US Dollar Fundamental Outlook: Fed Meeting in Focus; Will It Be Another Hawkish Surprise?

The dollar is staying firm but failed to rally to new cycle highs last week. After the big ECB meeting event, the focus shifts to the Fed and US economic data this week. It’s going to be another busy one in the Fx market with a pivotal Fed meeting on Wednesday, US GDP report on Thursday, and PCE inflation on Friday.

The last CPI inflation report from the US was another “hot” surprise of 5.4% y/y against a 4.9% consensus forecast. The main question for this Fed meeting is, will they keep the same guidance from June (which was then hawkish) or lean even more in the hawkish direction in response to the “stubbornly” rising inflation? In this regard, the market is looking for a tapering pre-announcement or some talk of rate liftoff for next year. Such a scenario would likely be perceived as another hawkish surprise from the Fed, probably also taking the dollar higher.

Underscoring these dynamics, the market’s pricing also reveals that most traders expect a hawkish Fed meeting this week. For instance, the dollar continues to trade near the highs and could push through the important technical area if the Fed gives the hawkish kick. However, in the opposite scenario, if the Fed firmly maintains the view that the rise in inflation is only temporary and transitory, then dollar bulls may be disappointed, leading to a decline in the USD.

Euro Fundamental Outlook: ECB’s New Policy Framework Keeps EUR Under Pressure

Last Thursday’s ECB meeting produced the anticipated volatile swings, though the directional impact was small and the EUR’s ranges were not broken. The ECB was unambiguously dovish, as was widely expected, and perhaps that’s why the scope for surprise (and therefore larger market reaction) was small.

However, the recent dovish shift at the ECB with the inflation target change is undoubtedly a factor that’s keeping EUR under pressure currently. Essentially, with the adoption of its new symmetrical 2% inflation aim, the ECB has now de facto become a more dovish central bank (i.e. it will take longer to reach the more ambitious target, meaning policy will stay loose for longer).

For the time being, the euro still remains in its ranges versus most currency peers. The EUR calendar for this week will be interesting on Friday, with preliminary (flash) GDP and CPI inflation reports due for release.

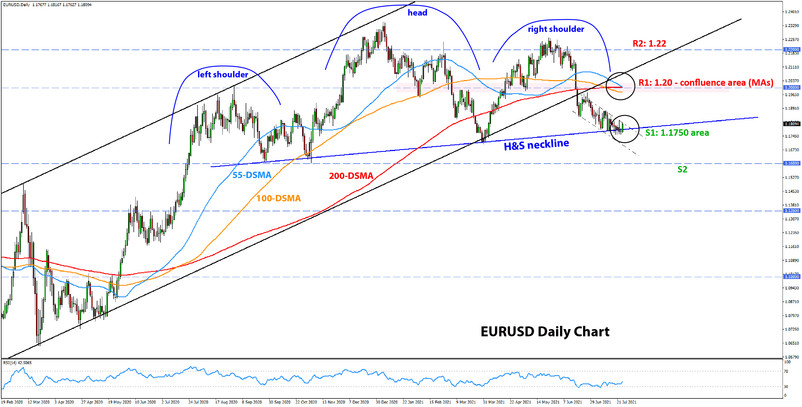

EURUSD Technical Analysis:

EURUSD continues to sit on the head and shoulders neckline, extensively testing the support here at the 1.1750 area. The main question on every trader’s mind is, will the neckline break or will the support hold in the end?

As we said in previous weeks, a downside breakout of the 1.1750 support can have significant bearish implications. Under this scenario, the head and shoulders pattern will be effectively triggered with a potential target of around 650 pips down (as projected from the height of the head of the H&S pattern).

If the neckline support at 1.1750 holds, on the other hand, then EURUSD can rally back toward 1.20 for another test of this important technical zone (see the cluster of moving averages here on the chart below).

British Pound Fundamental Outlook: GBP Is Treading Water As Impact from Delta Variant Remains Minimal

Not much has changed for GBP over the past week. The high number of new Covid cases with the delta variant pose a threat to the recovery, and this may be keeping a lid on sterling for the time being. However, the fact that death and hospitalization numbers remain well below the peaks during previous waves is an absolute positive in the whole situation. It’s also a positive that the number of daily infections has started to fall in recent days, and if this trend continues, it may offer a new glimmer of hope for GBP bulls.

