1. The Timeless Appeal of Metals Investment

Metals, cherished for their intrinsic value for centuries, maintain their allure for modern-day investors. They stand as unique investment options due to several enduring benefits they provide:

A. Diversifying Your Portfolio

Including metals in your investment mix can offer an effective strategy to balance risk and ensure portfolio diversification.

B. Safeguarding Against Inflation

Throughout history, metals have proven their resilience in retaining value amidst inflationary periods.

C. Real, Tangible Assets

Investing in metals signifies owning physical assets. In times of economic upheaval, such assets can act as a reliable safeguard.

2. Profitable Metals to Invest in 2023

Several metals look promising as potential profit generators in 2023. Some of these include:

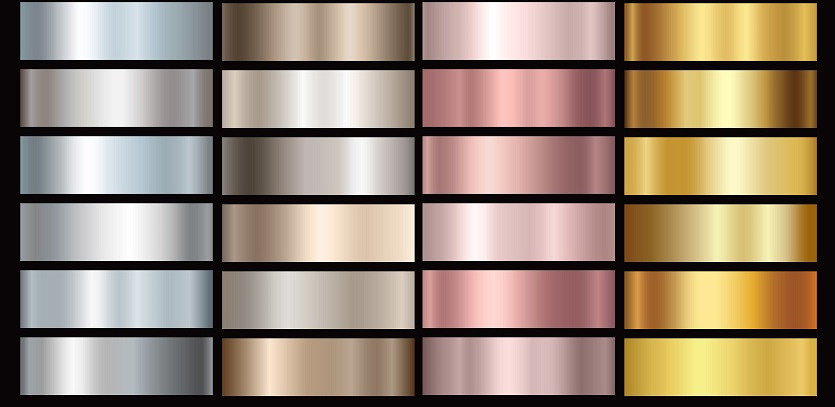

A. Gold

The timeless appeal of gold as an investment cannot be overstated. It stands as a protective measure against inflation and a wealth-preserver during economic crises.

B. Silver

Silver, another precious metal, carries potential for profit in 2023. Its use in industrial processes is anticipated to bolster demand in the future.

C. Platinum

Platinum's rarity and multi-industry use - from jewellery to electronics - make it a valuable investment. Its sustained demand is projected to positively influence its price.

D. Palladium

Sharing many uses with platinum, palladium also carries significant investment potential. Continued demand for this precious metal is expected to contribute to its price increase.

E. Copper

Copper, a common metal widely used in electrical wiring and construction, promises considerable investment potential. Its continued demand is likely to propel its price upwards.

3. Market Experts' Views on Metals in 2023

A consensus among market professionals points towards a bright future for metals in 2023. Some of the staunchest advocates for metals investment include:

A. Jim Rogers

Jim Rogers, a globally recognized investor and author, holds a positive stance on metals. He views them as reliable hedges against inflation and protective shields during financial turbulence.

B. Peter Schiff

Peter Schiff, another respected investor, maintains a bullish outlook on metals. He forecasts a collapse of the US dollar and positions metals as the ideal wealth protection measure.

C. Ron Paul

Former US Congressman and presidential contender, Ron Paul, endorses metals as a solid investment choice. He emphasizes their potential in retaining purchasing power.

4. Strategies for Investing in Metals

A. Start Small

Embarking on metals investment doesn't necessitate substantial initial capital. Begin by purchasing small quantities of metals like gold or silver, gradually increasing your holdings.

B. Diversify Your Metals Portfolio

Ensure a spread of different metals in your portfolio to offset risk if one metal's price drops.

C. Research Before Investing

Before committing to any metals investment, ensure a comprehensive understanding of the associated risks. Various resources online or at libraries can provide valuable information on metals investing.

Conclusion

Investing in metals can be a profitable strategy for 2023. Indications such as escalating inflation, geopolitical instability, and rising metals demand from developing markets suggest a favorable climate. However, always remember every investment carries risk and comprehensive research is vital before embarking on any investment journey.