In the conditions of an empty economic calendar, the dollar continues to lose ground, won the week before last and partially last week, under pressure from not very convincing data from the US labor market, published last Friday.

As you know, unemployment in the United States fell in January (to 6.3% from 6.7% a month earlier), however, investors drew attention to the weak growth in the number of jobs outside of agriculture in the United States, only 49,000 after falling in December by 227,000.

The dollar fell sharply last Friday, and today, for the third trading day in a row, continues to develop a downward trend.

DXY dollar index futures are traded early in the European session near 90.57, 103 points below the local 9-week high reached last week near 91.60 mark.

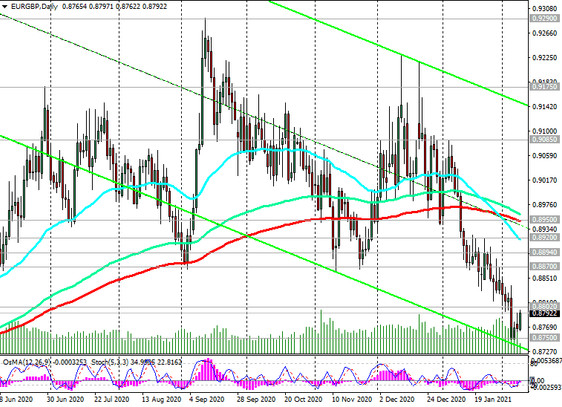

The dollar is falling against all of its main competitors in the foreign exchange market, including against the euro. At the beginning of today's European session, the EUR / USD pair is traded near the strong resistance levels 1.2100, 1.2105. The euro also strengthened strongly against the pound, and the EUR / GBP pair rose by 0.3% (up 30 pips) at the start of today's European session to the opening price of today's trading day, close to 0.8800.

In the current situation, the euro has received support due to the sale of the dollar in the EUR / USD pair. Nevertheless, the EUR / GBP pair remains under pressure, primarily due to the strengthening pound, and its active growth at the beginning of today's European session may also quickly subside.

The pound continues to enjoy support amid restrained comments from the Bank of England regarding the possibility of negative rates. According to some economists, in August 2021 and early 2022, headline inflation may exceed the 2% target set by the Bank of England, which also significantly reduces the likelihood of a decrease in interest rates by the Bank of England. This is another positive factor for the pound along with the higher rates of coronavirus vaccinations in the UK compared to Europe and other parts of the world.

Meanwhile, ECB chief Christine Lagarde recently said in an interview with Le Journal du Dimanche that "we will not see economic activity return to pre-covid levels until mid-2022". "The recovery (of the economy) of the Eurozone after the pandemic", in her opinion, "is postponed a little.

As some economists note, the continued quarantine measures and the relatively slow pace of vaccinations indicate that the recovery in Eurozone consumption is likely to be delayed again. Weaker outlook for consumer spending growth in the first half of 2021 outweighs the positive Q4 2020 results, which prompted economists to cut their 2021 Eurozone GDP growth forecast to 3.6% from 4.3%.

Thus, in the current situation it is better to refrain from aggressive purchases of the EUR / GBP pair for now, which may start to decline again near the strong resistance level of 0.8800. The pair can be bought only after it forms a basis for further growth in this zone. But so far there are no strong fundamental drivers for this.