Dissecting the Intricacies of the MACD Indicator

The Moving Average Convergence Divergence (MACD) is a prominent trading tool, cherished by market participants worldwide. However, the efficacy and reliability of this instrument are far more complex than what they appear on the surface. This powerful financial tool employs moving-average lines to depict the often subtle shifts in pricing trends that could make or break a trade.

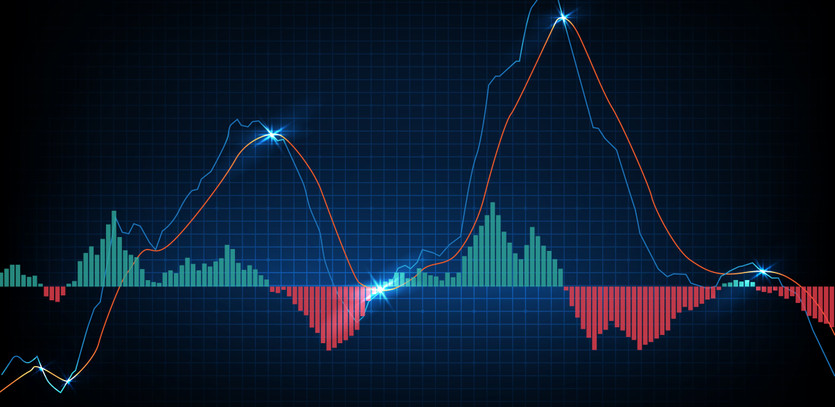

What traders term as 'divergence' occurs when there's a discrepancy between the direction in which an asset's price is moving and the trend of the MACD's indicator line. This is generally taken as a warning signal of a potential price trend reversal, but one must tread cautiously here. Such signals can often turn out to be not only inaccurate but also misleading.

Another manifestation of divergence surfaces when an asset's price hits a new high (or plummets to a new low) and the MACD indicator fails to keep pace. Conventionally, this scenario points to the price direction losing steam, suggesting a likely reversal on the horizon. However, this too can prove to be an unreliable trading signal, putting traders in a tricky spot.

While mastering the mathematical nuances behind the MACD trendlines' calculation is not crucial, having a clear understanding of how the MACD indicator works can be a game-changer. This understanding can help you steer clear of the trap laid by false signals, or lack thereof, particularly when the price changes course but the MACD fails to raise an alarm.

Untangling the Conundrum of Divergence Following a Sharp Move

A closer look at the dynamic relationship between the MACD technical indicator and price movement reveals several potential hiccups that might trip up traders, especially those who bank heavily on the MACD divergence tool.

An inconsistency or divergence in the pattern of the two MACD trend lines often emerges right on the heels of a sharp price change, irrespective of the direction. The challenge of judging whether a price move is sharp, slow, large, or small involves considering the speed and scale of the price fluctuations happening concurrently.

One immutable fact about the financial markets is that price momentum cannot keep going indefinitely. Once the price starts to stabilize after a steep climb or descent, the MACD trend lines diverge, implying that they change direction. This happens even when the price continues to decline.

After a massive price rally, the MACD divergence's utility diminishes. While a falling MACD in conjunction with a price that continues to rise or move sideways indicates slowing momentum, it doesn't guarantee a reversal.

For instance, consider a scenario where the EUR/USD is on a downward trajectory, yet the MACD rises. If a trader misinterprets the rising MACD as a positive signal, they might prematurely exit their short trade or enter a long trade despite a significant downtrend. This could lead to potential profit loss.

That said, it's crucial to remember that divergence occasionally can hint at a possible reversal. However, such signals should be treated with a healthy dose of skepticism following a significant move.

Since divergence often follows large moves, and immediate reversals rarely succeed such moves, presuming that divergence signifies an impending reversal can lead to a barrage of losing trades.

The Pitfalls of Divergence Between MACD Peaks (or Troughs)

Traders often compare preceding highs on the MACD with current highs or preceding lows with current lows. For instance, if the price surpasses a previous high, traders expect the MACD to follow suit. If it fails to do so, it's seen as a divergence and interpreted as a potential warning signal of a reversal.

However, this signal, like the issues discussed earlier, is not infallible. A lower MACD high-price level indicates that the price did not possess the same velocity during its last upward movement. It might have moved less, or at a slower pace, but it doesn't necessarily indicate a reversal.

As noted before, a steep price change will result in a significant move in the MACD, much more than what a slower price shift would cause.

Over long periods, an asset's price can rise or fall gradually. If this happens following a steeper move, the MACD will display divergence throughout the time the price is slowly (relative to the previous sharp move) ascending.

Should a trader mistakenly assume that a lower MACD high suggests an impending price reversal, they may miss out on a profitable opportunity to stay long and garner more profits from the slow ascent.

On a worse note, the trader might end up taking a short position in a robust uptrend, with little to no supporting evidence except for an indicator that is ineffective in such a situation.

In the case of a stock like APPL experiencing a downtrend due to sharp downward moves succeeded by slower descents, sharp price changes always result in larger MACD downturns than slower price movements. This results in divergence when the next price wave isn't as sharp but doesn't necessarily indicate a reversal.

With divergence monitoring, one could miss out on an entire day of profits as the price continues to drop throughout the day. Another downside to watching for this type of divergence is that it often isn't present when an actual price reversal occurs. This scenario leaves us with an indicator that provides numerous false signals but also fails to alert on many actual price reversals.

Here the MACD is making higher lows while the price keeps falling, making new lower lows

Here the MACD is making higher lows while the price keeps falling, making new lower lows

The Unquestionable Importance of Price Action and Trend

Despite its appeal as a useful tool for spotting reversals, MACD divergence frequently results in false signals due to its inaccurate, untimely information, and it may also fail to signal many actual reversals.

Instead of relying on divergence, traders would do well to focus more on price action. For a downtrend to reverse, the price must make a higher swing high and/or a higher swing low.

Similarly, to reverse an uptrend, the price must make a lower swing high and/or a lower swing low. Until these conditions are met, a price reversal cannot be confirmed. Whether divergence is present or not is irrelevant. Traders earn profits from price movements, not MACD movements.

In Summary: MACD Divergence Deciphered

MACD divergence, when considered in isolation, is not a reliable predictor of price reversals in the high-speed world of day trading.

However, this doesn't mean that the indicator is without any merit. Traders must be cognizant of its potential pitfalls and not depend solely on it. Instead, the focus should be more on price action and trends rather than MACD divergence.