On the financial markets - flat. The DXY dollar index remains in a narrow range near 90.00 for the third week in a row. As of this writing, the dollar is trying to hold onto its gains yesterday, and DXY futures are traded near 90.09 mark, 5 pips below their opening price this trading week.

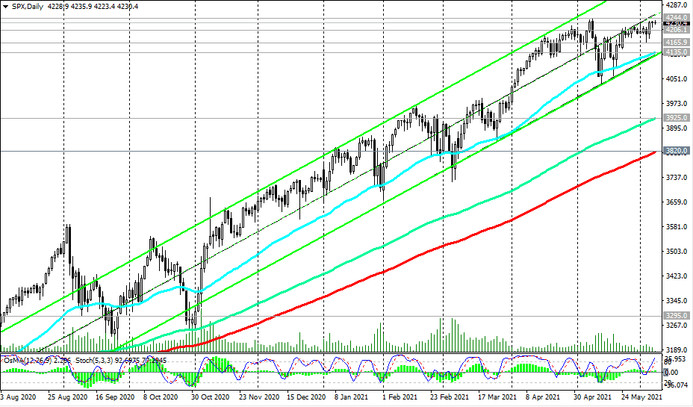

Major US stock indexes, in general, maintain positive dynamics, but also traded near the levels of the previous week. Thus, futures for the American broad market index S&P 500 at the time of publication of this article are traded near 4230.0 mark, 14 points below the local maximum of last month and 4244.0 mark, remaining in the zone of the long-term bull market.

It is possible that this situation will continue until Wednesday next week, June 16, when at 18:00 (GMT) the Fed's decision on monetary policy will be published.

Growing fears about curtailing the Fed stimulus program amid a strong economic recovery and rising inflation are increasingly making investors doubt the sustainability of the bullish trend in US stock indices and the bearish trend in the dollar.

Therefore, market participants will closely monitor the Fed meeting in order to catch from its side any hints of changes in the parameters of the current monetary policy.

As the Fed officials have repeatedly stated earlier, the growing inflationary pressure, according to their calculations, will be temporary. They admit that the inflation rate in the US will exceed the Fed's target of 2% for some time, although they have not yet precisely determined the duration of this period and the level of excess. But the level of interest rates of the FRS, as the leaders of the FRS promised earlier, they will keep unchanged until the end of 2023.

Earlier, Fed Chairman Jerome Powell said that before the central bank starts raising interest rates, it will first begin to reduce the volume of purchases of government bonds, and even then, as Powell promises, market participants will be notified in advance.

Recall that the Fed has kept the key rate at 0.25% since March 2020, monthly purchasing government bonds and mortgage bonds worth at least $ 120 billion since June 2020.

In an official statement following the April 27-28 meeting, Fed officials said the economy must "show further significant progress" towards the targets set by the regulator before they consider cutting back on asset purchases.

Nevertheless, unexpected statements are not ruled out on the part of the FRS. Last week, the president of the Federal Reserve Bank of Philadelphia and one of the Fed's leaders, Patrick Harker, said that he is preparing to think about scaling back monetary stimulus measures as the US economy continues to recover from the recession caused by the pandemic. “We plan to keep rates low for a long time, but maybe it's time to at least think about reducing the volume of purchases of government and mortgage bonds”, he said.

Lael Brainard, one of the central bank's governors, also said earlier this month that the previous approach to monetary policy should be maintained in the coming months, but that the Fed should be ready to make changes to its policy, if necessary, "while still closely monitoring changes in (economic data) and remaining ready to change (policy) if necessary".

Several other Fed officials have also said in the past few weeks that they would like to start discussions on a plan to phase out asset purchases.

Therefore, if such signals follow from the FRS, it will lead to the closure of a significant part of the short positions in the dollar and to its strengthening, and a downward correction may begin in the American stock market.

The tougher the statements of the FRS leaders following the meeting on June 16, the stronger the dollar will strengthen, and the deeper the correction in the stock market will be.

Still, it seems most likely that Powell will try to calm the markets again, repeating his previous statements about the need to adhere to the current parameters of stimulating policy.

Strong data released last Friday showed that the total number of jobs in the United States in May was still below pre-coronavirus levels by about 7.6 million, and 9.3 million potentially willing to work Americans remained unemployed. At the same time, the share of the economically active population working or looking for work even slightly decreased in May, to 61.6% against 63.3% in February 2020.

For the Fed leadership, more important than rising inflation is the full recovery of the labor market.

The second half of this week also promises to be interesting and volatile. On Wednesday (at 14:00 GMT) the decision on the rate will be published by the Bank of Canada, and on Thursday (at 11:45 GMT) - by the ECB.