US Dollar Fundamental Outlook: Fed Takes Center Stage in a Very Busy Calendar Week

Last week, the dollar remained in its ranges but recovered some lost ground from early January, much as we anticipated in our previous weekly edition. The overall USD sentiment remains neutral with a bullish tilt. That could very well be amplified this week given the packed calendar.

The Fed meeting on Wednesday is in central focus for Fx traders. It’s not a question “if” the Fed will be hawkish, but rather “how much”? This is the key question for where the USD will trade later this week. There appear to be two relatively probable scenarios for Wednesday’s meeting:

· The Fed could surprise hawkishly by ending QE earlier (this month instead of in March), discussing quantitative tightening (QT), and committing to a rate hike at the next meeting (March). While much of this is already priced in, there should still be scope for USD strength to extend notably on such a very hawkish outcome.

· However, a more neutral-sounding Fed that doesn’t announce a March rate hike or mention QT could disappoint USD bulls, who now have pretty high expectations (4 rate hikes this year). The dollar could retrace in this scenario, although a break of the range seems highly improbable.

The US calendar also sees the release of the advanced US GDP (Q/Q) on Thursday and PCE inflation on Friday. However, the post-Fed reaction could steal the show and mute any immediate market impact from these releases.

It is also important to watch the overall risk sentiment in the current market environment. For example, if the stock sell-off continues, it could be another bullish factor for the USD in the overall scheme of things, and could finally help push an upside breakout of the current range.

Euro Fundamental Outlook: Focus This Week on Economic Releases and Political Risks

The common European currency traded mostly down, ending the past week stronger only versus GBP and NZD. Overall, there is little to suggest individual EUR strength in the current context, and the single currency continues to trade on a neutral to bearish tone.

The calendar this week features important 1st tier economic data. Starting today (Monday), Markit’s flash PMI sentiment surveys showed better than expected business conditions in manufacturing and slightly worse than expected in the services industry. The data shows that the EU economy fared better than feared during the December lockdowns.

The market will also closely watch the German Ifo business climate index tomorrow and preliminary (flash) GDP figures from key Eurozone economies on Friday (e.g., Germany, France, Spain). While today’s less bad than forecasted PMI figures suggest some resilience, the economy’s trend has been down over the past several months. This trend is expected to continue and will not encourage any premature changes to the ultra-dovish stance at the ECB.

Politics are also in focus for the EUR this week. Italy is electing a new President after the sitting one Sergio Mattarella resigned in December. EUR traders are also closely watching the Russia - Ukraine tensions as the Eurozone is the most closely linked economy to the situation, especially regarding energy prices. Any armed escalation on the Russian-Ukrainian border would likely feed into EUR selling.

EURUSD Technical Analysis:

EURUSD is still trading inside the flag consolidation pattern that is by now taking two months to unfold. After that rejection at the upper border 20 pips shy of 1.15 and near the 100-day moving average, the flag pattern could be finally ready to break this week. The price has returned toward its lower border and is now challenging the support here around the 1.13 level.

Thus, the key support is at the 1.13 zone. A break down here will clear the road for the trend to extend. While the previous low around 1.12 can still be a moderate support zone, a break of the flag pattern (at 1.13) will signal trend continuation. In this case, 1.10 would be the next target to the downside for EURUSD.

The first important resistance to the upside remains at the 1.15 zone. A move above it would indicate a channel break, putting the downtrend in danger. Still, it won’t necessarily be that negative for the overall bearish trend as long as the price stays below the 1.16 - 1.17 area.

British Pound Fundamental Outlook: GBP Feeling the Impact of Souring Risk Appetite

The pound was a laggard among the major currencies last week as risk appetite remained under pressure and stocks extended the sell-off. While not as risk-sensitive a currency as the commodity bloc (AUD, CAD, NZD), GBP still has some correlation to risky assets and can feel the impact in times like these. Moreover, the technical factor of overbought conditions after the strong rally from mid-December to mid of this month may have certainly added to GBP’s correction in recent days.

