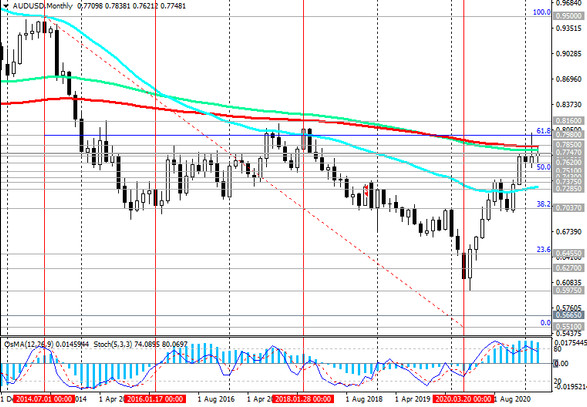

At the end of last month, AUD / USD broke through the important psychological level 0.8000, however, then dropped sharply due to the strengthening of the US dollar. Nevertheless, the pair maintains long-term positive momentum and potential for renewed growth.

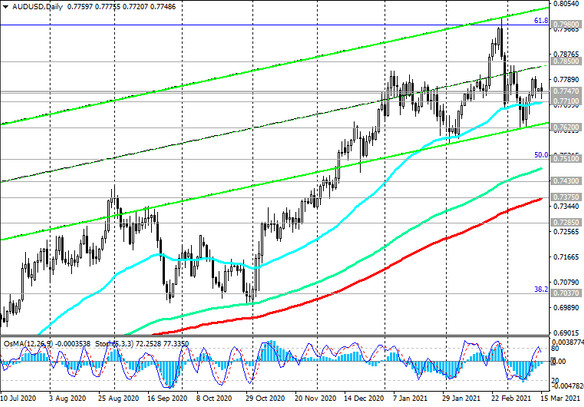

At the moment, the pair has stabilized at the support levels 0.7747 (ЕМА200 on the 1-hour chart), 0.7741 (ЕМА200 on the 4-hour chart).

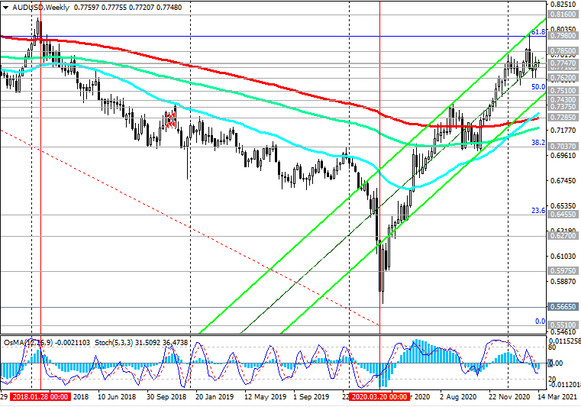

In the zone above the key support levels 0.7375 (ЕМА200 on the daily chart), 0.7285 (ЕМА200 on the weekly chart), the long-term positive dynamics of AUD / USD remains.

A breakout of the local resistance level 0.7850 will be a signal for the resumption of growth in AUD / USD towards the resistance levels 0.8000, 0.8100, 0.8160.

In the zone above the support level 0.7710 (ЕМА50 on the daily chart), one should also give preference to long positions.

In an alternative scenario, a signal for selling AUD / USD will be a breakdown of the support level 0.7710 with targets at support levels 0.7620, 0.7510 (Fibonacci level 50% of the correction to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), 0.7430, 0.7375, 0.7285.

Support levels: 0.7747, 0.7741, 0.7710, 0.7620, 0.7510, 0.7430, 0.7375, 0.7285

Resistance levels: 0.7850, 0.7980, 0.8000, 0.8160

Trading Recommendations

Sell Stop 0.7680. Stop-Loss 0.7815. Take-Profit 0.7620, 0.7510, 0.7430, 0.7375, 0.7285

Buy Stop 0.7815. Stop-Loss 0.7680. Take-Profit 0.7830, 0.7850, 0.7980, 0.8000, 0.8160