US Dollar Fundamental Outlook: CPI Inflation to Hit 8%? – Hawkish Fed & Risk Aversion Keep USD Strong

After some initial hopes in the first days that the conflict will remain more limited and smaller, events over the past week, sadly, have transitioned toward a full-scale and devastating war in Ukraine. Western allies led by the EU and US continue to press Russia with more sanctions, with a full ban on Russian oil and gas apparently being discussed over the weekend. This was the reason why WTI crude oil spiked above $130 per barrel on the open this morning, while European gas prices surged to absurd levels (trading at more than 20 times the 5-year average).

It is no surprise that the US dollar is a top-performing currency in the current geopolitical and market landscape. Surging energy prices are a huge shock for the global economy. The negative effects will be especially felt stronger in European countries, while less so for the United States. This fact was also highlighted by Fed Chairman Powell in his testimony before Congress last week, and he also confirmed that a rate hike will be delivered as expected when the Fed meets next week (Mar 16).

All of this points to more strength for the US dollar. Its safe-haven characteristics and global reserve currency status should keep it a preferred choice among money managers for the foreseeable future as risk-aversion stays the dominant driver in markets. This factor, combined with the expected Fed rate hikes this year, is a strongly bullish mix for the dollar.

The CPI report on Thursday is the key focus on the calendar and is expected to print numbers close to 8%. Given the unprecedented moves in the oil market, the number could be higher and could stay high in the following months (contrary to projections before the Russo-Ukrainian war that inflation will soon start to fall). High inflation coupled with a relatively insulated US economy from the Ukrainian war suggests that the Fed will stay hawkish this year and likely deliver at least several rate hikes (6-7 priced in).

Euro Fundamental Outlook: Surging Oil and Gas Prices Mean Eurozone Inflation Will Stay High and the Economy Weak

With war raging on its eastern doorstep and inflation already running hot, the ECB is in a very tough spot going into their Thursday meeting. There is little the ECB can do to affect the negative economic shock from the war in Ukraine, and they will likely want to avoid making the economy worse by sending any hawkish signal even in the slightest form.

At last month’s meeting (Feb 3), the ECB signaled a more hawkish stance for this year, but the Ukrainian war changes everything. So their preferred stance on Thursday will likely lean on the cautiously dovish side, and they may announce QE will run for longer to support the economy from the shock of the war.

All of this means that the EUR will remain weak for the foreseeable future, as the ECB will continue to be an outlier among central banks - keeping interest rates at zero while inflation runs above target. The geopolitical risks, general risk-aversion in the markets, and a dovish ECB are all factors that will keep the EUR currency pressured this week and probably beyond.

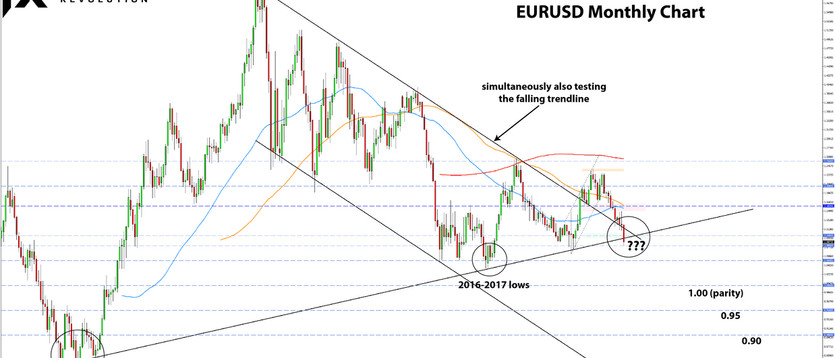

EURUSD Technical Analysis:

EURUSD is currently testing a major multi-decade support area; hence we decided to take a look at the monthly chart for this edition of the weekly Fx analysis (see chart below). For the near-term developments, take a look at the email newsletter we sent out last Friday (you can also subscribe if you haven’t already).

Due to the very long-term nature, the monthly support shown below is a wider area that can be defined between 1.05 and 1.10. This seems like a crucial support for the EURUSD pair, and a bearish break would likely result in further downside continuation. The next important technical zone below 1.05 would be parity (1.00).

The lows from late 2016 – to early 2017 around 1.0350 are also notable, but they will hardly hold the market if 1.05 breaks. Hence, below 1.05, the likely next destination could be parity. The monthly chart below there gets pretty scary. There is no visible support until the 0.95 and 0.90 areas, which would also be major psychological inflection points.

On the other hand, if the crucial support in this 1.05 – 1.10 area holds, then EURUSD could return within its previous ranges above 1.10. However, keep in mind the very long-term nature of this, as it could literally take many months for any of this to unfold.

