US Dollar Fundamental Outlook: USD Soars on Hawkish Fed That Surprised Everyone

The dollar soared on the FOMC’s dot-plot and economic projections publication which showed the Fed see two rate hikes by 2023, not zero as most traders were positioned for. Adding to the hawkishness was the Fed also nudging their PCE inflation forecasts higher.

The shift in the Fed’s stance is a clear sign that they’ve taken note of the recent surge in inflation and that they will not hesitate to crush it by raising rates. This is strongly bullish for the USD. Most investors thought the exact opposite – that the Fed will sit on their hands and continue to reiterate the “transitory inflation” narrative. Last week’s meeting makes it clear that this Fed is not as dovish as some have feared or hoped.

This week the focus will be on speeches from several Fed presidents, including Chair Powell who will testify before congress. Traders will want to see if they sound as hawkish as during last week’s meeting or if they will downplay the market reaction with more dovish comments. PCE and core PCE on Friday will be the other focus where traders will watch for it to confirm the inflation surge that showed up in the CPI (remember, the Fed watches both reports to gauge inflation).

Overall there are many opportunities for the USD to extend gains based on this week’s events. In a strongly USD bullish scenario, Fed presidents would mainly confirm the hawkish tone from the meeting and the PCE index will surge comparable to the CPI.

On the other hand, the USD rally may fizzle out if Fed presidents sound more dovish by downplaying last week’s market reaction and/or if the PCE index doesn’t accelerate as much as CPI. But even in such a dovish USD scenario, last week’s moves are unlikely to be fully reversed, and they most probably indicate the start of a new bullish leg in the dollar.

Euro Fundamental Outlook: Down Vs Safe-Havens, Up Vs Risk-On Currencies

The euro also came under pressure from the strong dollar last week, and particularly that was most evident in the EURUSD and EURJPY pairs. But the euro ended the week higher versus risky currencies (AUD, NZD, AND CAD), which were hit hard by a mix of falling commodity prices and souring risk sentiment.

Overall, these trends of weakness vs safe havens (JPY and USD in particular) and strength vs risk-on currencies (AUD, NZD, AND CAD) put the euro in a neutral position among the Fx majors. These directional themes will likely continue in the coming weeks, with the EUR likely holding up well in the broader context (such as measured by the trade-weighted EUR index) even if EURUSD and EURJPY continue lower (euro weaker than dollar and yen).

On the calendar, traders will watch the business sentiment reports. The services and manufacturing PMIs and the German Ifo will be in focus as usual, which will give the latest update on the state of the Eurozone economy.

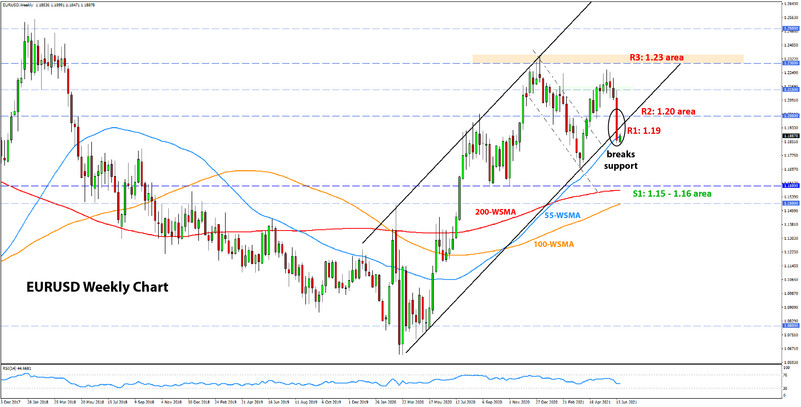

EURUSD Technical Analysis:

In our recent posts, we warned of more downside action in EURUSD, and indeed that was what happened last week (not to say that anyone can predict what the Fed will do, but the charts sometimes give clear signals to be prepared at least).

EURUSD is now firmly below what was the key support zone of 1.20. The next important support is 1.16 around the September-October lows. Moreover, this zone is best to be viewed as a broader area between 1.15-1.16 because the 200-week and the 100-week moving averages are located here (currently at 1.1575 and 1.1500, respectively). The technicals are clearly bearish now with little to stop the price from reaching this support area.

That said, some consolidation in the near term seems probable as the pair is now coming out from oversold levels on intraday charts. The 1.19 zone is the first resistance higher, while 1.20 will be the key zone that needs to hold again, only this time as resistance.

British Pound Fundamental Outlook: GBP Hit By Rising Covid Infections with Delta Variant

Sterling was hit hard last week by a combo of factors, though much as the euro, it mainly suffered against the dollar. The UK-specific factors that are negatively affecting GBP are related to 1) the rising number of infections with the new delta Covid variant (also known as Indian). Daily infections have already crossed above 10k; 2) the strain in EU-UK relations over Northern Ireland is not diminishing, increasing the risks for tariff escalation.

