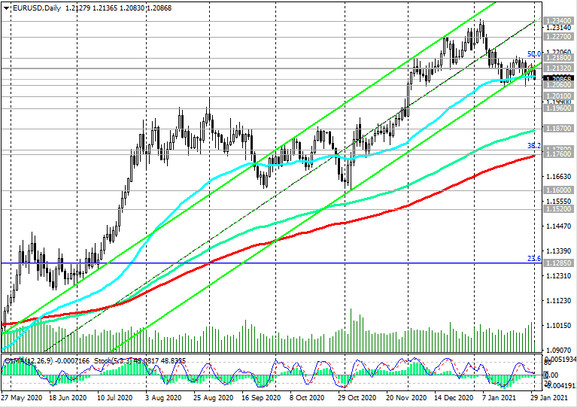

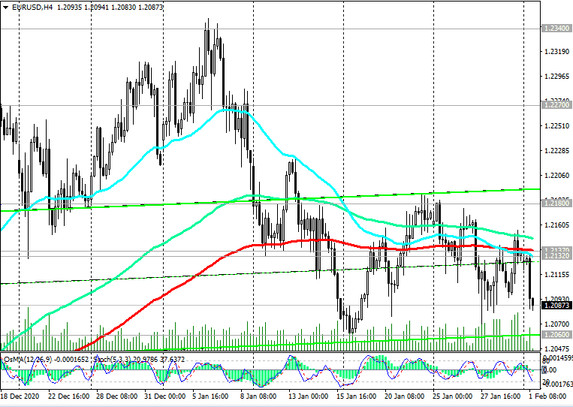

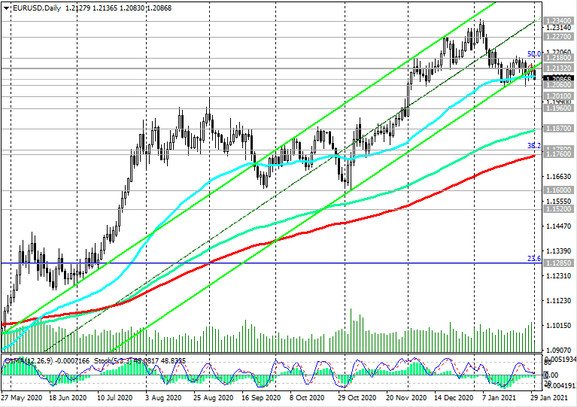

At the start of today's European session, EUR / USD is traded near 1.2087, below the important short-term resistance levels 1.2100 (EMA50 on the daily chart), 1.2132 (EMA200 on the 1-hour chart), 1.2137 (EMA200 on the 4-hour chart).

Below these levels, preference should be given to short positions. A breakdown of the local support level 1.2060 (and ЕМА200 on the monthly chart) may increase the risks of further decline towards summer highs and levels 1.2000, 1.1960.

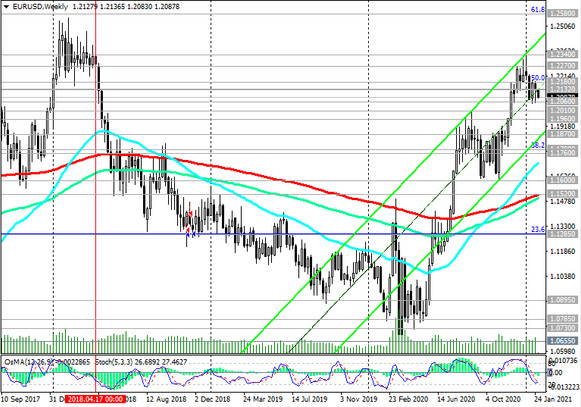

Despite the technical decline, the long-term positive dynamics of EUR / USD still remains, based primarily on the dollar's tendency to weaken further.

Therefore, it is equally important to consider the current situation as an opportunity to buy the declining EUR / USD pair from the current levels and near the support level 1.2060.

Growth in the zone above the resistance level 1.2137 will confirm the correctness of our conclusions.

An alternative scenario will be associated with further weakening of the euro and the fall of the EUR / USD. A signal for selling will be a breakdown of the support level 1.2060. If the downward dynamics develops, EUR / USD may decline to long-term support levels 1.1870 (ЕМА144 on the daily chart), 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014), 1.1760 (ЕМА200 on the daily chart).

A breakdown of the support level 1.1285 (Fibonacci level 23.6%) will finally return EUR / USD into a long-term downtrend.

Support Levels: 1.2060, 1.2010, 1.1960, 1.1870, 1.1780, 1.1760, 1.1600, 1.1520, 1.1285

Resistance Levels: 1.2100, 1.2132, 1.2137, 1.2180, 1.2220, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.2050. Stop-Loss 1.2120. Take-Profit 1.2010, 1.1960, 1.1870, 1.1780, 1.1760, 1.1600, 1.1520, 1.1285

Buy Stop 1.2120. Stop-Loss 1.2050. Take-Profit 1.2132, 1.2137, 1.2180, 1.2220, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600