The focus of traders' attention today is certainly the Fed meeting. Market participants are awaiting the publication of the Fed's decision on the interest rate and comments from its management, which can help investors understand the prospects for the Fed's monetary policy. The publication of the decision on the interest rate and the start of the Fed press conference are scheduled for 19:00 (GMT).

Meanwhile, the dollar is showing stability on the eve of this event. At the start of today's European session, DXY dollar index futures are traded near 90.36, up 16 points to the opening price of the current trading week.

Still, there are conflicting opinions among market participants and economists about what Fed Chairman Jerome Powell will say today and what prospects he will "draw" for the US economy and the Fed's monetary policy.

Many expect that the Fed will not change monetary policy. But Jerome Powell may hint at the likely timing of the withdrawal of stimulus measures, which may be perceived by market participants as a signal to close some short positions in the dollar, which may, accordingly, cause its strengthening.

If Powell tries to reassure investors and dispel rumors about the premature curtailment of the bond purchase program, then the yield on US Treasury bonds may again head "south" and fall below 1%. At the same time, the dollar will weaken again.

At the same time, some economists believe that Powell will not be able to significantly weaken the dollar and the over-optimism of market participants based on the vaccination campaign and the prospect of further fiscal stimulus in the United States.

Meanwhile, at the beginning of today's European session, there is multidirectional dynamics of major European currencies.

If the franc and the euro weakened sharply against the dollar, moreover, the euro fell on the comments of the ECB representative Note, regarding possible interventions by the Central Bank in case of further growth of the euro, the pound is strengthening both against the euro and against the dollar.

The pound surged to multi-month highs against the euro and the US dollar amid media reports that more than 6.8 million people have supplied the first vaccine component in the UK, and hopes that high rates of Covid-19 vaccinations in the UK will power the economy countries earlier return to recovery and normalcy.

Expectations that the situation in the UK may improve in the 2nd quarter are contributing to the strengthening of the pound and the growth of the GBP / USD pair.

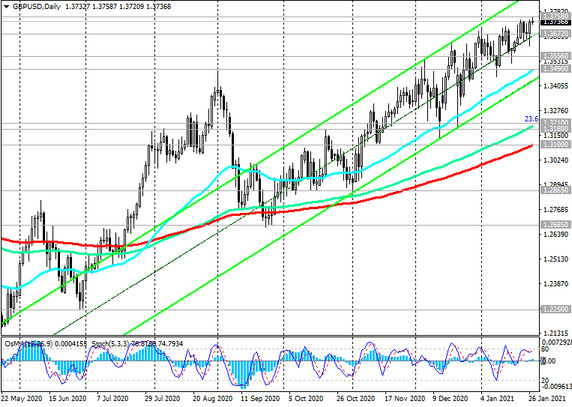

As of this writing, the GBP / USD pair is traded near 1.3735, while hitting a new nearly 3-year high today near 1.3758.

In general, its long-term positive dynamics remains (see "Technical Analysis and Trade Recommendations").

From the news for today regarding the dynamics of the dollar and the GBP / USD pair, it is also worth paying attention to the data on orders for durable goods and capital goods in the US, the publication of which is scheduled for 16:30 (GMT).

This indicator reflects the value of orders received by manufacturers of durable goods and capital goods (capital goods are durable goods used to produce durable goods and services), implying large investments. A high result usually strengthens the USD.

Forecast for December: +0.9% (orders for durable goods), +0.6% (orders for capital goods excluding defense and aviation).

It looks like the growth of indicators has stalled again after their recovery in previous months from a strong fall in March and April, which may negatively affect the dollar. The slightly better-than-expected data is also unlikely to have a long-term positive impact on the dollar.