UK economic data last week was largely bullish, except for Friday’s retail sales, which were weaker than the consensus forecast. This should keep BOE rate hike probabilities intact, with markets expecting them to deliver a 0.25% hike at next Thursday’s meeting. Given that this week’s GBP calendar is relatively light, the focus may remain firmly on that BOE meeting and the prospects for more rate hikes. This could mean that GBP may soon find some support, although that will also depend on the broader risk sentiment to a large degree, which is currently taking a further beating with stocks selling off.

The political woes around calls for Boris Johnson’s resignation should continue to be in the back seat as the market doesn’t perceive this as a big risk for GBP (even if Boris resigns).

GBPUSD Technical Analysis:

GBPUSD today is extending the retracement down that started last week following that upside breakout of the 7-month downward channel. The retracement comes after the rejection at the 200-day moving average (red) in the 1.3750 zone. The price has now also fallen below the 100-day MA (orange), which indicates that a deeper correction could be on the cards.

While the wider support zone around 1.35 can still hold here, the upside breakout of the channel is in serious question now. In this sense, the weekly close on Friday will be important, and only a close above 1.35 would suggest that the bearish attempt has been successfully rejected. In this scenario, the bullish breakout of the channel would remain intact.

However, if GBPUSD closes below 1.35, we can assume that the breakout was fake. This negative scenario could see GBPUSD trade down toward the next support, which is at the 1.3350 - 1.34 area. The next and more significant support is at 1.3150 - 1.32.

Japanese Yen Fundamental Outlook: JPY Stays Firm as Equities Continue Their Struggle

The JPY remained a top performing currency among the majors last week as global equity indices extended their decline, some breaking below key support areas (e.g., NASDAQ). In the meantime, US Treasury yields also pulled back from the highs last week, perhaps adding to the JPY’s overall strength.

The Bank of Japan meeting last Tuesday gave no food for JPY bulls as Governor Haruhiko Kuroda poured cold water on rumors that the BOJ is preparing to adjust its policy. He instead reaffirmed that interest rate changes are a long way into the future and that the BOJ will continue to provide easy monetary conditions via large amounts of QE and maintain the yield-curve control (YCC) policy.

Developments around equity markets and US Treasury yields will remain crucial for where the yen moves in the period ahead. In this regard, yields and risk sentiment (stocks) can keep pulling the Japanese currency in different directions, especially if stocks embark on a steeper decline (bullish JPY). On the other hand, if stocks start climbing again, JPY weakness could return too.

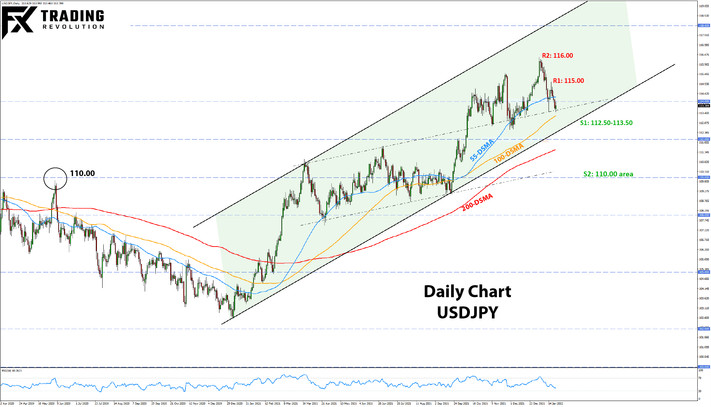

USDJPY Technical Analysis:

USDJPY has been falling over the past two weeks and has now arrived to test that support zone at 113.50 again (see chart). The 100-day moving average (orange) is nearby, so a technical break here could be significant.

However, the 112.50 low from December is no less significant. In particular, this price zone is where the big 1-year support line of the channel comes in. Thus, we could say that this whole 112.50 - 113.50 area is likely a key support area for USDJPY in the current context. A break below this area would be even more significant and could send USDJPY on a steeper sell-off toward the next big support area, which is around 110.00.

To the upside, resistance is first noted at 115.00 and then at 116.00.