Today, market participants will focus on the speech (at 15:00 GMT) of the future head of the US Treasury Janet Yellen. She, being the head of the FRS (before Jerome Powell), always advocated a soft policy of the central bank, remaining an adherent of the policy of Ben Bernanke (he was the chairman of the FRS in 2006-2014). He, in turn, called on the central bank and the government to almost "drop money from a helicopter".

The conclusion involuntarily suggests itself that Janet Yellen will, as before, advocate a policy of cheap money, which, in theory, puts pressure on the dollar and supports the stock market.

However, one should not rush to conclusions. She can also argue in favor of “market shaping” exchange rates, thereby making it clear that the United States does not need a weak dollar to gain a competitive advantage. According to media reports, this was recently hinted at by representatives of the team of President-elect Joe Biden.

If she really surprises the markets and speaks out in favor of a strong dollar, then this can be a starting point, if not for breaking the bearish dollar trend, then at least for its stabilization and for more prudent conclusion of deals to sell it.

Yellen is also expected to speak out in support of broader fiscal stimulus and economic bolstering, speaking in front of the Senate Finance Committee today.

However, one does not interfere with the other. Yellen can simultaneously urge Congressmen to take more ambitious actions aimed at stimulating economic recovery, and speak out in favor of strengthening the national currency, and this is - the Fed's job. More recently (last week), Federal Reserve Chairman Jerome Powell reaffirmed the propensity of the American central bank to continue an overly soft policy, saying that it is too early to talk about a revision of the central bank's soft policy, including a $ 120 billion a month bond buyback program. However, things could change quickly with regard to the outlook for the dollar, and the Fed could signal a rate hike earlier than expected.

A new plan to support the American economy from Joe Biden, which provides for direct payments to households, an increase in unemployment benefits and a sharp rise in the minimum wage, will also be a positive factor for the dollar.

Stronger budget support in the US, as well as faster vaccinations, will have a positive impact on the economic outlook. In such conditions, stock markets are growing. But it can also contribute to a new round of growth in demand for the dollar and the redistribution of investor interests in its favor as the funding currency of the American stock market from foreign investors. On the other hand, if the effect of vaccination is not as tangible as expected, and the global economic recovery stalls, then this will also support the dollar, but already as a safe haven asset.

But so far, the dollar is declining in the first half of today's trading day, while stock indices and gold quotes are growing.

Greater financial support from the government will lead to higher government spending and current account deficits in the US balance of payments, higher inflation and dollar devaluation. And this, in turn, creates the preconditions for the growth of demand for gold, which, although it does not bring investment income, is one of the most popular defensive assets.

Concluding the above, one thing is certain that with the arrival of the new administration of the White House, its financial policy will also change.

In which direction the dollar will move, we will probably find out very soon. But for now, it is not worth continuing its active sales, at least at the present time, until more accurate benchmarks appear.

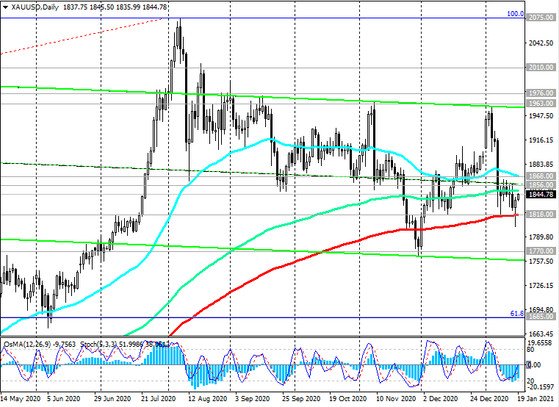

The XAU / USD pair, on the eve of Janet Yellen's speech and at the beginning of today's European session, is traded near the 1844.00 mark, maintaining positive dynamics (see "Technical Analysis and Trading Recommendations").