report will be a bigtest. Strong jobs numbers may finally turn the tides for the dollar and bring about an overdue rebound as they may even allow for the Fed to turn more hawkish (read thinking about thinking) at its meeting on June 16.

On the other hand, another major disappointment in the NFP would be a bearish scenario, which would likely see the USD crashing to fresh monthly lows.

Euro Fundamental Outlook: EUR Likely to Stay Neutral in Broad Terms

The euro had another positive week on balance, as it continues to be one of the preferred currencies for investors to hold in the current environment. While the catch up with vaccinations in EU countries and the subsequent expected faster reopening of the economies is a positive for the euro, the EUR’s appreciation probably has just as much to do with the broadly weak dollar as with the domestic EU developments. That being the case, a possible USD reversal could feed into a weaker euro as well going forward.

This week’s EUR calendar features the preliminary (flash) CPI reports as the data in key focus. Like in the US, a rise in inflation is expected due to oil base effects, but this is widely priced in, so there should be no big immediate price reaction. But unlike in the US, the inflation surge in the Eurozone is far more muted, a dynamic which argues that the ECB probably won’t be able to turn hawkish before the Fed, nor as hawkish as the Fed once global central banks start to withdraw stimulus. This should likely limit further upside in EURUSD in the current environment.

Other European data that will be released this week includes services and manufacturing PMIs, and retails sales. A speech by ECB President Lagarde is also scheduled as part of a panel discussion on Friday.

EURUSD Technical Analysis:

EURUSD remains in an uptrend, but signs of exhaustion are starting to appear on the charts, much as we warned last week. The bulls tried to break higher but the attempt was reversed and EURUSD closed the week almost as low as where it began it.

The weekly chart below also shows us that there is some important resistance lying in this 1.23 – 1.2350 area. While EURUSD didn’t exactly test those level last week, the rejection in the weekly candle indicates that the uptrend is facing problems. The bulls need a strong close above last week’s high (1.2265) to rejuvenate their optimism, but even then, they would still face the 1.23 – 1.2350 resistance area mentioned earlier.

To the downside, 1.2150 is the nearest technical zone that should provide support. Closes below it on the daily chart will be early signs that things are starting to break down, while a move below 1.21 will open potential for EURUSD to fall to 1.20. This 1.20 area remains the key support in the current context on the weekly timeframe.

British Pound Fundamental Outlook: GBP Close to Fair Valuations Here; More Tangible Positives Needed to Fuel Further Rally

As we noted last week, a lot of the “good news” for GBP is already in its price, and that is limiting the potential for further appreciation. GBP bounced last week on hawkish comments by BOE’s Vlieghe, who said he expects the central bank to raise interest rates next year, but the rally soon stalled, and GBP wasn’t able to extend the gains. This seems to attest to the narrative that indeed, a lot is already priced in, so further gains may be more difficult to achieve.

The calendar for the week ahead is quiet with only a few reports and a speech by BOE Governor Bailey, none of which should induce much volatility into GBP. Global and developments in other nations and currencies will, therefore, also dictate how GBP trades this week.

It’s important to remember that the market remains bullish GBP on balance, but at the same time, the scope for further appreciation is getting smaller. The risk in such situations in Forex trading is that a potential negative surprise (even a smaller one) could have a big bearish impact on the price. One important front GBP traders are watching is the spread of the Indian Covid variant in the UK, which has already caused some delays in planned easing of restrictions.

