Having received a decent portion of positive from the published macro statistics, which turned out to be better than forecasted, the dollar has strengthened since the beginning of this week. The growth of the DXY dollar index to date has amounted to almost 1%, and at the time of publication of this article, DXY futures were traded near 91.43, 227 points above the local and almost 3-year lows reached in early January near 89.16 mark.

So, published on Wednesday, the purchasing managers' index (PMI) for the service sector (from ISM) in January rose to 58.7 (against the revised December value of 57.7 and the forecast of 56.8). Also released on Wednesday, the ADP report exceeded expectations, pointing to +174,000 growth in the number of jobs in the private sector of the US economy in January (forecast was +49,000).

After the publication on Thursday of data on the volume of factory orders and weekly data on unemployment benefits in the United States, which also indicated continued improvement in the US labor market and the growth of activity in the manufacturing sector, the dollar gained momentum. By the end of yesterday's trading day, DXY futures were traded near 91.60, which is the same as at the end of November 2020.

Major U.S. stock indexes also rose strongly this week, fueled by investor optimism amid reports that Democrats are willing to compromise with Republicans and accept a $ 1.3 trillion support plan, rather than the $ 1.9 trillion Joe Biden promised. Market participants began to take into account the faster and more significant economic growth. Despite the Fed's stance to keep interest rates close to zero for the next few years, as follows from statements by Fed leaders, the dollar is growing also receiving support from the faster pace of economic recovery in the United States compared to other major economies. Investors continue to actively buy risky assets of the US stock market, leaving defensive assets such as government bonds and gold, and this, in turn, also contributes to the strengthening of the dollar.

Thus, the yield on US 10-year bonds rose today to 1.153%, returning to the levels of the end of February 2020.

Today we are also expecting an extremely volatile American trading session. The focus of traders is the publication (at 13:30 GMT) of the most important monthly data from the US labor market. Average hourly wages in the US are expected to rise 0.3% in January, the number of new jobs created outside the agricultural sector by 50,000, and the unemployment rate remained at 6.7%. This is the lowest unemployment rate since April, when it jumped to 14.7% amid massive layoffs and shutdowns of stores and offices due to quarantine restrictions.

The data speaks of a gradual improvement in the American labor market after its collapse in early 2020. Prior to the coronavirus, the U.S. labor market remained strong, signaling the stability of the American economy and supporting the dollar.

Also at the same time (at 13:30 GMT) Statistics Canada will publish data on the country's labor market for January. Unemployment in Canada last month rose according to forecasts by 0.3% to 8.9%, and the number of employees fell by another -47,500, due to massive factory closures in previous months due to coronavirus and layoffs. If unemployment continues to rise, the Canadian dollar will decline. If the data is better than the previous value, then the Canadian dollar will strengthen. A decrease in the unemployment rate is a positive factor for CAD, an increase in unemployment is a negative factor.

The publication of data from the labor market, especially the American one, is usually accompanied by a sharp increase in volatility. The more the data differs from the forecast, the higher the volatility can be, moreover, in the entire financial market.

It is often difficult to predict the market reaction to the publication of indicators, because many indicators for previous periods may be revised. Probably the most cautious investors will choose to stay out of the market during this time frame.

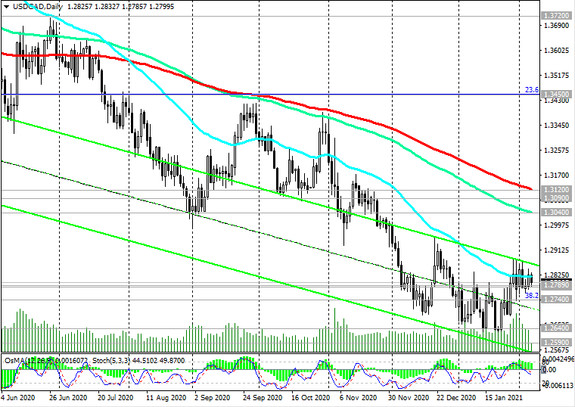

Since the beginning of this month, the USD / CAD pair has been traded in a range near the current mark of 1.2800 in anticipation of new drivers for either growth or decline.

It is very possible that today such drivers for USD / CAD will appear after the publication of data from the Canadian and American labor markets.