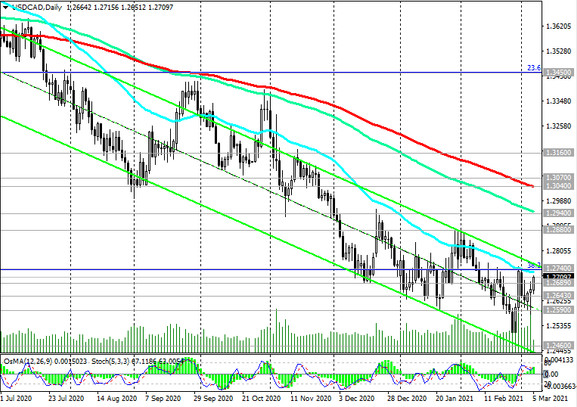

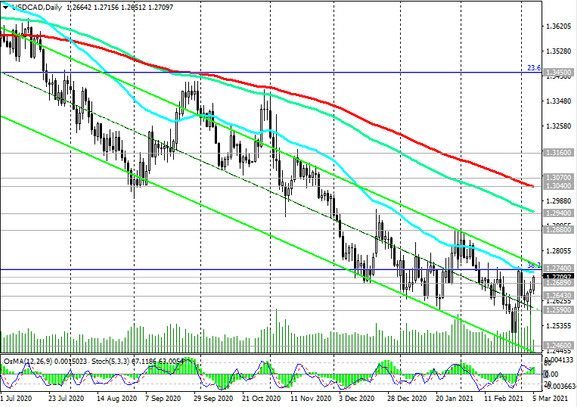

At the beginning of today's European session, the USD / CAD pair is traded near the 1.2710 mark, in the zone above the important short-term support levels 1.2689 (ЕМА200 on the 4-hour chart), 1.2643 (ЕМА200 on the 1-hour chart).

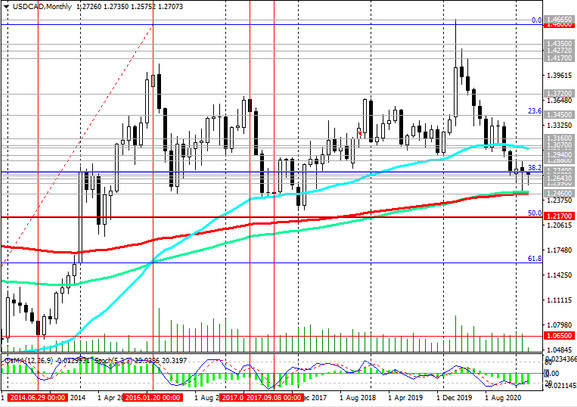

USD / CAD is still inclined to further decline. However, a breakdown of the resistance level 1.2740 (ЕМА50 on the daily chart and Fibonacci level 38.2% of the downward correction in the wave of USD / CAD growth from 0.9700 to 1.4600) may provoke further growth of the pair towards resistance levels 1.2880, 1.2940 (ЕМА144 on the daily chart), 1.3040 (ЕМА200 on the daily chart).

In an alternative scenario, the breakdown of the support level 1.2689 will be a signal for the resumption of short positions.

Remaining below the key resistance levels 1.3040, 1.3070, in fact, USD / CAD is

in the bear market zone. The pair is declining towards the key and long-term support level 1.2460 (ЕМА200 on the monthly chart).

Its breakdown will strengthen the tendency to further decline, and a breakdown of the support level of 1.2170 (50% Fibonacci level) will finally return USD / CAD into a long-term bearish trend.

Below the resistance level 1.2740, preference should still be given to short positions.

Support levels: 1.2689, 1.2643, 1.2590, 1.2500, 1.2460, 1.2170

Resistance levels: 1.2740, 1.2880, 1.2940, 1.3040, 1.3070, 1.3160, 1.3200

Trading scenarios

Sell Stop 1.2680. Stop-Loss 1.2755. Take-Profit 1.2643, 1.2590, 1.2500, 1.2460, 1.2170

Buy Stop 1.2755. Stop-Loss 1.2680. Take-Profit 1.2880, 1.2940, 1.3040, 1.3070, 1.3160, 1.3200