Despite the unexpected decision of OPEC+ (members of the cartel decided to significantly increase production volumes), oil quotes rose yesterday. The price of WTI crude oil jumped by $ 1.80 per barrel. Today, trading operations in oil, indices and metals are not carried out. Trading volumes will be also lower on Monday (Easter Monday is celebrated in Catholic countries).

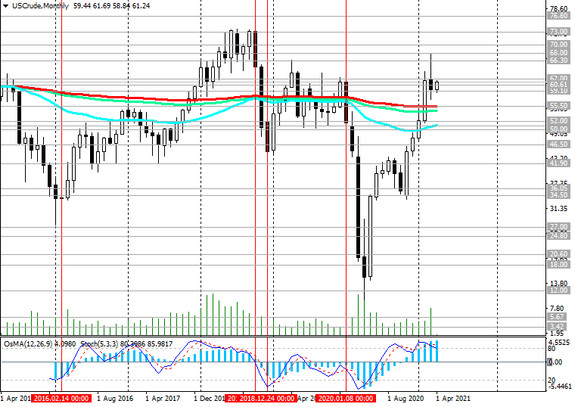

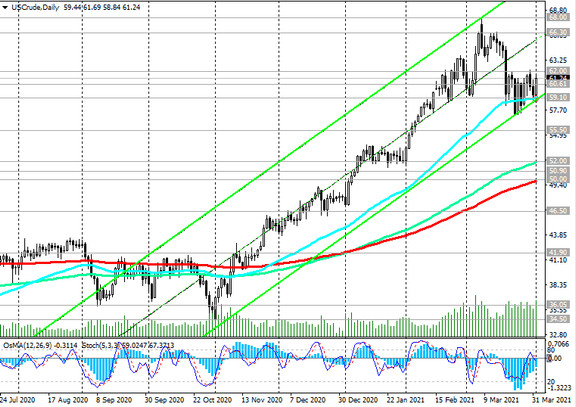

Meanwhile, the price of WTI oil remains positive. This brand of oil continues to trade in upward channels on the daily and weekly charts, above the key support levels.

Yesterday, WTI crude bounced off the support level 59.10 (ЕМА50 and the lower border of the ascending channel on the daily price chart) and rose to 61.24, breaking through the important short-term resistance level 60.61 (ЕМА200 on the 1-hour and 4-hour charts).

Breakdown of the local resistance level 62.00 will confirm the resumption of the upward dynamics.

In an alternative scenario, the price will resume its decline towards the long-term support level 55.50 (ЕМА200 on the monthly chart), and in case of its breakdown - towards the key support levels 52.00 (ЕМА144 on the daily chart), 50.90 (ЕМА20 on the weekly chart), 50.00 (ЕМА200 on the monthly chart) daily chart).

Their breakdown can increase the risks of breaking the bullish trend. A breakdown of the 41.90 support level (balance line from July to November 2020) will increase the risks of a renewed bearish trend in WTI crude oil.

In the meantime, WTI oil is traded in the bull market zone. Above the resistance level 62.00, long positions will again become relevant with the target at around $ 70.00 per barrel (the upper border of the ascending channel on the daily chart).

Support levels: 60.61, 59.10, 55.50, 52.00, 50.90, 50.00, 46.50, 45.00, 41.90

Resistance levels: 62.00, 66.30, 68.00, 70.00

Trading recommendations

Sell Stop 58.80. Stop-Loss 62.10. Take-Profit 55.50, 52.00, 50.90, 50.00, 46.50, 45.00, 41.90

Buy Stop 62.10. Stop-Loss 58.80. Take-Profit 66.30, 68.00, 70.00