Today in the United States is a national holiday "Martin Luther King Day", banks and stock exchanges in the country are closed, and the stock market is calm. Since the opening of today's trading day, world stock indices, including American ones, have been moving in a narrow range.

So, futures for the American stock index S&P 500 were traded during today's Asian session near the mark of 3761.0, remaining there at the time of publication of this article. Trading volumes are minimal and, most likely, this situation will continue until tomorrow's trading day.

Meanwhile, the US dollar remains resilient and seems to continue "gaining momentum". At the beginning of today's European session, futures on the DXY dollar index are traded near 90.90 mark, 174 points above the local almost 3-year low reached at the very beginning of 2021 near 89.16 mark.

In 2020, the DXY dollar index is down more than 6%. This was the largest decline in three years. But now the dollar continues to strengthen against its main competitors in the foreign exchange market.

Future new Treasury Secretary Janet Yellen is scheduled to speak on Tuesday and is likely to show her commitment to market-driven exchange rates and make it clear that the United States does not need a weak dollar to gain a competitive advantage. This was announced by representatives of the team of President-elect Joe Biden.

In a speech last week, Fed Chairman Jerome Powell reaffirmed the propensity of the US central bank to continue an overly soft policy.

Powell said it was too early to talk about a revision of the central bank's soft policy, including a $ 120 billion a month bond buyback program. "The economy is far from our targets", Powell explained, reaffirming intention to keep interest rates low for an extended period of time.

However, Powell's statements only put the dollar under short-term downward pressure. The demand for the US dollar rose sharply against the background of a worsening epidemiological situation and forecasts for the near future. A positive factor for the dollar was also a new plan to support the American economy from Joe Biden, which provides for direct payments to households, an increase in unemployment benefits and a sharp rise in the minimum wage more than doubled. The new support measures also provide for the allocation of about 20 billion dollars for vaccination of the population and 50 billion for testing.

Yet economists' views on the dollar's outlook remain controversial.

Some of them believe that the strengthening of the dollar may soon fade away. Stronger budget support in the United States, as well as accelerated vaccination, will positively affect the outlook for the economy, and in such an environment, stock markets are rising, and the dollar usually declines. Second, the rise in government spending will lead to an increase in the US current account deficit, which will exacerbate real inflation and dollar devaluation. Third, the Fed chairman confirmed that monetary policy will remain extremely soft for a long time.

Other economists, on the contrary, believe that a more optimistic view of the outlook for the US economy this year will also strengthen the dollar as a national currency. In their opinion, if vaccines against coronavirus turn out to be less effective, and the global economic recovery stalls, this will support the dollar as a safe haven asset. At the same time, if the US stock markets significantly outperform other stock markets, the dollar decline could slow down or reverse, and the Fed could signal a rate hike earlier than expected.

One way or another, time will tell where the dollar will move. In the meantime, it is strengthening on the eve of important economic events scheduled for this week. Meetings of the central banks of China, Canada, Japan and the Eurozone will take place on Wednesday and Thursday.

Meanwhile, tough quarantine measures continue to be in place in Europe to counter the spread of coronavirus. German Chancellor Angela Merkel has once again called for all necessary measures to be taken against its new strain.

Against the backdrop of longer and more stringent lockdowns, the risk of another GDP contraction in the Eurozone in the 1st quarter (and, consequently, a technical recession) has increased markedly, economists say.

At a meeting on December 10, the ECB left key rates unchanged. At the same time, the central bank increased the volume of PEPP by 500 billion euros, to 1.85 trillion euros, and extended its validity until at least the end of March 2022. At the same time, the bank extended the targeted long-term refinancing program until June 2022.

It is expected that at the meeting scheduled for this Thursday, the ECB will not change its monetary policy, but will confirm its readiness to take additional stimulus measures if necessary.

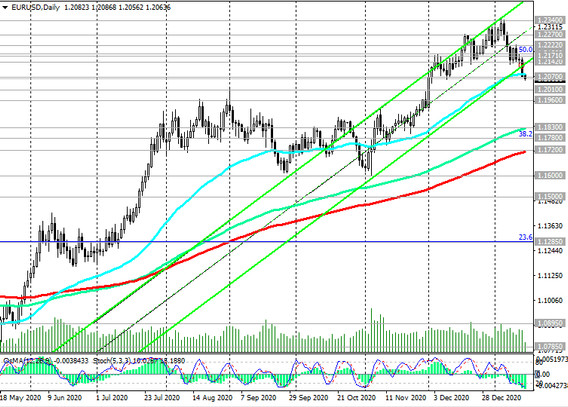

Since the beginning of the month, the EUR / USD pair has been declining, and today's trading day is also going mainly with the tactical advantage of the dollar.

At the start of today's European session, the EUR / USD pair is traded near the 1.2070 mark, through which a key long-term support level passes (see "Technical Analysis and Trading Recommendations"). Its breakdown will cause a further decline in EUR / USD.