The light UK calendar this week offers few reasons to expect exciting action in GBP pairs, though impact can always come from a “surprise factor”, for example, related to the pandemic and Covid variants or perhaps even UK politics.

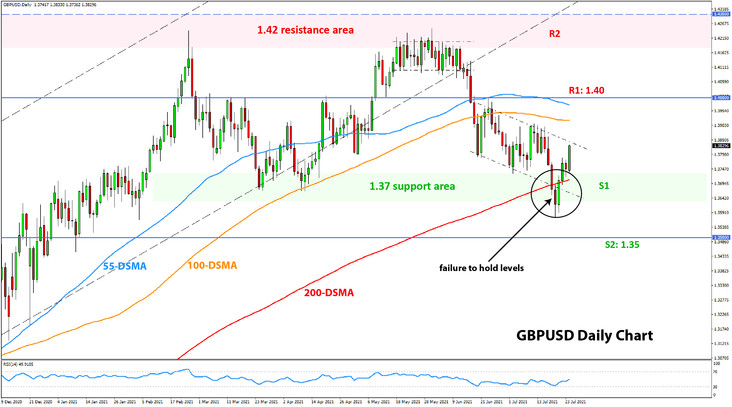

GBPUSD Technical Analysis:

Cable is also in no man’s land for the most part. While the price tried to break lower last week, the attempt was quickly rejected, and GBPUSD is now back in the range. Essentially, it was simply a fake breakout below the support, and the fact that the 200-day moving average (red) was also in this area amplified the situation.

Although the price is back in the range, the predominant feel remains bearish because of that lower low that was achieved last week. There is a possibility that GBPUSD starts a new trend of lower lows and lower highs from that June 2 high. However, even in this scenario, GBPSUD can still test the top of the range, around 1.42 which is the main resistance higher.

1.37 remains strong support to the downside in the current context. But as noted above and as is quite often the case with GBPUSD, support and resistance zones aren’t precise to the pip, so it’s tricky to estimate how the price would react with these levels when it reaches them.

The 1.40 level is mid-way between the 1.37 support and the 1.42 resistance, and will likely continue to be an important technical level, though it is not of key importance currently.

Japanese Yen Fundamental Outlook: JPY Gives Up Gains as Risk Mood Quickly Improves

The JPY strengthened sharply last Monday, in tandem with the hard sell-off in global equities. However, a lot has happened since then. Equities recovered all the losses and beyond, reaching new all-time highs already this Monday.

JPY quickly followed to give up its gains from last week, though not all of them and the Japanese currency is not back near its cycle lows. This again shows that risk sentiment in the currency market can deteriorate much more easily but it takes longer for it to recover. The whole situation also highlights again what the JPY is most sensitive to and the main fundamentals that are driving its movements. Risk sentiment still appears to be in the main seat in this regard.

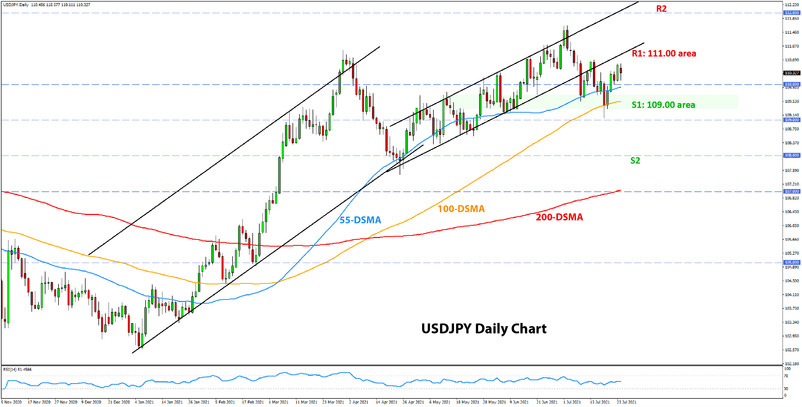

USDJPY Technical Analysis:

After the breakdown of that ascending channel formation, it is now not very clear what USDJPY is doing technically. The price has climbed above 110.00, but the key resistance now is around the 111.00 zone. So, this move above 110.00 is not as significant as in other times.

The technicals will remain bearish as long as USDJPY is below 111.00 because this is where the broken support line of the channel formation stands. The price can retest a broken trendline from the other side, but the trend is not reversed as long as the price doesn’t move back above the line of resistance.

To the downside, the key support remains around last week’s lows and that confluence with the 55-day (blue) and 100-day (orange) moving averages.