During today's Asian trading session, there was a fairly high volatility in the quotes of the dollar and futures of the world's major stock indices. As a result, futures on world stock indices generally rose, while the dollar fell. Nevertheless, at the beginning of today's European session, the dollar seems to again seize the initiative from its main competitors in the foreign exchange market. As of this writing, DXY dollar futures are traded near 91.10, 185 points above the local 2.5-year low reached in early January near 89.16 mark.

The dollar index is receiving support from the declining yen and euro, which occupy the lion's share in the basket of 6 DXY currencies. Euro falls at the beginning of the European session after the publication of data on Eurozone GDP for the 4th quarter, which turned out to be better than the forecast, but worse than the data for the 3rd quarter. According to the published preliminary estimate, the Eurozone's GDP contracted -0.7% in the 4th quarter. On an annualized basis in the 4th quarter, GDP contracted by -5.1% (against the forecast of -5.7%).

This week is full of important events and the publication of important macro statistics of an economic nature. Among others - the RB of Australia meeting this morning, at which the central bank unexpectedly announced the extension of the government bond purchase program (it was supposed to end in April) to further support the economy in the first time in 30 years recession.

The central bank left its key rate and target yield on 3-year government bonds at 0.10%. RBA Governor Philip Lowe said the economic recovery "is going well and stronger than expected". However, the unemployment rate is still higher than it has been in the last twenty years and, although it is expected to decline, under the RBA's main scenario, it will be around 6% by the end of this year and 5.5% by the end of 2022, Lowe said.

The main negative factors for the Australian economy are weak wage growth, a weak labor market and a slowdown in growth. Annual inflation has remained below the 2% -3% target set by the RBA for four years, and unemployment has remained above the 5% level for many years (as RBA chief Philip Lowe said earlier, the unemployment rate should fall to "four-something"). According to the RBA, both in 2021 and in 2022, Australia's GDP will grow by 3.5%.

Lowe also said the conditions for raising interest rates "will not be created until 2024 at the earliest", and that this will require substantial employment growth and a strong labor market.

Lowe will also give a keynote speech on Wednesday (at 01:30 GMT) on the outlook for the current year, and on Thursday (at 22:30 GMT) will present the central bank's economic forecasts to lawmakers, which may once again cause more volatility in AUD quotes. It will also rise on Thursday at 00:30 (GMT) in connection with the publication of data on the foreign trade balance of Australia and on Friday at the beginning of the Asian session (at 00:30 GMT), when the RBA commentary on monetary policy and the retail sales level index will be published. The RBA Commentary provides an overview of economic and financial conditions, as well as an assessment of risks to financial stability and sustainable economic growth. The retail sales index is often considered an indicator of consumer confidence and reflects the state of the retail sector in the short term. Index growth is usually positive for the AUD; a decrease in the indicator will negatively affect the AUD. The previous value of the index (in November) was +7.1% after falling by -17.7% in April. If the data for December turns out to be weaker than the previous value, then the AUD may sharply decline in the short term. If the data turns out to be higher than the previous values, then the AUD is likely to strengthen.

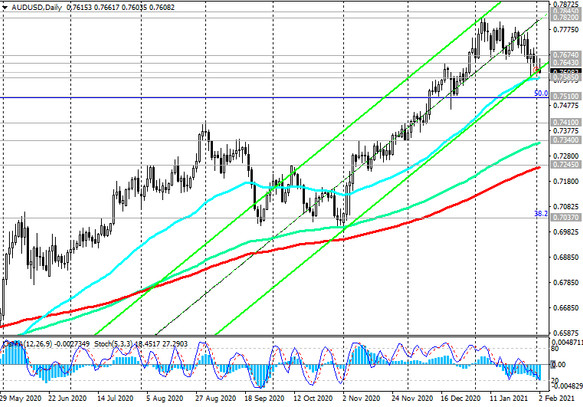

In the meantime, after today's RBA meeting, the Australian dollar continues to decline, including in the AUD / USD pair, which is traded near 0.7608 mark at the time of publication of this article, remaining above key support levels and, so far, maintaining long-term positive dynamics (see “Technical analysis and trading recommendations").