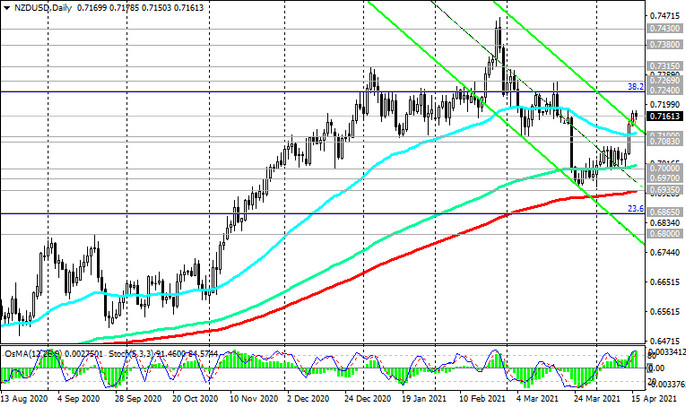

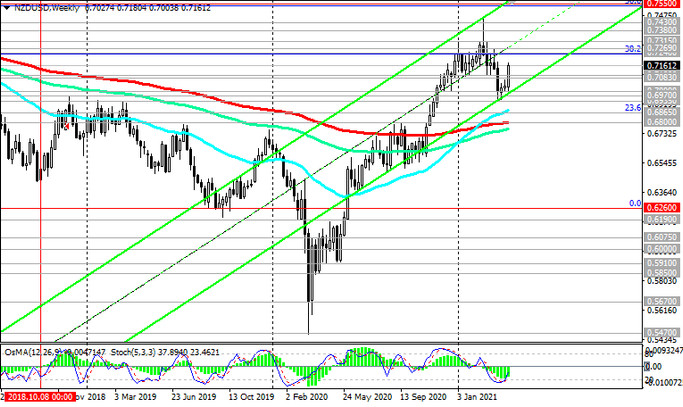

At the time of publication of this article, the NZD / USD pair is traded near 0.7160 mark, maintaining long-term positive dynamics above the important support levels 0.6970 (ЕМА200 on the monthly chart), 0.6935 (ЕМА200 on the daily chart).

Last Wednesday, the NZD / USD broke through the important resistance levels 0.7100 (ЕМА50 on the daily chart), 0.7140 (the upper border of the descending channel on the daily chart), remaining in the bull market zone.

In case of further growth, the targets will be the resistance levels 0.7240 (Fibonacci level 38.2% of the correction in the global wave of the pair's decline from the level 0.8820), 0.7550 (Fibonacci level 50% and the upper line of the ascending channel on the weekly chart).

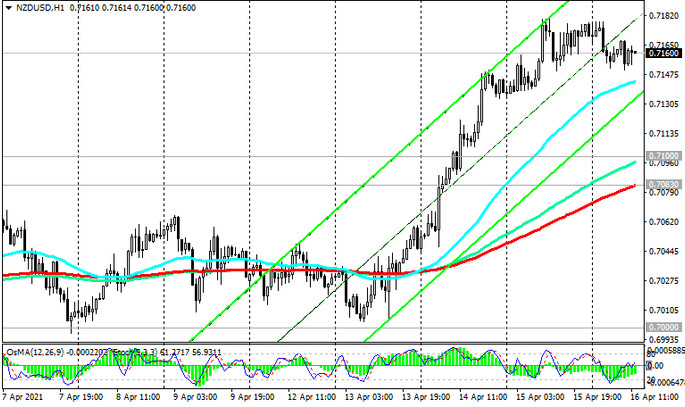

In an alternative scenario, NZD / USD will resume its decline. The first signal to open short positions with a target at support level 0.7000 will be a breakdown of short-term support level 0.7145 (ЕМА200 on 15-minute chart).

A breakdown of the support levels 0.6865 (Fibonacci level 23.6%), 0.6800 (ЕМА200 on the weekly chart) will increase the likelihood of a further decline in NZD / USD and its return into the global downtrend that began in July 2014.

Support levels: 0.7145, 0.7100, 0.7083, 0.7000, 0.6970, 0.6935, 0.6865, 0.6800

Resistance levels: 0.7200, 0.7240, 0.7269, 0.7315, 0.7380, 0.7430, 0.7550

Trading recommendations

Sell Stop 0.7135. Stop-Loss 0.7185. Take-Profit 0.7100, 0.7083, 0.7000, 0.6970, 0.6935, 0.6865, 0.6800

Buy Stop 0.7185. Stop-Loss 0.7135. Take-Profit 0.7200, 0.7240, 0.7269, 0.7315, 0.7380, 0.7430, 0.7550