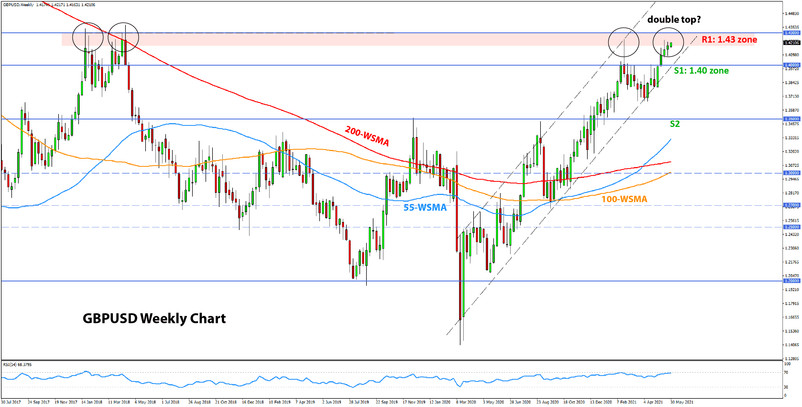

GBPUSD Technical Analysis:

Cable recorded another green weekly close but not at a fresh high. In fact, it ended the third consecutive week off the high, which is suggestive that the bulls may be facing some problems at these levels.

The weekly chart below shows us the potential for a double top formation at the 1.4300 resistance area. Another push toward the February high and above is a clear possibility this week. How the price reacts on such an attempt will give important clues for whether the resistance here holds or breaks. Do note that there are considerable risks for fake breakouts above 1.43 only to see the price crashing down later, so breakout traders should be especially careful.

On the downside, the initial support is located at 1.41. The key support, however, is at the 1.40 area, a break of which will open significant bearish potential and likely put an end to the 1-year old uptrend.

Japanese Yen Fundamental Outlook: JPY Suffers Another Sell-Off

The Japanese yen took a hit last week and was the worst-performing currency of the Fx majors. There was no specific catalyst for the sell-off, though the fact that risk appetite remains broadly supported continues to provide a tailwind for JPY currency crosses (weaker yen).

Although the decline wasn’t that large last week, it was notable in the current low volatility environment, particularly as all other major Fx pairs remained range-bound. Rebalancing of portfolios by Japanese money managers may have also contributed to JPY outflows last week, though this factor shouldn’t persist in the coming weeks.

JPY traders will also keep watching how the correlations with US Treasury yields unfolds and whether it continues to hold or possibly break down. On balance, it looks like the yen will continue to move slowly and largely remain in its loose ranges for the time being.

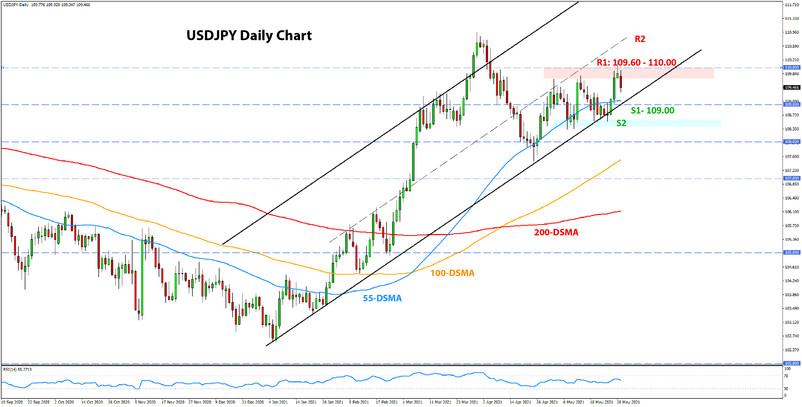

USDJPY Technical Analysis:

USDJPY tried to break out of its “loose” range last week, but with the price now back below 109.60, it appears that it has essentially failed to do so. If the decline continues toward 109.00, the pair will essentially remain stuck here in this range between 108.40-108.60 and 109.60-109.80.

The gradual ascend of slightly higher high and higher lows, however, does suggest that the bulls have the upper hand to some extent. In this sense, USDJPY may continue to climb at a slow leisurely pace for a while longer. A stronger bullish scenario would unfold perhaps on a momentum close above 110.00 as a signal of the next bullish leg inside of the rising channel.

On the other hand, a decisive close below 109.00 and then a move below the 108.50 lows would change this dynamic and turn the daily technicals bearish. Under this scenario, there will be potential for a move toward the 107.00 area.