Speaking on Thursday at a virtual conference of the International Monetary Fund, Fed Chairman Jerome Powell again tried to reassure market participants, assuring them that the leadership of the US central bank remains committed to its extra soft policies. Powell also reiterated concerns about "long-term damage" to the US labor market and pledged that the central bank will continue to support those who have lost their jobs due to the coronavirus pandemic and the ensuing recession.

Jerome Powell also said a key threat to the economic outlook is the weak pace of Covid-19 vaccinations outside of the United States. "It is important to remember that we will not return to the previous state of the economy", he said. "It will be a different economy".

In particular, the weekly statistics on the labor market published on Thursday indicated an increase in the number of applications for unemployment benefits in the United States, and, moreover, for the second week in a row. The number of applications rose to 744,000 (economists forecast that the number of initial applications for unemployment benefits fell to 694,000 over the past week), the value for the previous week was revised to 728,000. This growth indicates an uneven economic recovery.

Yesterday's comments from the Fed chief also confirm that the economic recovery will be uneven and incomplete, even regardless of what the data will indicate in the coming months.

Two other Fed officials (St. Louis Federal Reserve Bank President James Bullard and Minneapolis Fed Governor Neil Kashkari) also said Thursday that it is too early for the central bank to scale back support for the economy.

Earlier this week, Federal Reserve Bank of Chicago President Charles Evans said "monetary policy will remain unchanged for some time", and Dallas Federal Reserve President Robert Kaplan said he agreed "with the overall direction of monetary policy", stressing that “the crisis has not yet been overcome”.

At the same time, all Fed leaders, including Jerome Powell, note the improvement in the outlook for the economy, saying that "there is reason to be optimistic about the future".

American stock indices reacted positively to yesterday's speech by Jerome Powell. Also, albeit insignificantly, oil prices rose.

Nevertheless, since the opening of the trading day on Friday, futures for US stock indexes and oil prices have declined, while the DXY dollar index has risen.

As of this writing, DXY futures are traded near 92.27 mark, offsetting some of their losses this week. At the same time, the yield on 10-year US bonds also increased (to 1.664% against the previous week's high of 1.775%), which corresponds to almost 15-month highs.

Regardless, the DXY dollar index ends this week with a decline of about 0.75%. The dollar remains under pressure from stimulus policies from the Fed and the White House: the Fed intends to maintain a policy of low interest rates until at least 2023, buying back bonds worth $ 120 billion every month, and the US government has adopted a stimulus plan worth $ 1.9 trillion, which acquired the status of law 11th of March.

Huge sums of dollars place an additional and significant burden on the federal budget, increasing the already huge US national debt, accelerating inflation and devaluing the dollar itself. Economists and market participants are well aware that a significant portion of these funds will be covered by the additional capacity of the dollar printing machine.

However, the dollar will not fall forever. If inflation starts to spiral out of control, then the Fed will still have to intervene in this process and begin to curtail the stimulus program. Powell previously promised that the Fed would give early warning of the possible timing of the start of phasing out bond purchases.

However, the process of curtailing the stimulus program and raising the interest rate at the Fed may begin earlier than market participants now expect. And many of them are already starting to plan these prospects, trying to catch signals of a reversal of the dollar's downtrend in the early stages.

Moreover, the leaders of the Federal Reserve System still do not pay much attention to the growing yields on US government bonds, referring it to the growing optimism of the stock market participants, who began the 2nd quarter on a positive note in April. So, the index of the broad market S&P 500 since the beginning of the month has already gained about 3.1%.

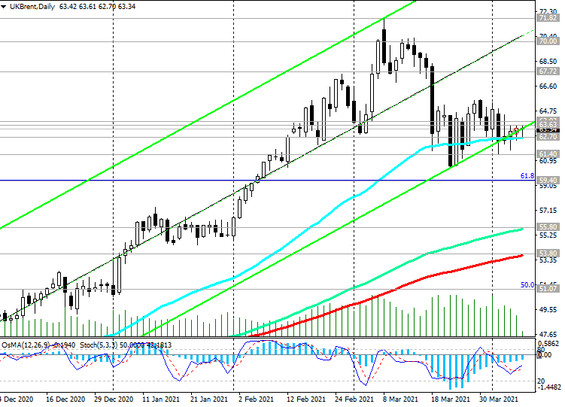

Returning to the oil market, it should be noted that in the last three weeks, prices have stabilized near the medium-term support level, expressed by the 50-period moving average on the daily charts for WTI and Brent crude oil.

Obviously, prices need new drivers. So far, positive and negative factors are balanced on the one hand by the positive sentiments of stock market participants, and on the other hand, by fears about the "stalled" vaccination against coronavirus in Europe, growing oil production volumes in the USA and the world, as well as the situation around Iran, since it is expected that Negotiations on the nuclear deal will resume at the end of this week. Also, participants in the oil market will pay attention to the monthly reports of OPEC and the International Energy Agency, which will be presented next week. As you know, at the beginning of this month, Saudi Arabia, which has voluntarily reduced its production by 1 million barrels since February, has now decided to increase oil production to 9.495 million barrels by July, against the current 8.15 million. At the same time, OPEC+ experts lowered the forecast for world oil demand by 300 thousand barrels per day, while the cartel members decided to significantly increase production volumes. Thus, the total oil production by OPEC+ countries will increase by almost 2 million barrels per day over the next three months.

Meanwhile, in Europe, there is a difficult epidemiological situation associated with an increase in the number of cases of COVID. New quarantine restrictions in Europe and a resumption of the rise in the incidence of coronavirus in the United States may lead to a new reduction in demand for oil and refined products, which will put pressure on prices.

From the news for today, participants in the oil market will pay attention to the weekly report of the American oilfield services company Baker Hughes (17:00 GMT). The week before last, the number of active drilling rigs in the United States amounted to 337 units (against 324, 318, 309, 310, 309, 305 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a short-term negative impact on oil prices.