The dollar weakened during today's Asian session. However, its gain against the Japanese yen could give the DXY the necessary momentum to move into positive territory. If the euro also starts to decline, the DXY dollar index will again change its direction "from south to north". At the beginning of today's European session, DXY futures are traded near 90.32 mark, remaining in the middle of the range between the local high of 91.60, reached last week, and the local and almost 3-year low of 89.16, reached in the very beginning of January this year.

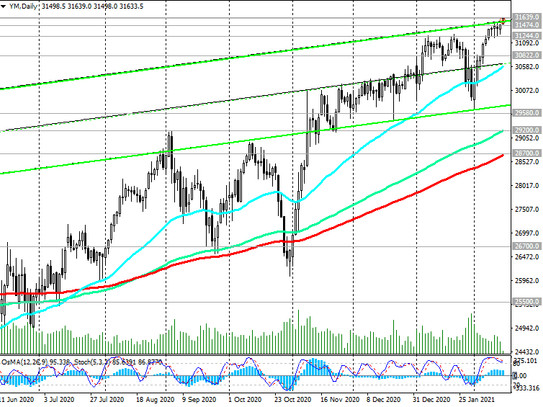

Last Friday, the S&P 500 rose another 18.45 points (+0.5%) to 3934.00 points, setting the 10th record in 2021. The Nasdaq Composite rose +0.5% to 14095.00 points, setting the 12th record this year. The Dow Jones Industrial Average climbed 27.70 points (+0.1%) to 31458.00 points, reaching its 7th record high since the beginning of the year, and at the beginning of today's European session, DJIA futures rose to a new all-time high of 31639.0, maintaining positive dynamics.

The S&P 500 has added 1.2% over the past week, the Nasdaq Composite - 1.7%, and the Dow Jones Industrial Average - 1%.

Successful worldwide coronavirus vaccinations bolster hopes for a quick economic recovery as the Fed continues to declare the status quo remaining in the next couple of years and a $ 1.9 trillion bailout package is on the way in the US.

In general, investors are still optimistic, suggesting a further weakening of the dollar and growth of world stock indices. However, the more cautious investors are increasingly asking the question: how long will the practically non-stop growth of stock indices continue, despite the fact that at the moment there are all conditions for their continued growth?

Some investors take profits, believing that quotations now look overvalued. Concerns about the still high incidence of coronavirus, its new mutations and problems that have arisen during vaccination in many countries are forcing some investors to take a pause.

Meanwhile, trading volumes will be limited today. Markets in China and Hong Kong are closed for Chinese New Year, and the US is celebrating Presidents' Day. The publication of important macro statistics in the economic calendar is also not planned today.

However, this does not exclude the likelihood of a short-term increase in volatility in the thin market, especially if unexpected news of a political nature appears, or regarding the situation with the coronavirus.