British Pound Fundamental Outlook: GBP Can’t Escape the Negative Shock of Sanctions and High Prices

GBP was the 2nd weakest currency (of the major 8) last week, only stronger than the worst-performing EUR. The same factors that are pressing the euro are hitting the pound due to the geographic proximity to Europe and close trade ties. It seems risk-off contagion from continental Europe to the UK is spreading fast.

GBP is also a relatively risk-sensitive currency, and the UK is a net commodity importer. So the current environment of risk aversion conjoined with skyrocketing commodity prices provides no support for the pound. Hence, GBP is likely to stay weak in the period ahead and could even accelerate further if this risk-aversion mood spreads more broadly via deeper declines in stock markets (especially European).

The calendar in the week is very light, which means the markets’ focus will remain fully on the war in Ukraine.

GBPUSD Technical Analysis:

GBPUSD extended the drop last week and is now testing its critical support at the 1.3150 – 1.33 area. We’ve discussed this technical area on numerous occasions previously, most notably highlighting that little can hold the market below this support area.

The next support lower on the weekly chart remains all the way down at 1.25. That’s a more than 500-600 pips scope to the downside. This area may be quickly reached in the event of a breakout below 1.3150 – 1.33.

To the upside, the 100-week moving average (orange) may serve as a moderate first resistance zone (currently around 1.3390). Above it, the 1.35 and 1.37 zones should provide stronger resistance.

Japanese Yen Fundamental Outlook: JPY Stays Relatively Strong Amid Risk-Aversion (But Not as Much as AUD & NZD)

While the JPY was not the top-performing currency in the past two weeks, it remains high on the list. This is to be expected from the safe-haven yen. But what is somewhat strange is that the Australian and New Zealand dollars are the top performers of the past two weeks.

The AUD and NZD’s outperformance doesn’t have anything to do with risk aversion (as AUD and NZD should be falling) and has everything to do with surging commodity prices. Australia, for example, is a major exporter of the commodities that are most affected by the war in Ukraine. Hence, more money will be flowing to Australia. Japan is in completely the opposite situation. Much like Europe, Japan is a net importer of these commodities. Hence, more money will be going out of Japan to buy the same amount of goods. Considering this, the JPY’s performance and that of the AUDJPY pair are not that surprising.

The question now is, for how long can JPY stay behind the pack? It may not be for too long. Now that commodities have rallied strongly and could soon stabilize (albeit at astronomically high levels), the next thing that may break is equity markets. And it is particularly this part that could provide the most bullish impetus for JPY. USDJPY could fall to 110.00 or below in case of a stock market meltdown, while there would probably be even more downside for more risk-correlated JPY pairs such as EURJPY, GBPJPY, and even AUDJPY and NZDJPY.

In the meantime, US Treasury yields are falling too in expectations of lower economic growth due to the negative impact of high commodity prices. With yields less of a drag on JPY, the currency may be close to reaching a turning point. A break of key support in USDJPY (see more below) will likely signal when the time for JPY strength has come.

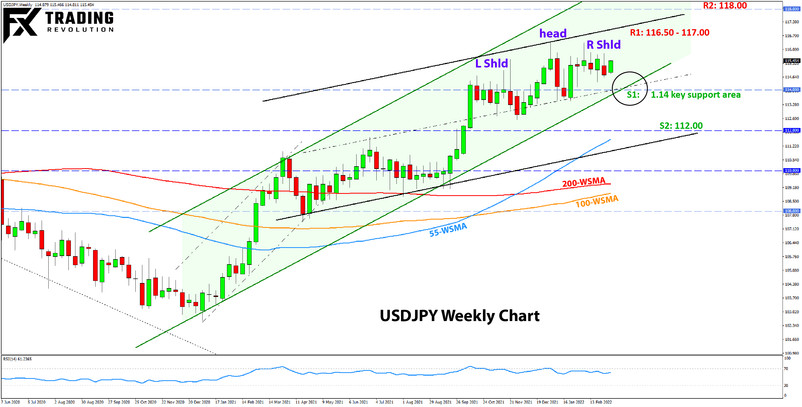

USDJPY Technical Analysis:

The USDJPY technical situation remains the least changed amid the recent volatility elsewhere. In fact, USDJPY is still trading within the 130 pips range since the war started on February 24.

The key support zone is firmly established at the 114.00 area. A break to the downside will likely clear the road for steeper losses, with 112.00 being the next important support and likely next destination lower.

To the upside, the 116.50-117.00 zone is the first resistance. The next resistance is toward the 118.00 area, followed by 120.00.

Finally, the potential for a bearish head and shoulders remains, with the right shoulder possibly forming at the moment. That 114.00 support zone would be crucial for this potential H&S pattern too.