Today is the third day of the week and of the new month, and the third day in a row, the DXY dollar index is growing, continuing and developing the upward dynamics that originated in the very beginning of January, when the DXY reached a local almost 3-year low near 89.16 mark. The last time near this mark, the dollar index was in April 2018. DXY futures are traded near 91.16 mark in early European session today, 60 pips above this week's opening price.

Interestingly, the dollar is strengthening against the background of the growth of American stock indices, violating the recently established trend of their inverse correlation.

US stocks are rallying on the back of investor optimism, encouraged by strong financial statements and the prospect of additional fiscal stimulus.

However, the upward trend of the dollar may continue for the same reason. If the US government approves additional bailout packages in excess of the expected $ 1.9 trillion, then the need for extra soft monetary policy from the Fed, which keeps interest rates near zero and injected billions of cheap liquidity into the financial system, will gradually decrease. And this means that sooner or later the Fed may signal the start of curtailing its stimulus programs, which, in turn, will strengthen the trend towards strengthening the dollar.

However, it is not worth betting on a more significant strengthening of the dollar so far. As long as hopes for a global economic recovery persist, and the Fed refrains from tightening its policy, the current decline in the main currencies-competitors of the dollar in the market, most likely, will be short-term.

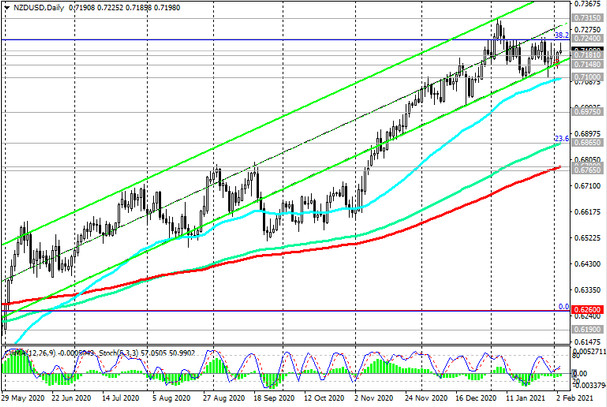

In the meantime, the New Zealand dollar tried to interrupt the current strengthening of the dollar. At the time of this posting, the NZD / USD pair is traded near 0.7198 mark, above important near-term support levels (see "Technical Analysis and Trading Recommendations").

The pair rose sharply after the publication (on Tuesday at 21:45 GMT) of data from the New Zealand labor market. According to the Bureau of Statistics of New Zealand, the unemployment rate in the 4th quarter of 2020 fell to 4.9% (versus the forecast of 5.6% and 5.3% in the 3rd quarter). The employment rate rose 0.6% quarter-on-quarter, well above the Reserve Bank of New Zealand's forecast of a 0.1% decline. A significant improvement in the situation in the labor market in New Zealand should put an end to fears that the trend to improve the economic situation in the country may reverse, economists say. According to them, by the end of 2022, unemployment in New Zealand will be about 4%, which is significantly lower than in other economically developed countries. The decline in unemployment to 4.9% in the 4th quarter excludes the possibility that the Reserve Bank of New Zealand will again lower the official interest rate, economists also say. And this is a strong fundamental factor aimed at further strengthening the NZD.

Today the focus of market participants will be the publication of important macroeconomic statistics from the US (on the level of business activity in the service sector and the state of employment in the private business sector of the American economy). The ADP employment report precedes official US labor market data on Friday. While this report does not have a direct correlation with the US Department of Labor report, it is, in a way, a harbinger of official data. The ADP report is expected to reflect private sector employment growth of 49,000 new jobs. With such data, this report can hardly be called strong after a decline by 123,000 in December. It is unlikely to provide strong support to the dollar.

It is also worth paying attention to the speeches (at 18:00, 19:00, 22:00 and 23:05 GMT) by the FRS representatives. It will be interesting to hear their opinion on the prospects of the Fed's monetary policy after the President of the Federal Reserve Bank of Minneapolis, Neil Kashkari, announced on the eve that it would need active support from the Federal Reserve System and the government to fully restore the economy. "It is critical now that the Fed continues to hold the gas pedal", helping the economy recover from the coronavirus pandemic, Kashkari said, adding that the central bank will use every tool available to it to meet employment and inflation targets.

If the Fed representatives speak in the same spirit today, it will moderate the excessive expectations of some market participants regarding the imminent curtailment of the Fed's stimulus program, which means further growth of the dollar.