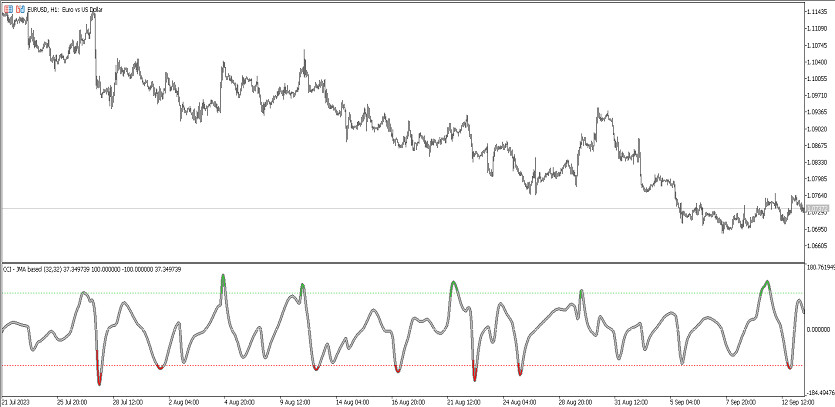

The CCI JMA Based indicator is a trading algorithm that is based on a modification of the CCI indicator using the JMA indicator as a signal filter. Its calculations are aimed at determining the current trend, namely its presence, current direction and strength. The indicator is presented in the lower window of the price chart in the form of two parallel lines combined into one. Under certain market conditions, the indicator line is painted in a certain color, changes its direction and location relative to the signal levels. Taking into account the indicator values, the trend is determined, and at the same time the trade that is opened at this moment.

The CCI JMA Based indicator is suitable for use on any timeframes, with any currency pairs.

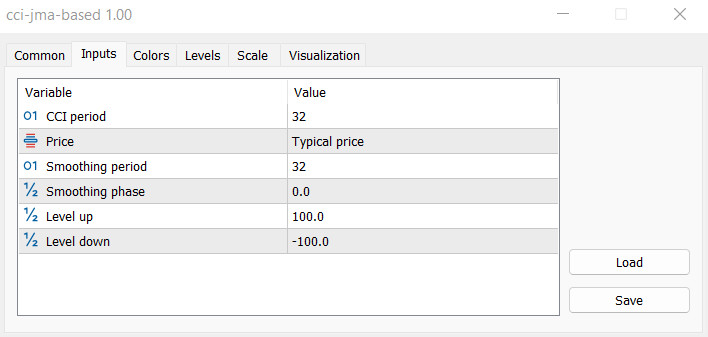

Input parameters

In the settings of the CCI JMA Based indicator, there are several sections that are responsible for its general functioning. Input parameters are responsible for its technical operation, the Colors section is responsible for its general visualization, and the Levels section is used to add signal levels to the indicator window.

-CCI period - calculation period of the CCI indicator. The default value is 32.

-Price - the type of price to which the indicator calculations are applied. The default value is Typical price.

-Smoothing period - smoothing period for indicator calculations. The default value is 32.

-Smoothing phase - the moment of smoothing the indicator values. The default value is 0.0.

-Level up - the value of the upper signal level of the indicator. The default value is 100.0.

-Level down - lower signal level of the indicator. The default value is -100.0.

Indicator signals

To open a specific trade using the CCI JMA Based indicator, it should be taken into account the presence of a trend, as well as its direction and strength. This, in turn, is determined taking into account the direction and color of its line. If the current market trend is upward, long positions are opened, if the trend is downward, short positions positions. When the current trend changes, trades should be closed. It should be taken into account that at the moment when the indicator line has a neutral color, there is no trend in the market and trades are temporarily not opened.

Signal for Buy trades:

- The indicator line moves up and crosses its upper level.

If you receive such conditions on a signal candle, it should be opened a buy trade, conditioned by the presence of an uptrend. If the current trend changes, namely, when it is received opposite conditions from the indicator, the trade should be closed. At this moment, a change in the trend or its weakening is possible.

Signal for Sell trades:

- The indicator line drops below the lower signal level and is colored with the fall value.

A sell trade, conditioned by the presence of a downtrend, can be opened immediately upon receipt of such conditions on the signal candle. At the moment of a trend change, namely, upon receipt of opposite conditions from the indicator, the trade should be closed and considered opening a new one.

Conclusion

The CCI JMA Based indicator is very effective, since its calculations are based on a modification of the Forex indicator, the accuracy of which has been proven over time. To obtain the necessary trading skills and correct use of the indicator, practice on a demo account is recommended.