The above domestic dynamics combined with USD strength will likely continue to pressure GBPUSD this week and probably for longer. Further out, it will depend on what happens with the new Covid wave that’s spreading in the UK now. The sooner it is contained, the better it will be for GBP.

On the UK calendar, the Bank of England meeting will attract the main attention. Still, it should go down as a non-event as no big decisions from them are expected or likely at this meeting. With that, the market reaction is likely to be muted too.

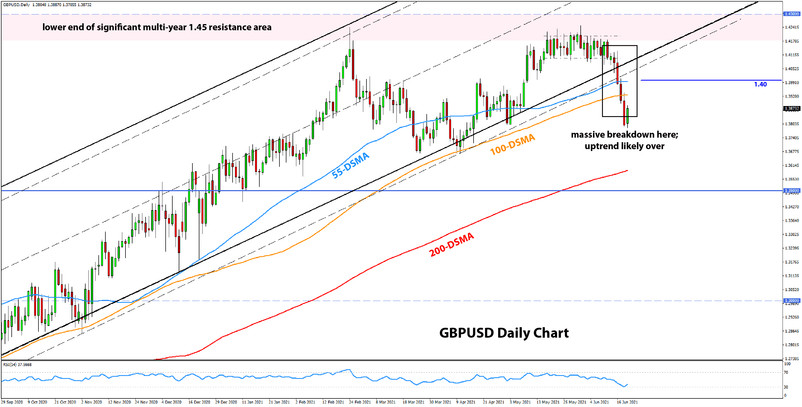

GBPUSD Technical Analysis:

As we expected, once the 1.40 support broke, the floodgates for more bearish action were open. GBPUSD sold off hard, and the 15-months long uptrend can now be considered finished from a technical analysis perspective.

The picture has clearly flipped here, even on larger timeframes such as the weekly. There is no support in cable until the March-April lows at the 1.37 zone, which means it’s very probable it will be reached. About 100 pips lower, the 200-day moving average (red) is located around 1.36. The big resistance in the larger context is, of course, located at the 1.35 zone (GBPUSD has stopped and reversed many times here in the past).

To the upside, the first resistance is seen at 1.39. Next higher is the 1.40 technical zone turned into resistance now.

Japanese Yen Fundamental Outlook: JPY Firms as Crowded Trades Reverse

JPY was the second strongest of the eight majors last week as it benefited from the broad reversal of Forex trends that were dominant for the most part of the year. Namely, risk-off soured last week as the Fed turned hawkish while commodities across the board are getting hit hard.

Commodity-linked currencies such as AUD, NZD, and CAD enjoyed support from steadily rising commodity prices for most of the year. Now the trends have reversed. And, while not much has changed domestically for JPY, the selling of risk-on currencies is making the yen stronger in this environment.

JPY will likely continue to benefit versus other currencies this week, while USDJPY should remain in its seemingly sideways though gradually upward moving trend.

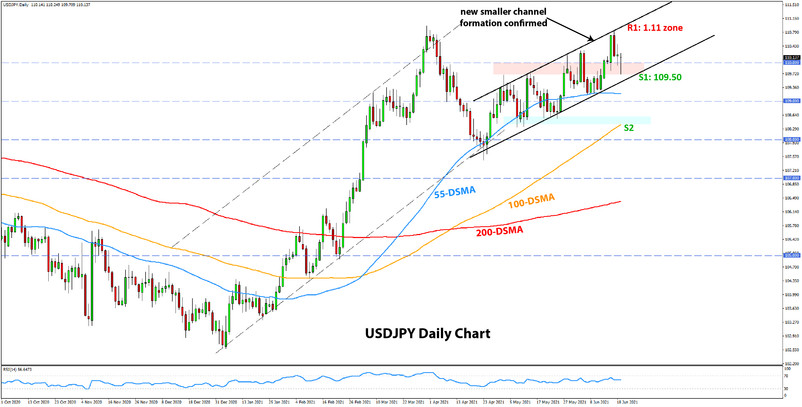

USDJPY Technical Analysis:

USDJPY indeed stayed within the rising channel formation and found resistance around the 110.80-110.90 zone. Essentially, not much has changed in the USDJPY technical picture (since it’s still tidily trading inside its established channel formation), except for the fact that it now trades above 110.00.

The primary resistance remains at the channel’s upper trendline, now getting nearer to the 111.00 level. The April high near the same level creates some potential for a double top at this juncture. This bearish scenario would be confirmed if USDJPY breaks the current channel formation to the downside.

Support is seen at 109.50, where the lower trendline of the chart formation comes in. Slightly below it, the 55-day moving average (blue) concurs with the prior lows around 109.20 and can also act as another support zone just under the one at 109.50.