US Dollar Fundamental Outlook: USD in a Holding Pattern as Fx Traders Watch Inflation Data This Week

It was unexciting, largely range-bound trading for the dollar last week. There were some disappointments in the economic data, such as the IMS services and JOLTS job openings, but overall nothing significant enough to alter the already established dynamics that are driving the dollar. The FOMC minutes didn’t provide much new info, and the USD was left trading more on technicals (staying within its range) rather than specific fundamental developments.

This week could be more exciting, potentially if we get a hotter inflation CPI than what forecasters expect. The report will be released tomorrow (Tuesday) at 2:30 pm CET, with consensus expectations standing at 4.9%. An upside surprise here could push the dollar higher as traders will likely start pricing in Fed rate hikes. On the other hand, if CPI inflation cools off more than expected, then the dollar could extend its downside correction as Fed rate hikes expectations will likely be cut back.

Other than the key CPI report, this week’s US calendar also features Fed Chairman Powell testifying before Congress on Wednesday and Thursday, and the retail sales report on Friday. Expect these events to take a back seat and the main attention to go to the CPI print as discussed above, though a large surprise in the retail sales data could spur some movement in USD pairs.

Euro Fundamental Outlook: ECB Changes 2% Inflation Target With Little Market Impact

The EUR remains on its broadly neutral trend versus currency peers, including the dollar at the moment (EURUSD was range-bound last week). At present, there is little to suggest that the ongoing dynamics of a broadly neutral (range-bound) euro will change, though there is the ECB meeting next week (July 22) to look forward to as a potential catalyst that can break the ranges.

Eurozone data last week was slightly disappointing, yet there was little action in the Fx market, reflecting the narrative that technicals are a bigger driver of EUR at the moment instead of secondary economic data. Everyone was focused on the ECB’s release of their strategy review last week, in which they adjusted their inflation target to allow for overshoots above 2% (similarly to the Fed’s AIT regime). The ECB has said they will provide more information on their decision at the July 22 meeting, making the meeting that much more important to watch.

The EUR calendar for the week ahead is quiet, with only tier 2 economic data scheduled (considered not very market impactful).

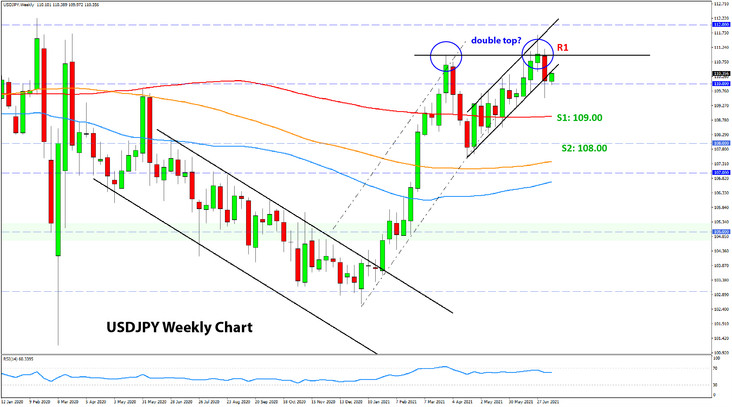

EURUSD Technical Analysis:

The bears made another attempt to push EURUSD to a new lower low last week, but were again rejected, and the pair closed above 1.1850 again. This was the second consecutive rejection of levels below 1.1850, which indicates that solid buying pressures exist here and strengthens the support at the lows around 1.1800.

With the stabilization of the sell-off over the past two weeks, the weekly chart looks more balanced now, and the potential for a move higher has increased. While the downside breakout of the channel and below 1.20 three weeks ago keeps the longer-term trend bearish, the fact that 1.18 has held firmly suggests that it’s not going to be an easy ride lower for EURUSD bears.

If EURUSD extends higher, the key resistance is at the “old-good” 1.20 price zone. It’s unlikely that it will be broken, aside from short-term attempts above it into 1.2050 and 1.2100, which are possible but would not break the resistance (chart). Overall, EURUSD may be starting a new range here between 1.1750 – 1.1800 as support and 1.20 – 1.21 as resistance.

The head and shoulders pattern would also be triggered with a break below the 1.1750 – 1.1800 support (see neckline). If this support area gives way in the coming weeks, it will unlock a seriously bearish scenario.

British Pound Fundamental Outlook: UK Will Fully Lift Covid Restrictions Next Monday

GBP traders continue to be unworried by surging Covid cases in the UK because the rates of hospitalizations and deaths remain very low. The Government will proceed with the plan to reopen the economy fully on July 19, and we don’t even have to mention that the UEFA EURO 2020 final was hosted yesterday in London with 60,000 fans. UK officials are confident that the vaccines are working for the delta variant too, and will allow life to return to “normal” in the UK next Monday.

While GBP is not selling off, it’s not flying higher either. A lot of this good news is already in the price, and it appears the currency needs a fresh catalyst to propel it higher. Otherwise, GBP is more likely to stay range-bound or even slide lower again if the “lack of good news” persists for a while.

