USD Fundamentals: King Dollar Resumes Uptrend as Powell Says There Will Be No Fed Pivot

The USD is edging higher again following the brief correction and bullish reversal last Friday, triggered by Fed Chair Jerome Powell’s speech at Jackson Hole. There were no big surprises from Powell; he sounded hawkish and reaffirmed that bringing down inflation back to the 2% target is the Fed’s primary and most important task. This disappointed some who expected the Fed would already be turning dovish (pivoting) in the face of the weakening economy, which is coming under the pressures of rate hikes and QT. Powell clearly signaled to investors that anyone who is hoping for a dovish Fed is on the wrong side.

Indeed, it is all about inflation at the moment, and Powell just told us the Fed won’t stop hiking rates until inflation moves sustainably down toward 2%. Thus, this US dollar bull trend remains fully intact, still supported by the firmly hawkish Fed and now already much higher interest rates in the United States compared to other countries.

The US calendar this week gets busier as we enter September, with the main focus on Friday’s jobs reports, particularly the Nonfarm payrolls component. But as usual, the wage growth (average hourly earnings) component will be closely watched too. Strong numbers in the NFP and AHE reports will only further support the case for a resolutely hawkish Fed, which will likely result in a strong bullish reaction for the US dollar. EURUSD could fall another 100-200 pips in such a scenario this Friday (e.g., toward 0.98), while the DXY dollar index can climb above 110.00.

EUR Fundamentals: No respite for the beaten-down euro

The common European currency remains one of the most unwanted assets among investors. Every attempted rebound or recovery in recent months has ended the same - rejection and a resumption of the downtrend.

Investors are rightfully bearish on the euro. Electricity and gas prices remain at ludicrously high levels and keep climbing. The more they climb, the higher and the deeper the Eurozone recession will be this fall. Thus, the further surge in gas prices in the past 1-2 weeks only exacerbates the bearish sentiment on the EUR currency. An eventual extension lower in the bearish trend (especially in EURUSD) is a probable scenario now.

This week on Tuesday and Wednesday, the focus is on CPI inflation data from the leading EU economies (Germany and France) and the aggregate for the whole Eurozone. While the numbers may be interesting for creating bombastic news headlines, the inflation in the US and in Europe is completely different. In the EU, it’s almost entirely about gas and energy prices, while the economy is weak. Thus, the ECB can’t do anything to alleviate the situation, and any hawkish talk or actions from the ECB are still unlikely to help the beaten-down euro currency.

EURUSD Technical Analysis:

EURUSD pushed below parity (1.00) and closed the last weekly candle under this psychologically significant level. EURUSD also touched levels under 0.99 before bouncing back to 1.00, where it now still trades in consolidation.

The longer-term predominant downtrend is well intact here, and following the break to new cycle lows last week, it appears that the trend is ready for continuation. If EURUSD breaks below 0.99 again, then a move toward the 0.98 zone at least would become a very probable scenario. Under it, 0.95 is the next important technical zone and is also quickly becoming a realistic possibility.

To the upside, the first resistance is at parity near current levels (1.00). Above it, trendline resistance and the 55-day moving average converge at 1.02 - 1.0250. It’s important for the bearish trend that this resistance area holds.

GBP Fundamentals: Bearish Trend Extends; Light Data Calendar This Week

UK traders are off today for the summer bank holiday, but that didn’t stop GBPUSD from breaking to new lows for the cycle at 1.1650. The Covid lows from March 2020 in the 1.14 - 1.15 area are now only a possibility but a likely destination for the pair.

Like the euro, the pound is hit by similar bearish factors. The economy is very weak under the weight of high energy costs and rising interest rates which the Bank of England is hiking to combat the highest CPI inflation rates in 40 years. The stagflationary cocktail has already reduced GBP’s value a lot in recent months, and there is no end in sight to this trend.

The pound is also under pressure from political uncertainty in the UK as the race for the Prime Minister role between Rishi Sunak and Liz Truss is still on. Other than that, the UK economic calendar is light this week with no tier 1 reports scheduled.

