At the beginning of today's European session, the USD / CAD pair is traded near the level 1.2677, still maintaining a tendency to further decline, including amid strong fundamental factors.

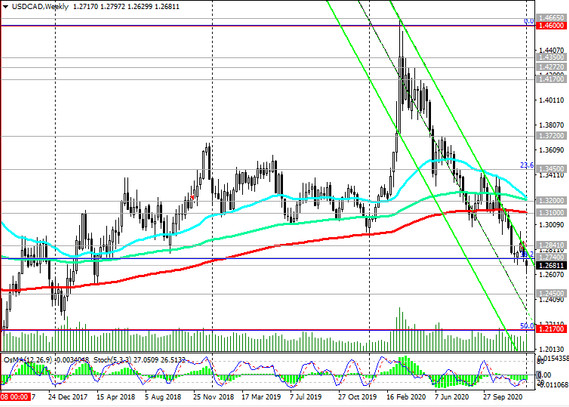

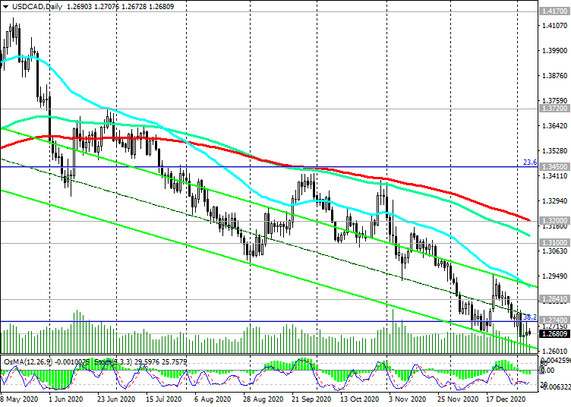

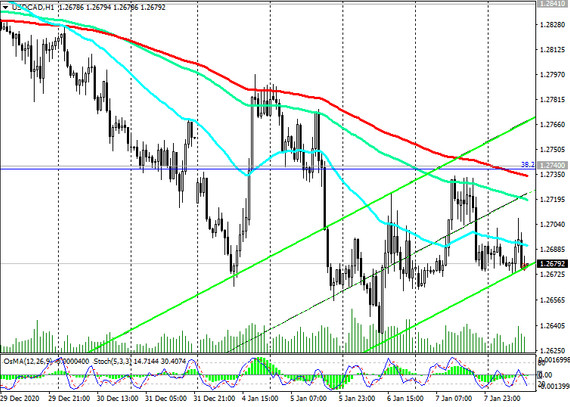

The pair remains within the descending channels on the daily and weekly charts, below the important long-term resistance levels of 1.3100 (ЕМА200 on the weekly chart), 1.3200 (ЕМА200 on the daily chart), 1.3450 (23.6% Fibonacci level of the downward correction in the wave of USD / CAD growth with level 0.9700 to level 1.4600), as well as below the important short-term resistance levels 1.2841 (ЕМА200 on the 4-hour chart), 1.2740 (ЕМА200 on the 1-hour chart and Fibonacci level 38.2%).

Staying below the key resistance levels 1.3100, 1.3200, in fact, USD / CAD is in the bear market zone. The pair is decreasing towards the key and long-term support level 1.2450 (ЕМА200 on the monthly chart). Its breakdown will strengthen the tendency to further decline, and a breakdown of the support level of 1.2170 (50% Fibonacci level) will finally return USD / CAD into a long-term bearish trend. So far, everything is in favor of short positions and further decline.

In an alternative scenario, a buy signal will be a breakdown of the resistance level 1.2740 with the prospect of growth towards resistance level 1.2841. Short positions are still preferred below the resistance levels 1.3100, 1.3200. And only a breakdown of the resistance levels 1.3300, 1.3450 (Fibonacci level 23.6%) will indicate the restoration of the bullish trend in USD / CAD.

Support levels: 1.2600, 1.2500, 1.2450, 1.2170

Resistance levels: 1.2740, 1.2841, 1.3000, 1.3100, 1.3200, 1.3300, 1.3450

Trading scenarios

Sell by market. Stop-Loss 1.2720. Take-Profit 1.2600, 1.2500, 1.2450, 1.2170

Buy Stop 1.2720. Stop-Loss 1.2665. Take-Profit 1.2740, 1.2841, 1.3000, 1.3100, 1.3200, 1.3300, 1.3450