Neither the Bank of Canada nor the ECB have dared to change the parameters of their current monetary policies, appealing to the fragility of the recovery of their regional economies until the third wave of coronavirus finally dies down.

"The Canadian economy is expected to recover strongly, supported by rising consumer spending as the vaccination process accelerates and the planned easing of antiviral restrictions this summer", the Bank of Canada said in a statement after its meeting ended last Wednesday, following which the bank's management decided to leave the one-day interest rate target unchanged and continue its quantitative easing program at the same pace.

The European Central Bank, following a regular meeting that ended on Thursday, also left interest rates unchanged, but announced its intention to increase the pace of purchases of government bonds.

The ECB said in a statement that the key interest rate would remain at -0.5%, as well as continued purchases of bonds in the scope of the emergency PEPP program worth 1.85 trillion euros (2.2 trillion US dollars) at least until the end of March 2022. The ECB also noted that bond purchases will be carried out at a "substantially higher" pace than in the first months of this year, echoing a statement made in March.

It is noteworthy that at a press conference after the meeting, ECB President Christine Lagarde said that the European economy is lagging behind the American one in recovery. In the United States, annual inflation jumped to 5% in May, the highest in nearly 13 years, while inflation in the Eurozone is only 2%.

Lagarde expects a strong recovery in economic activity in Europe as the pace of vaccinations picks up and stores and restaurants open, while noting that more than one in seven Europeans are still unemployed or on unpaid leave.

Now the focus of investor attention is shifting to next week's Fed meeting, following which central bank officials are likely to also keep loose monetary policy in place. Recall that the Fed has maintained its key rate at 0.25% since March 2020, purchasing at least $ 120 billion in government bonds and mortgage bonds every month since June 2020.

Nevertheless, the opinions of market participants regarding the short-term prospects of the dollar after the Fed meeting were divided.

Approximately half of them believe that the Fed's decision and its statement, which may contain a signal that the discussion of the stimulus reduction will begin earlier than expected, will not affect the dynamics of the dollar. In their opinion, one should also expect the dollar to weaken against currencies that rise along with commodity prices or have high yields.

According to official data from the Ministry of Labor, released last Thursday, the consumer price index (CPI) in May showed an annual increase of 5.0%, which is the highest in about 13 years, while the number of applications for unemployment benefits continued to fall.

However, according to the Fed's leadership, the surge in inflation in the US is temporary, and the labor market has not yet reached levels before the pandemic.

As follows from data published last Friday, the total number of jobs in the United States in May, despite the growth, was still below pre-coronavirus levels by about 7.6 million, and 9.3 million potentially willing to work Americans remained unemployed. At the same time, the share of the economically active population working or looking for work even slightly decreased in May, to 61.6% against 63.3% in February 2020.

For the Fed leadership, more important than rising inflation is the full recovery of the labor market.

Earlier, Fed Chairman Jerome Powell said that before the central bank starts raising interest rates, it will first begin to reduce the volume of purchases of government bonds, and even then, as Powell promises, market participants will be notified in advance.

In an official statement following the April 27-28 meeting, Fed officials said the economy must "show further significant progress" towards the targets set by the regulator before they consider cutting back on asset purchases.

Nevertheless, unexpected and more radical statements on the part of the FRS are not excluded.

If tough signals follow from the Fed, it will lead to the closure of a significant part of the short positions in the dollar and to its strengthening.

The tougher the statements made by the FRS leaders following the meeting on June 16, the stronger the dollar will strengthen. However, it seems most likely that Powell will again try to calm the markets, repeating his previous statements about the need to adhere to the current parameters of stimulating policy.

Thus, the upcoming Fed meeting, which will end on Wednesday at 18: 00 (GMT), can be both a turning point in the future fate of the dollar, and a "passing", neutral for it.

And, given the huge amounts of liquidity that the FRS pours into the financial system every month, the wait-and-see attitude of the FRS leadership may lead to further weakening of the dollar.

As of this writing, DXY futures are traded near 90.20 mark, 6 pips above this week's opening price. The DXY has gained 42 points since the beginning of this month.

From the news for today, which may again increase the volatility of its quotes, one should pay attention to the publication at 14:00 (GMT) of the University of Michigan Consumer Confidence Index (preliminary release), which reflects the confidence of American consumers in the country's economic development. A high level indicates economic growth, while a low level indicates stagnation. Previous values of the indicator: 82.9 in May, 88.3 in April, 84.9 in March, 76.8 in February, 79.0 in January 2021. An increase in the indicator will strengthen the USD, while a decrease in the value will weaken the dollar. This indicator is expected to be released in June with a value of 84.0. There is a steady trend towards a gradual recovery in the growth of the indicator, which is positive for the USD. The data worse than the forecast may negatively affect the dollar in the short term.

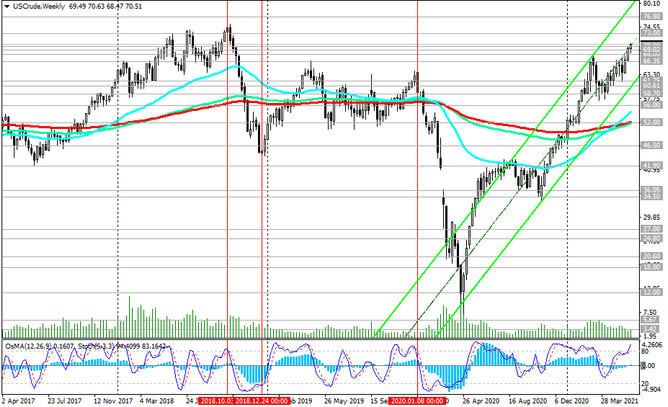

In terms of commodity prices, they continue to rise. In particular, quotations of Brent crude oil returned to the levels of May 2019, and WTI - October 2018. The price of WTI oil, whose futures are currently traded near 70.50 mark, is only $ 3 - $ 4 below multi-year highs reached in June 2018 near $ 73.50, $ 73.90 per barrel.

Today the price of oil is also growing, and the quotes of WTI crude oil are at the time of publication of this article near the mark of $ 70.50 per barrel, corresponding to the highs of this month.

Today, the attention of oil market participants will also be attracted by the publication (at 17:00 GMT) of the weekly report of the American oilfield services company Baker Hughes. The week before last, the number of active drilling rigs in the United States was 359 (versus 356, 352, 344, 342, 343, 337, 324, 318, 309, 310, 309, 305 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil quotes. However, it will be short-lived. In general, at the moment, long positions in oil seem to be more preferable.