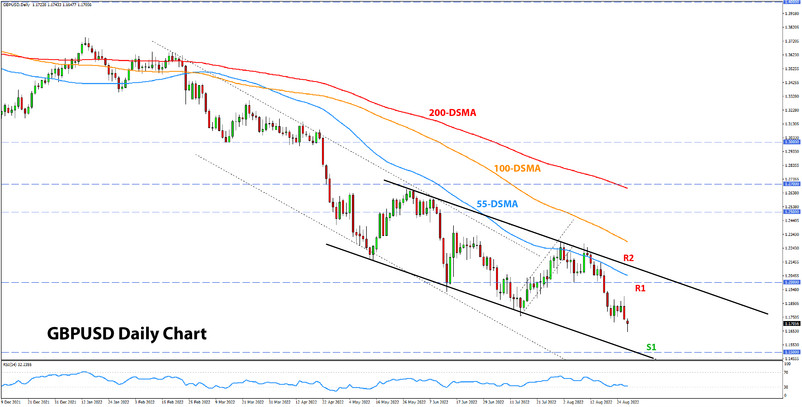

GBPUSD Technical Analysis:

GBPUSD is breaking to new lows too, and even faster than EURUSD. The bearish momentum on GBPUSD is powerful, and further price action in this direction is likely.

The 1.15 zone is the big historical and psychological focus. The support zone here is likely to attract some buyers, which could lead to some reaction. Still, given the powerful bearish momentum, it would not be a surprise if GBPUSD breaks further down.

To the upside, resistance is at 1.18 - 1.1850. The next resistance higher at 1.20 is the key one and obviously another important historical and psychological focus.

JPY Fundamentals: Yields Rising Again

The yen has been weakening since mid-August as global bond yields started rising again. With the BOJ still keeping Japanese Government bond yields fixed at around 0%, whenever yields in other countries rise, the yen falls due to this interest-rate differential disadvantage. The opposite is also true; if bond yields in other countries are falling, the JPY is strengthening (as was the case in the second half of July).

US Treasury yields rose moderately over the past 2-3 weeks, and this is taking USDJPY to revisit the cycle highs around 139.00. Being so close to this zone, a break higher is possible but still looks unlikely to be sustained. The reason is the outlook for US Treasury yields, which are unlikely to keep rising so strongly and steeply from here into the future. In fact, it’s still the most probable scenario that the 10-year Treasury yield peaked around 3.5% back in June. If that proves correct, then the peak in USDJPY is not far either.

Other JPY pairs like EURJPY and GBPJPY will likely face even stronger bearish pressures if USDJPY turns around and starts falling again. Such JPY crosses could provide excellent trading opportunities in the weeks ahead if such a scenario unfolds (USDJPY reverses down).

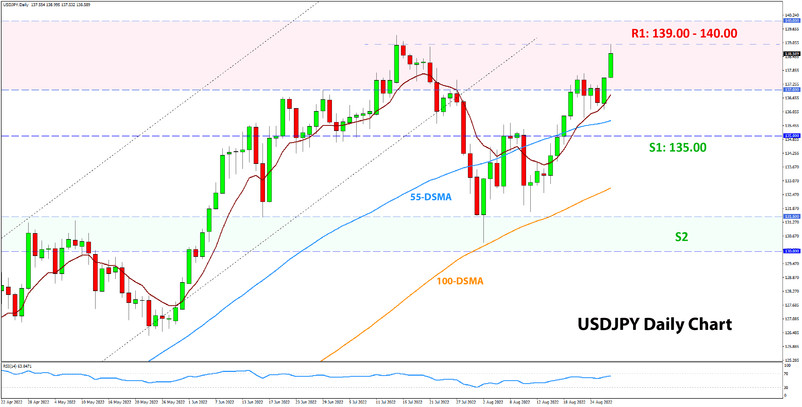

USDJPY Technical Analysis:

USDJPY rebounded at the 131.50 - 133.00 support area in early August, and the upside move has continued into the present day. USDJPY is now making another attempt at the previous high in the 139.00 - 140.00 area.

The main question for traders now is whether this is part of some range-trading formation (where 139.00 is the upper end of the range) or USDJPY is readying to make another bull leg higher. If this is part of a range, then traders should look for bearish opportunities at current levels. In either case, we’ll soon find out if the 139.00 - 140.00 resistance holds or not.

To the downside, the support zones are at 135.00 and then the aforementioned 131.50 - 133.00 area.