The UK calendar promises a busy week for sterling. CPI inflation is out on Wednesday, while jobs and wages data is due on Thursday. Positive surprises could give a lift to GBP, though unlikely that it will be enough to trigger large-scale moves or breakouts.

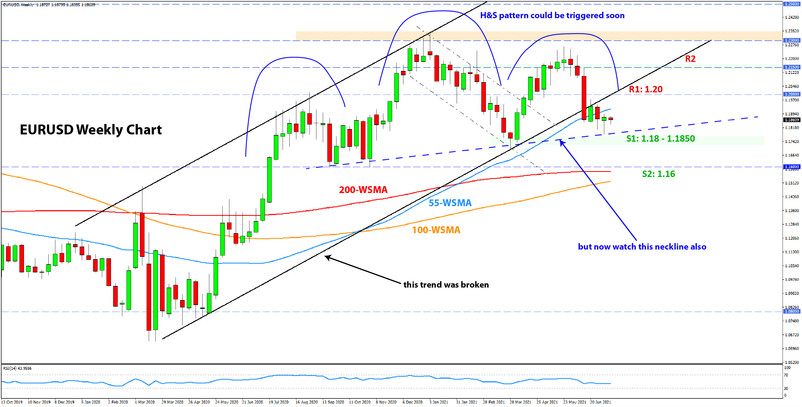

GBPUSD Technical Analysis:

Cable formed a bullish engulfing candle last week that came about from another test of the 1.37-1.3750 support area. Like in EURUSD, this support zone looks more solid now, and the probabilities for the bounce to extend higher have increased.

If GBPUSD starts to move up from here, then the key resistance will be at the 1.40 zone. This likely won’t break easily as it is a strong confluence zone. Nonetheless, if the bulls manage to push above it, then even stronger resistance waits at the cycle highs around 1.43.

With nearby resistance at 1.40 and nearby support at 1.37 – 1.3750, it’s not hard to imagine a range evolving between those two zones. Another interesting development worth watching on GBPUSD charts is the potential for the right shoulder of a head and shoulders pattern to start taking shape (see chart).

Japanese Yen Fundamental Outlook: JPY Slightly Firmer on Risk Aversion Into BOJ Meeting This Friday

The JPY broke its recent trend and appreciated last week as a correction in equity markets triggered a risk-off wave. While the volatility was not huge, it shows that JPY is still closely correlated with risk appetite and episodes of risk aversion. The other primary driver of JPY, US Treasury yields, declined further though have now retraced back and largely remain within the recent range.

Domestically, the delta variant is hitting Japan too and Covid infections are increasing rapidly just as the country prepares to host the Summer Olympics later this month. The new wave of infections has prompted the Government to impose new restrictive measures as well as ban fans from attending the Olympic games. The BOJ meets this Friday, and there won’t be much they can be positive about given the latest news, though they will most likely keep monetary policy unchanged, which means there will be little impact on JPY.

In the end, the yen will likely continue to be influenced by its usual drivers, such as bond yields (especially US Treasury yields) and risk appetite. On the latter, stocks have already recovered last week’s losses, though JPY is lagging this move for now.

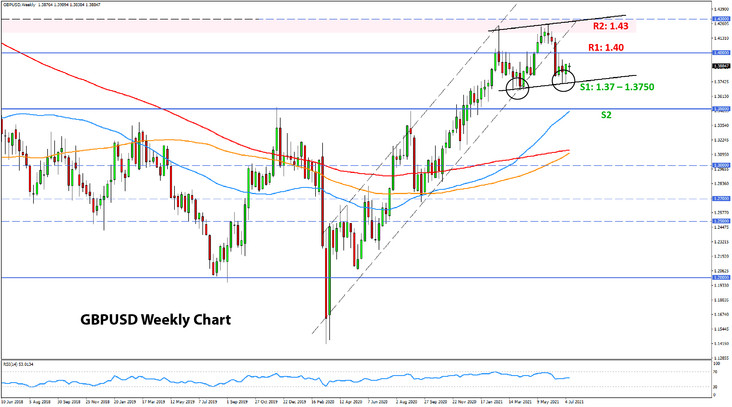

USDJPY Technical Analysis:

As we anticipated for the past several weeks, USDJPY was not able to move materially higher as part of its gradual uptrend. Instead, the pair is now showing more of the opposite characteristics, namely those of a reversal.

USDJPY bulls pushed the price above 111.00 and then 111.50, only to come crashing down in the past week. USDJPY was even trading below 110.00 on Thursday, though in the end closed the week somewhat above this level. The weekly candle looks bearish, nonetheless. The engulfing candle appears at resistance and broke the most recent ascending channel formation. The beginning of a double top formation has now been confirmed.

With that, the resistance at the 111.00 – 111.50 area is solidified, while to the downside, the road is clear toward the 109.00 support and then the more important 108.00 zone.