Today, the focus of traders trading in the USD / CAD pair is the release (at 13:30 GMT) of the most important monthly data from the US and Canadian labor markets. The average hourly wage in the US is expected to rise 0.2% in December, the number of new jobs created outside the agricultural sector by 71,000, and the unemployment rate rose 0.1% to 6.8%.

In general, the indicators can not yet be called positive, but they are quite understandable due to mass layoffs in American companies and the closings of offices and shops due to the coronavirus, when severe restrictive quarantine measures were introduced in a number of states. At the same time, the data show a gradual improvement in the American labor market after its collapse in previous months at the beginning of the year. Prior to the coronavirus, the US labor market remained strong, signaling the stability of the American economy and supporting the dollar.

The US dollar, meanwhile, has been making an attempt to recover from the strongest decline in 2020 for the third day in a row, although it remains vulnerable for a number of fundamental reasons.

DXY dollar futures traded at 89.90 in early European session today, 46 points above last year's late December low and 73 points above a new local and nearly 3-year low of 89.17 hit earlier this week.

At the same time, the yield on 10-year US bonds continues to grow. Investors are selling defensive assets, including gold and government bonds, increasing purchases of risky assets of the American stock market. Sales of gold and US government bonds are also helping to strengthen the dollar. At the moment, the yield on US 10-year bonds is 1.078%, after falling to 0.318% in March.

Also at the same time (at 13:30 GMT), Statistics Canada will publish data on the country's labor market for December. Unemployment in Canada last month also rose, according to forecasts, by 0.1%, to 8.6%, and the number of employees fell by 27,500 people, due to massive factory closures in previous months due to coronavirus and layoffs. Unemployment rose from the usual 5.6% - 5.7% to 7.8% in March and already to 13.7% in May. If unemployment continues to rise, the Canadian dollar will decline. If the data is better than the previous value, the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for CAD, an increase in unemployment is a negative factor.

The publication of data from the labor market, especially the American one, is usually accompanied by a sharp increase in volatility. The more the data differs from the forecast, the higher the volatility can be, moreover, in the entire financial market.

It is often difficult to predict the market reaction to the publication of indicators: many indicators for previous periods may be revised. Probably the most cautious investors will choose to stay out of the market during this time frame.

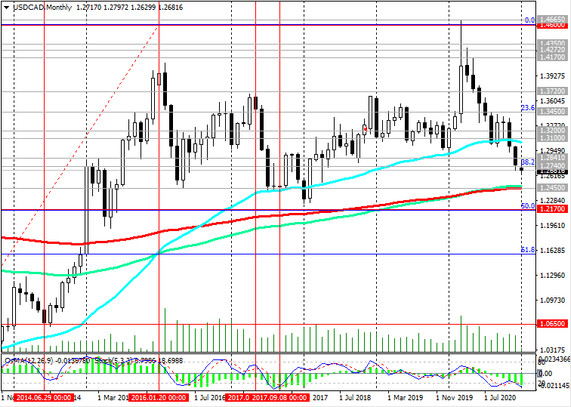

Since the beginning of 2021, the USD / CAD pair has been declining again, and is currently traded near the 1.2680 mark. If the pair's downward dynamics persists, the nearest target will probably be the key support level 1.2450 (see "Technical analysis and trading recommendations").